5 Portfolio Moves For The Second Half

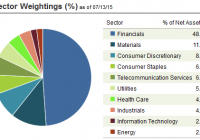

After a relatively calm few months, market volatility is back. In recent weeks, stocks have swung between ups and downs, as investors have attempted to digest the latest news out of Greece , the recent bear market in China and the growing likelihood that the Federal Reserve (Fed) will hold off on raising rates until after its September meeting. Some of this shouldn’t come as a surprise. At BlackRock, we have long been saying that the second half was likely to be characterized by more volatility, given increasing investor attention on the Fed’s next move. We also have long viewed China’s market as expensive. However, not everything has played to script, like some of the twists in Greece’s debt crisis and the possible delay of a Fed rate hike. That said, the big-picture economic themes we discussed in the beginning of the year still appear to be in place: slow but steady growth, low inflation and low rates. Even recent events in Greece and China aren’t likely to have a longer-term impact on the global economy or markets. Against this economic backdrop, we’re sticking with our basic market views. So, to help prepare your portfolio for the second half, investors can consider these five portfolio moves, as I write in the Mid-Year Update to The BlackRock List: What to Know and What to Do in 2015 . Favor stocks over bonds Stocks in general still look more attractively valued than bonds, but certain stock segments offer more value than others. We like international stocks over U.S. ones (more on that in the next bullet point). Meanwhile, within the U.S., we’re cautious on segments that will likely be most affected when interest rates go up, such as utilities. Greater value can be found in sectors positioned to benefit from economic growth, such as technology and financials. Consider more international equity exposure With the U.S. in the sixth year of a bull market, better value exists overseas, particularly in Europe and Japan. While it’s true that Europe is no longer cheap and faces political challenges, contagion from the situation in Greece is unlikely, and we still expect European equities to notch decent performance relative to pricier U.S. stocks. Europe and Japan should also continue to benefit from market-friendly central bank easing, while the U.S. is poised to raise rates soon. Within bonds, favor credit over duration. While bonds remain expensive, it’s important to have some exposure to fixed income. Given that rate volatility will likely remain elevated in coming months, investors may want to look to the high yield sector, which is typically less sensitive to rate movements than other fixed income sectors. We also like tax-exempt municipal bonds, which currently offer attractive yields. Look for tactical opportunities within fixed income Income seekers must keep in mind that rates around most of the world will remain low for some time despite any Fed action, so flexibility and selectivity are critical in fixed income asset allocation. Consider alternatives, but remain cautious on commodities Finally, in a slow-growth world where many traditional assets look pricey, you may want to consider casting a wider net toward alternative investments in an effort to optimize your portfolio’s results. Nontraditional asset classes such as infrastructure or real estate may be worth considering. Commodities, on the other hand, are likely to remain challenged, particularly if real rates continue to rise. The bottom line: As volatility continues, resist the temptation to abandon the markets. A better strategy for long-term investors would typically be to stay the course, assuming your portfolio is aligned properly. Source: BlackRock Original Post