The End Of The 30-Year Bull Market For Bonds: Mitigating Portfolio Risk In A Rising Rate Environment

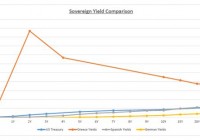

In a rising rate environment an investor should maintain a fixed income allocation, but with caveats. According to history, equities are a good investment option during certain rate hike cycles. Investing in private investments and flexible bond and alternative strategies is a good way to reduce portfolio volatility. The current investment climate presents some unique challenges for investors given the uncertain geopolitical environment, eurozone concerns surrounding Greece, and conflicting monetary policies between the U.S. and much of the rest of the world. Speaking of the latter, investors have been anticipating a rising interest rate environment within the U.S. in accordance with signals from the Fed to likely begin in late 2015. The commencement of quantitative easing (QE) in the eurozone in January and a loose monetary policy in Japan have driven down rates outside of the U.S., making U.S. yields generally more attractive than the rest of the developed world. Please look at chart 1 for interest rate differentials between the U.S. and other sovereign markets. Such a divergence makes little intuitive sense from a credit risk perspective and creates a conundrum for investors. Does an investor buy U.S. yields that are relatively higher yet likely to move even higher, or invest in Europe where the credit might be risky, but appreciation more likely due to QE? Further, how should investors view equities in the context of rising interest rates? Chart 1 (click to enlarge) Source: Bloomberg First, let’s examine the fixed income conundrum. Yes, it is likely that bond investors will experience price declines when the Fed begins the next rate hike cycle. Despite this risk, we argue that conservative investors should maintain some exposure to U.S. dollar denominated high-quality fixed income investments since these vehicles tend to weather market volatility well when investors are fearful; remember negative T-bill yields during the 2008 financial crisis! The aforementioned yield differentials should make the decision to move money to U.S. Treasuries much easier in such a scenario, but ideally investors should hold these positions via separate accounts, individual holdings, or through high-quality, short- to intermediate-term bond funds and ETFs. While it is true that separately managed accounts will decline in value like other bonds, investors will experience only paper losses unless sold, and short dated bonds will redeem at par and reinvest at the higher rates. In terms of bond funds and ETFs, using high quality, short-intermediate dated paper should help to control rate risk and to mitigate potential liquidity problems in the event of forced selling to meet redemptions. Turning to equities, it might be instructive to view stock market performance during previous rate hike cycles. First let’s look at correlations between weekly stock returns and interest rate movements, which are shown in chart 2. Going back to 1963, when 10-Year Treasury yields were above 5% and rising, there was generally a negative relationship between yield movements and stock prices. When yields were below 5%, however, an increase in rates was generally associated with rising stocks prices, reflecting a positive economic environment with generally modest inflation, which should be good for overall corporate profitability. Chart 2 (click to enlarge) Comparing today’s environment with previous cycles, we turn to chart 3, which shows the historical impacts of rate increases. While each cycle displays unique characteristics and circumstances, we would argue that the June 2004-July 2006 period was most reflective of today’s environment. We were at artificially low rates after emerging from a crisis, and while inflation in 2004 was higher than it is today, it was still modest by historical standards. Looking at the green line, while the S&P 500 exhibited some volatility along the way, the trend was generally positive during this 2004-2006 period. A key difference between today and 2004-2006, however, is in corporate earnings volatility. While P/E ratios were similar in both periods (in the 18 range), after a six-year bull market the current and future earnings outlook remains much more uncertain and volatile than was the case in 2004-2006. Chart 3 (click to enlarge) Considering the current environment and the comparison to previous rising rate cycles, how should investors adjust their portfolios to enhance returns and mitigate volatility? While there has been a significant shift toward maintaining maximum liquidity after the 2008 financial crisis, we believe investors should consider initiating or increasing exposure to private and/or alternative investments to diversify away from the volatility of public markets (both equity and fixed income) to reduce correlation among asset classes. For those investors choosing to maintain maximum liquidity, consider investing in flexible fixed income or ’40 Act alternative mutual funds focused on absolute return, not market benchmarks. Additionally, despite the likely scenario of rising rates in the U.S., maintain at least some exposure to high-quality U.S. fixed income based on global interest rate differentials and as a portfolio safe haven. Finally, be willing to hold some cash as it will act as both a buffer, as well as a means for replenishing the marginal liquidity given up in the private markets. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.