Time In, Not Timing, Is Everything

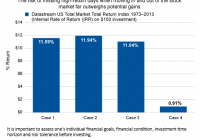

Editor’s note: Originally published on December 22, 2014 Market timing can be a perilous game that long-term investors should avoid playing. It’s difficult to get it right. And the time spent on the sidelines waiting for “the right moment” presents big risks to your portfolio. Last week proved to be a roller-coaster ride for investors and an important reminder for investors to stay the course in the face of short-term market gyrations. Stocks dropped dramatically in the first half of the week, as the price of oil continued to fall and Russia raised interest rates in a desperate attempt to defend the ruble. That all changed on Wednesday afternoon, when the FOMC announcement halted the selloff. The announcement and accompanying projections appeared to soothe markets and actually change the mindset of investors, sending stocks sharply higher. Heading for the Exits Unfortunately, many investors had sold out of stock funds by then and missed that rebound. In fact, according to EPFR Global data, the week ending Wednesday saw the biggest outflows from equity funds since 2005. This is troubling because it shows that investors continue to let their emotions get the better of them. Moving in and out of the stock market based on the headlines is hazardous to the health of investors’ long-term portfolios, and puts financial goals at risk. In light of last week’s market tumult and the response from investors, I feel compelled to repeat the findings of a study published in early 2014 by my colleagues on the Economics & Strategy team at Allianz Global Investors. Their research shows the dangers of market timing. Specifically, the study looked at the performance of the Datastream US Total Market Total Return Index from 1973 through the end of 2013, comparing four different investment approaches: 1. Investing $100 at the start of the first year and adding an additional $100 at the start of each subsequent year. 2. Investing $100 on the day of the lowest index level of the year and adding an additional $100 each year on the day of the lowest index level of that year—the best day of the year to invest. 3. Investing $100 on the day of the highest index level of the year and adding an additional $100 each year on the day of the highest index level of that year—the worst day of the year to invest. 4. Investing $100 each year at the start of the year as in the first approach, but assuming one misses the returns of the best three trading days in each year. The results provide a strong cautionary tale: Time in the market beats timing the market. The returns are actually quite similar in the first three hypothetical scenarios, ranging from 11% to 11.9% in annualized terms. However, the fourth hypothetical produces dramatically lower performance: an annualized return of just under 1%. In other words, it doesn’t matter when you get in, it matters that you stay in for the long haul. Equally compelling are the results of Morningstar’s research on the disparity between mutual fund returns and mutual-fund shareholder returns. Over the 10 years ending Dec. 31, 2013, Morningstar found a widening performance gap between investors and the funds themselves. That makes sense given that investors became extremely risk averse in the wake of the global financial crisis, shunning stocks even as they rebounded. The scars from the crisis clearly run deep and have exacerbated investors’ emotional responses to market events. Breaking down the numbers, Morningstar shows that the typical investor gained 4.8% on an annualized basis over that 10-year period versus 7.3% annualized for the typical mutual fund. The gap is caused by the investor’s time (or lack thereof) in the stock market. In fact, market timing takes a bigger bite out of investor returns than fees for active management. Poor Timing Mutual fund flows in 2012 reveal the perils of market timing. Flows in 2012 Show Poor Timing 2012 Flows ($ Billion) Subsequent Return 2013 (%) U.S. Equity -93,677 35.04 Sector Equity 3,264 18.90 International Equity 13,604 13.19 Allocation 20,399 15.40 Taxable Bond 269,760 0.15 Municipal Bond 50,313 -3.40 Alternative 14,781 -4.85 Commodities 1,365 -9.10 Source: Morningstar. Looking ahead to 2015, we expect more market turbulence and rotation among different styles and asset classes. In this type of environment, it’s critical that investors remember the importance of developing a long-term plan in an emotional vacuum—and adhering to it even when the world around us seems to be panicking. In short, investors don’t plan to fail, but they often fail to plan. The key is to have a plan—and then stick with it. These are words to invest by as we prepare for 2015 and beyond.