Tag Archives: nreum

Don’t Overpay For An Epic Investing ‘Fail’

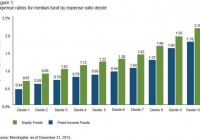

Summary Lowering the cost of actively managed funds is an important step in improving the odds of outperformance. Highly rated funds are not good predictors of future performance. Why a holistic approach with good judgment, including quantitative and qualitative elements is a “WIN!” By Chris Philips, CFA An investing “FAIL”? Pop culture and investing rarely cross paths. After all, pop culture is hip, exciting, and flashy. Conversely, we’ve seen that successful investing is generally anything but. Nevertheless, the last decade or so has seen the rise of an internet meme that may be applicable to the investing world-“FAIL.” So what are a “FAIL” and its illustrious cousin “epic FAIL”? Both are generally used to describe embarrassing events, such as setting your kitchen on fire as you film yourself attempting to light birthday candles (FAIL)-by using a blowtorch to be cool (epic FAIL). Now I hope none of us have burned down a house while reviewing an investment portfolio! So I can’t visualize an investing epic FAIL in this vein (although some may suggest that the global financial crisis would suffice), but there are at least three areas where I can confidently say FAIL: cost, ratings, and performance. The cost-value riddle First up is the issue of cost. People intuitively associate higher cost with value and performance. Unfortunately, it’s backwards. For example, see Figure 1, where I break out U.S. equity and fixed income funds into deciles according to their reported expense ratios. Cost and performance ARE related. However, the data show that the lower the cost, the better the experience (on average). You should pay more for performance? FAIL (click to enlarge) Relying on ratings Next is the question of industry ratings. The allure of something-anything-that could potentially help us do better by our clients is strong. Figure 2 illustrates this -investors have clearly favored higher-rated funds and shunned lower-rated funds. These patterns wouldn’t be noteworthy if 4- and 5-star-rated funds consistently added value. (Or perhaps they would be, if they revealed a metric that could reliably predict performance!) However, in the research underlying Figure 2, we showed that highly rated funds in one rating period tended to be the worst performers relative to a style benchmark over the next 3 years-underperforming on average by 138 basis points per year. Funds with 1-star ratings also underperformed, but at a much more modest rate of 15 basis points per year. You should stick to top-rated funds? FAIL Patience and performance Of course, some may dismiss the cash-flow example as “retail” investors chasing returns. However, there’s also evidence of return-chasing among institutional investors.[1] After all, we are all human, whether acting in a fiduciary capacity or on our own behalf. In an article published in The Journal of Finance , Amit Goyal and Sunil Wahal reported on the outcomes of hire/fire decisions across a broad sample of plan sponsors. They found that underperforming managers were (not surprisingly) replaced with managers who demonstrated significant outperformance (represented with blue bars in Figure 3). I say “not surprisingly,” because what fiduciary would want to keep an underperforming fund or asset on the books? However the twist is in what happened following the replacement. On average, those managers who were hired to replace the poor performers underperformed the same managers they replaced in the next 1-, 2-, and 3-year periods! In Figure 3, this record is shown by the green bars. You should systematically replace underperformers? FAIL Avoiding FAIL The moral of this story is that while ratings and cost should not be summarily dismissed, we should take a collective step back and think about what really matters when constructing portfolios or looking to provide clients with the best opportunity for success. Controlling costs is critical, to be sure. But equally important is a robust evaluation process that includes many variables for considering whether fund A, B, or C should be added, dropped, or ignored. Such a qualitative process can complement the quantitative metrics that have been shown to potentially lead us astray. A holistic approach with good judgment, including quantitative and qualitative elements? Now that’s a WIN! Footnotes Mark Grinblatt, Sheridan Titman, and Russ Wermers initiated the academic literature on return-chasing behavior among institutional investors in their paper “Momentum investment strategies, portfolio performance, and herding: A study of mutual fund behavior,” The American Economic Review , 85(5), 1995. Notes All investing is subject to risk, including the possible loss of the money you invest. Past performance does not guarantee future results.

EWZ: July Review

Summary Share price of the iShares MSCI Brazil Capped ETF declined by more than 12% in July. The Brazilian economy is in a bad shape, the commodity prices are weak and the corruption scandal keeps on growing. It is hard to expect any positive changes in August. Share price of the iShares MSCI Brazil Capped ETF (NYSEARCA: EWZ ) declined rapidly in July. It was negatively affected by declining commodity prices and by new developments in the Petrobras (NYSE: PBR ) corruption affair. Six former execs of a construction company were sentenced to 6-15 years of jail due to their involvement in the Petrobras corruption scandal and money laundering. Moreover, the former Brazilian president da Silva is being investigated for his involvement in a scandal related to foreign activities of Brazilian construction company Odebrecht SA. Although this case is not directly related to Petrobras’s kickback schemes, it has reignited the fears of investors that investigations will reveal involvement of current president Dilma Rousseff which could destabilize the Brazilian political situation even more. Investigations have shown that other Brazilian state controlled companies were involved in corruption schemes. One of them is Eletrobras (NYSE: EBR ). Moreover, the S&P rating agency warned that the Brazilian investment grade rating is endangered. And another bad news for the share markets came in the end of July, as the Brazilian central bank increased interest rates to 14.25% to tackle inflation. 53% of EWZ’s portfolio is created by shares of 15 companies. The three biggest holdings are the same as in June: preferred shares of Itau Unibanco (NYSE: ITUB ), shares of beer and soft drink producer Ambev (NYSE: ABEV ) and preferred shares of Banco Bradesco (NYSE: BBD ). Weights of oil giant Petrobras and diversified miner Vale (NYSE: VALE ) decreased significantly compared to June. Source: own processing, using data from ishares.com EWZ lost 12.45% of its value in July. Among the most significant holdings, only shares of the apparel producer Lojas Renner ( OTC:LORPF ) experienced a notable growth. On the other hand, share prices of Kroton Educacional, Petrobras, BMF Bovespa and preferred shares of Itau Unibanco experienced double-digit declines. (click to enlarge) Source: own processing, using data from Bloomberg Although EWZ’s share price was strongly correlated with the S&P 500 and the United States Oil ETF (NYSEARCA: USO ), these correlations were slightly fluctuating over the last two months. On the other hand, the correlation between share prices of EWZ and Petrobras is extremely high and stable. It has been moving in the 0.8-1.0 range for the last 10 weeks. It shows that Petrobras and its corruption scandal is still the main factor affecting the Brazilian share market. (click to enlarge) Source: own processing, using data of Yahoo Finance The chart below shows the volatility of EWZ, using the 10-day moving coefficient of variation. Although June and the first part of July were relatively calm, the volatility increased significantly in the second half of July and it peaked at the 5.5% level. Although it has been declining for the last couple of days, it is still high and other news related to the corruption investigations may lead to further dramatic spikes. (click to enlarge) Source: own processing, using data from Yahoo Finance Some of the more interesting news: Petrobras doesn’t have problems only with the corruption scandal but also with the Brazilian tax authorities. As a result, it had to pay R$1.6 billion ($463 million) of tax deficiencies. Petrobras desperately needs more cash. One of the ways how to raise it should be the IPO of Petrobras Distribuidora , the largest Brazilian fuel distributing company with more than 7,000 service stations. The IPO may occur as soon as Q4 2015. On July 31, Petrobras announced the start of production from the Iracema Norte project, that is located in the Lula field, in the pre-salt area of the Santos Basin. The first production well is expected to produce up to 32,000 barrels of oil per day. In Q2, Vale achieved first profit after three quarters of losses. The company recorded net income of $1.675 billion, mainly due to higher iron ore production and lower iron ore production costs that reached only $15.8/t. Vale has also announced that it will sell its 36.4% share in Mineracoes Brasileiras Reunidas S.A. for R$4 billion ($1.16 billion). The Brazilian economy is not in good shape and its problems should also continue in 2016, according to a study by Itau Unibanco. The bank expects that the Brazilian economy will decline by 2.2% in 2015 and by 0.2% in 2016. The previous estimate expected -1.7% and +0.3% respectively. Moreover, the unemployment rate should climb to 8% in 2015 and to 9% in 2016. Also the Brazilian government acknowledged the poor performance and bleak outlook of the economy, as the targeted 2015 primary fiscal surplus was reduced from 1.2% to 0.15% of GDP. Conclusion A bad condition of the Brazilian economy, weak commodity prices and the raging corruption scandal pushed the share price of EWZ down by more than 12% in July. Also August will be probably hard for EWZ investors, unless the commodity prices start to recover. On the other hand, any positive momentum may be easily drowned by another corruption related news. EWZ may seem to be cheap, but it is also risky right now. Disclosure: I am/we are long PBR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.