Tag Archives: nreum

Precious Metal And Natural Gas: 2 ETFs Trading With Outsized Volume

In the past trading session, U.S. stocks were in green as the Fed did not go for a policy tightening in its latest July meeting. Among the top ETFs, investors saw the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) gain 0.7%, the SPDR Dow Jones Industrial Average ETF (NYSEARCA: DIA ) inch up around 0.7% and the PowerShares QQQ Trust ETF (NASDAQ: QQQ ) move higher by nearly 0.4% on the day. Two more specialized ETFs are worth noting in particular though as both saw trading volume that was far outside of normal. In fact, both these funds experienced volume levels that were more than double their average for the most recent trading session. This could make these ETFs ones to watch in the days ahead to see if this trend of extra-interest continues: ETFS Physical Precious Metal Basket Trust ETF (NYSEARCA: GLTR ) : Volume 3.56 times average This broader precious metal ETF was in focus yesterday as roughly 77,400 shares moved hands compared to an average of roughly 22,700 shares. We also saw some stock price movement as shares of GLTR added 0.4% yesterday. Yesterday’s move was largely the result of the Fed’s no imminent rate hike decision in its July meeting. Some market participants shifted back the timeline of a lift-off to December which probably had a big impact on precious metals like what we find in this ETF’s portfolio. For the month, GLTR is down 6.4% and has a Zacks ETF Rank #3 (Hold). First Trust ISE-Revere Natural Gas Index ETF (NYSEARCA: FCG ) : Volume 3.37 times average This natural gas exploration and production ETF was under the microscope yesterday as nearly 2.98 million shares moved hands. This compares to an average trading day of 884,000 shares and it came as FCG gained over 3.2% on the session. The big move yesterday can be attributed to higher natural gas prices caused by the forecast for warmer temperature. Higher-than-normal temperature should result in increased usage of air conditioning. FCG was down over 22% in the past month and the fund currently has a Zacks ETF Rank #4 (Sell). Link to the original post on Zacks.com Share this article with a colleague

Crisis? Tempted To Flee To Shelter Of Big Funds? Bad Idea

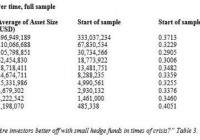

A new report out of the Cass Business School, City University, London, indicates that investors, especially in times of crisis (that is, when the use of the adjective “hedge” in front of “fund” is most apropos), are better off investing with a small fund rather than a large one. This is counter-intuitive, in that it is precisely in times of crisis that the temptation to flee to the larger institutions is most powerful for many investors. Yet the negative statistical correlation between size and performance was largest in three periods within the database of this study, times of crisis: 1999 to 2000, 2003 to 2004, and 2008 to 2010. Why? Largely because of the restrictions that the larger funds place on redemptions. More obviously, diseconomies of scale play a role, and can themselves vary with the business cycle. Size and Time The authors (Andrew Clare, Dirk Nitzsche, Nick Motson) describe their study as based on a more comprehensive database that that of earlier studies along the same lines. Specifically, their database consisted of 7,261 funds and their performance over a twenty year period (1994 to 2014). One important side issue for their study involves the evolution of average industry size over time. Bigger Than It Used to Be (click to enlarge) As the above table shows, the average size of funds has grown, consistently over every decile, through the 20 year period included in the TASS data the authors reviewed. This is what one would expect even before looking at such data, having only a headline-inhabitant’s view of the industry, but it does highlight the issue of whether and to what extent the size/performance relationship itself has varied over the years. Another counter-intuitive finding to emerge from their study: age is also negatively correlated with performance. This seems odd because common sense might indicate that a small fund that has been around for several years (and has remained small) is a fund that has failed to attract investors, likely in turn because it has failed to perform. A large fund may well be a fund that became large because of performance and thus new investment. So … why the negative correlation here? The authors don’t offer a hypothesis. Time and Context They do say, though, that the age/performance relationship is considerably less impressive than the size/performance relationship. Here, again, one has to look at the development of the industry over the 20 years discussed in order to develop a sense of the context for the relationships found in the data. The age/performance relationship was statistically significant in the earlier years of the study’s sample, but by the period since 2003, especially since 2009, this relationship has become “not significantly different from zero.” So the authors focus on the stronger relation of the two they have identified, that between size and performance, and they look at it strategy by strategy, for L/S Equity, Emerging Markets, Event Driven Funds, and Managed Futures. They find considerable variation by strategy. In particular, Managed Futures don’t follow the general rule at all, the relationship between size and performance is positive in that context. It is positive in a way that doesn’t appear “statistically different from zero,” but still … it is not negative. That indicates “that this strategy is less constrained than others by size.” On the other side, the strategy that makes the greatest case for the proposition that petite is sweet is: L/S Equity.