NextEra Energy, Part 1 – This Utility Leader’s Upside Might Be Limited

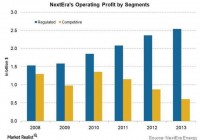

Summary NextEra’s Hawaii deal is truly a place of growth, but it may be priced in for now. NextEra’s economic moat creates true long-term value to dividend players. NextEra looks unlikely to increase dividend significantly with recent investments and limited FCF or cash on hand. NextEra (NYSE: NEE ) is coming off a very strong 2014 in which the company was able to see a return of 20%. Utilities were very strong. The company’s valuation increased to a nearly 19 P/E. The question, now, is whether this utility giant is still a buy or should investors wait for a pullback. 2015 looks like an interesting year for the company with the development of their operations in Hawaii, continued economic moat strength that is reliable during volatile times, and some moves the company is making in the green arena that we believe has interesting potential. This is Part 1 of a two-part article we are doing on NextEra for our assessment of the company as a socially responsible investment. The first part of all of our work is a traditional analysis of the company as an investment. Do we believe that “X” company has upside in the current environment? From there, we add a lens of socially responsible analysis to understand if the company also presents compelling factors for social responsibility. If both line up, it becomes a great SRI. In this article, we are examining NextEra in terms of traditional financial analysis. In Part 2 , we will examine the secondary factors of socially responsible investing. 2015 Catalysts Economic Moat Strength To us, the most important catalyst for NextEra remains their economic moat strength. Utility companies, as a whole, maintain very strong economic moats due to their non-competitive arrangements with municipalities. These arrangements allow the company to remain very consistent profits, and the more non-competitive arrangements…the better for these companies. These moats are extremely important. For example, the company had 80% of its business in the regulated, and regulated utilities profits continue to increase while competitive utilities stay stagnant. See this image from Market Realist: (click to enlarge) The company continues to see regulated profits growing while competitive profits have been flat to weak. The company has seen lower prices in competitive areas due to wholesale a wider mix of energy that is less profitable. Yet, the company’s 80% regulated market is a huge win for the company. It creates a great economic moat that other companies just do not have, and it is something investors can rely on. The company maintains one of the highest margins in the industry with this strong mix, and there is little threat to a major push down. For those looking for consistency, NEE is definitely a leader. This theory of strong profit, regulated business is why we are excited about the company’s foray into Hawaii. Hawaii – Another Regulated Market to Add Shareholder Value The Hawaiian market has a new entry from NextEra after the company bought Hawaiian Electric (NYSE: HE ) for $4.3B in 2H of 2014. We believe that this move is key to 2015 and even beyond. What we think is the best aspect of this deal is the combination of regulated markets with the company’s penchant for bringing more efficient practices to bear. The company, in fact, will reduce customer costs. The expertise that NEE has in using combinations of energy, especially renewable, will be very beneficial for Hawaii. The state, today, pays greatly for importing oil and other electricity generators. NEE has plans to revolutionize the space with solar energy. The state is one of the best for solar energy, and the company can use their strength here to help the state as well as company revolutionize their grid. The deal is more than just solar, though. The company has already got a deal together with a giant wind farm that will be part of the company’s push to use Hawaii’s natural state to bring down costs: NextEra Energy Resources, a wholesale electricity supplier and subsidiary of NextEra Energy , which is buying Hawaiian Electric Co. for $4.3 billion, has locked in long-term access rights to Parker Ranch Foundation Trust lands to develop renewable energy projects. ‘We have been aggressively seeking ways to reduce the cost of electricity for our community and our island by using the potential renewable energy resources available on PRFT’s Hawaii Island lands,’ Neil ‘Dutch’ Kuyper , president and CEO of Parker Ranch, said in a statement. ‘During this time, we have also been seeking capital and technical expertise from potential development partners. We have been working collaboratively with NextEra Energy Resources for more than a year and believe that they are the ideal partner to utilize PRFT’s wind resources.’ What does that mean for NEE shareholders? The deal was announced on Dec. 4, and the stock has gone nowhere since. There was speculation obviously leading until the deal. Thus far, shareholders have rewarded the company very little for the deal. So, just how much value might this deal add. The deal is still going to take 2015 to get done, but that sets the company up for 2016. Further, they are already doing work at bringing this deal up to speed. It is a short-term capex bust, but we see large potential moving forward. According to Dana Blankenhorn , the state is still very dependent on coal and oil: On my own visit to the Big Island of Hawaii, now served by Hawaiian Electric, I marveled at the wealth of potential renewable resources – wind, solar, geothermal and tidal energy – and was amazed at how much people had to pay for their power. Since then the state has begun tapping into that potential , but 86% of its electricity still comes from coal and oil. The company brings the expertise of how to apply a mix of renewable energy and create consistent returns. With the prices that Hawaii is used to paying, the company should reduce costs for Hawaiians yet also make a strong profit. The company’s mix, though, of more green energy plays has not been as profitable. The company still makes its bread and butter in Florida where it uses a majority natural gas. So, the question will be if they can return the type of 20% operating margin in Hawaii? The nice thing that is baked into the cake for them is that Hawaiians are used to paying more than most Americans, so they will be able to invest more easily. How this plays out is the key theme to watch for the coming year. Current Pricing Let’s take a look at the current price of NextEra stock and understand what it means for the company. From there, we will examine the bull case for that price and the bear case. Finally, we will look at exactly where we believe the company is going. While you may see the article as negative, we presented the first portion of this article to establish how we will look at the current pricing. In order to price the company, we need to make certain assumptions. Revenue growth will continue at a clip of 4-5% per year, and we believe that level will maintain for the next several years. Utility revenue is fairly consistent. The key to the company is definitely margins. Operating margins are key to our DCF analysis. The coming has forecast that they will come in at the 22-23% in 2015, but I imagine this number will dip some with the onslaught of Hawaiian Electric when it is approved. The deal should add roughly $4.5B in sales in 2016, but the company operates with a 10% operating margin. The deal is really essentially to take what is a tough market for making money, revolutionize it, and improve it. This plan, though, will take several years. Therefore, margins will drop in 2016 but gradually improve again through 2020. Taxes have averaged roughly 25% for the past five years, and it’s likely this will stay around 28%-30% over the next several years. We may see it jump even a bit more beyond 2016 when more solar credits are expected to expire. Depreciation will continue to grow at about the same rate as revenue growth. Capex should come down in 2015 to around $6B and again in 2016 to $4B.The $4B rate, though, is pretty standard for the company. Our cap rate or discount rate is at 3%. This does not reflect the high-growth but rather the strong ROE, dividend, and low volatility the company will face over the next several. When we use this math in our five-year DCF analysis, we come up short at $82 for our share price. In order to reach the $100-plus level that the company is currently operating at, they would need to see revenue growth averaging 6% per year for the next five years and maintaining a 22% margin. Here is what that looks like: PROJECTIONS 1 2 3 4 5 2015 2016 2017 2018 2019 Income from Operations 3,740.000 3,700.000 5,148.000 5,456.000 5,784.000 Income Taxes 1,122.00 1,110.00 1,544.40 1,636.80 1,735.20 Net Op. Profit After Taxes 2,618 2,590 3,604 3,819 4,049 Plus: Depreciation 2600 2700 2800 2900 3000 Less: Capex -6000 -3900 -4000 -4250 -4500 Less: Increase in W/C -100 -100 -100 -100 -100 Available Cash Flow -682 1,490 2,504 2,569 2,649 The Bull Case The bull case is twofold. On one end, the company is a strong utility with consistent profits and a yield of nearly 3%. Further, the company provides a green edge that will continue to develop as both a reason to buy companies and a competitive advantage. The company’s margins are strong and consistent. Further, on the other side, the company has real opportunity with Hawaii. While it may detract in the near-term, if the company can do it right, it could end up bringing a strong revenue/profit burst. Yet, we believe that the current pricing on the company suggests that a best-case scenario is priced in. We understand you don’t buy utilities for value or growth. You buy them to hedge volatility, add consistent ROE/yields, and diversify by industry, and NEE is one of the leaders in the industry. The Bear Case Utilities have been very strong, and it appears that NEE is probably cooked about to perfection right now with its current pricing. The company is unlikely to make a major pullback, but near-term upside may be limited. We believe a price target around $90 is more fair level with an upper band at $105 to $110. The reason for this is that we can’t foresee more than 22% operating margins and 6% revenue growth with the HE deal on the docket. The company also is not flush with cash or FCF right now to really pour into share repurchases or add more to its dividend. Therefore, the value in the company is that it is consistent right now. Where We Come In We like NEE’s business model, but as value investors, the company seems priced correctly at this time. We would be interested if NEE came back in under $90. Yet, we also see the value of a true leader in the industry that continues small dividend increases and is making moves in natural gas and new territory that remain intriguing propositions. Conclusion NextEra has interesting catalysts to 2015, but after a tremendous run in 2014, the company looks like its upside may be limited in the near-term. The value of adding a deal like HE to the mix is definitely long-term, and we do like the consistent margins/yield/growth. The company has great economic moats, so it is a nice place to park cash, expect limited losses, and collect dividends. For value/growth investors, though, this play has lost its allure … for now. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.