Tag Archives: nee

NextEra Energy Still Not Worth Buying, More Questions Emerge In Hawaii

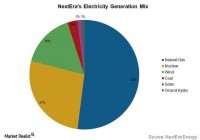

Summary Hawaii Electric looks less likely to close by the end of the year than in our previous analysis. NextEra still doesn’t appear worth more than the mid-$90s. NextEra is doing really well in Florida and profits are higher than expected. Today, we will to take a refreshed look at NextEra Energy (NYSE: NEE ). We first looked at the company in late February and followed that with an update in June . When we started our analysis in February, we argued for some correction. We then reiterated that valuation was too rich in June. YTD, the company is now down 5% and has not shown much ability to add more value. We noted we would be interested at the 90-level. Our main thesis was that, while the company’s health and catalysts were strong, valuations were pricing in a best-case scenario of 6% revenue growth and 22% operating margins consistently moving forward. In the June update, we continued to be worried about margin compression from the Hawaii Energy (NYSE: HE ) deal. Today, we want to revisit our catalysts in the wake of the last set of earnings as well as other developments that have occurred. Additionally, we will take another look at our pricing model to update that given this analysis. 2015 Catalysts Revisited Economic Moat Strength For me, the key strength for NEE has always been its economic moat that exists from non-competitive agreements that the company has with many municipalities. Non-comp agreements exist in many of the relationships the company has where it negotiates a “fair price” deal with a town/city/county that limits competition but keeps prices in check for citizens. As we noted before, NEE is very attractive because about 80% of its business is in the regulated arena, where profitability is strongest. This image from Market Realist tells the tale: (click to enlarge) (click to enlarge) The company benefits strongly from these regulated industries as it can establish infrastructure, keep consistent revenue/earnings flowing, and doesn’t have to worry about competition. As long as the company can maintain this strong mix, it will be attractive for income, long-term investors. To me, the real catalyst, though, is the company’s ability to have success in Hawaii. Hawaii – Another Regulated Market to Add Shareholder Value In 2014, NextEra bought Hawaiian Electric ( HE ) for north of $4B. The move was a chance to come into a new market that was in need of cost savings and be able to combine a regulated market with the company’s practice of making efficient utility deliveries. Further, NEE wanted to be able to bring its ability and knowledge of scaling renewable energy in an area that is burdened by extreme energy costs. Between the company’s initiatives in solar energy and knowledge of other sources, NEE stands to be able to generate a very strong value proposition for Hawaii while also continuing to promote its economic moat. So, how have things been moving since the last time we looked at the company… The last time we looked at the HE/NEE deal, the main aspect of the deal was just to get it done and approved. In April, HE’s CEO came out saying he was confident that the deal would be completed within a year, and the Hawaiian House of Representatives put a resolution in place to complete the deal by June 2016. Given the market is regulated, it is a major decision for Hawaii, consumers, etc. In the company’s latest earnings, here was the company’s comments on the HE deal: Steven Fleishman – Wolfe Research Yes, hi good morning and congrats. The couple things that I guess you didn’t mentioned, first is any kind of thoughts on the Hawaiian deal and just, there does seem to opposition in your ability to get that done? James L. Robo – Chairman and Chief Executive Officer Steve this is Jim, obviously the state filed a testimony ten days ago saying that they opposed the deal in its current form and the Governor held a press release where he, press conference where he said he opposed the deal in its current form. I think the key, the keywords there in its current form, they also, the state also listed several conditions that would be, I think just positive for them to think about changing their view. And we are in the process of responding to that testimony and we think we have a very strong case to put forward to the Commission around the benefits to customers, the benefits to customers were actually pretty compelling and I think we’re going be able to make that case as we go forward. So, this was not necessarily a surprise to me that the state filed a kind of testimony that they did and we are going to continued to move forward on laying out our arguments and we look forward to the hearings we’re going to have in December to make our case. As we can see, things aren’t progressing as well as the company has hoped. In the last report, the company had noted that they expected the deal to be done by the end of the year. Now, the company is not quite as positive. Waiting till December to answer testimony is much different than getting approval then. The state of Hawaii published testimony in July, and the Governor came out against the deal: Gov. David Ige said Tuesday he doesn’t support the sale of Hawaiian Electric to Florida-based NextEra Energy. The sale was approved by Hawaiian Electric’s shareholders in June but still needs approval from the state Public Utilities Commission. Ige said he supports capital investment in Hawaii, but he joined critics saying he’s concerned that NextEra may not be able to fulfill Hawaii’s goal that its utilities use 100 percent renewable energy by 2045. This news was not exactly the type of “positive” news that the company had hoped for. Since that comment in July, the Governor has said the process was still very early, and that he is looking forward to the company’s responses to testimony it presented. While we all expected some snags, the process continues to move quite slow and questions the long-term prospects of being able to have this deal work well for all parties. Overall, though, we believe this deal is very important to NextEra Energy. As we noted previously: The company brings the expertise of how to apply a mix of renewable energy and create consistent returns. With the prices that Hawaii is used to paying, the company should reduce costs for Hawaiians yet also make a strong profit. The company’s mix, though, of more green energy plays has not been as profitable. The company still makes its bread and butter in Florida where it uses a majority natural gas. So, the question will be if they can return the type of 20% operating margin in Hawaii? The nice thing that is baked into the cake for them is that Hawaiians are used to paying more than most Americans, so they will be able to invest more easily. We will continue to monitor this situation, but for now, the company is starting to look like they are getting off track. Current Pricing Next, we want to update our current pricing model for NextEra. The latest earnings for NEE were pretty solid in the latest quarter. EPS came in at 1.56 versus 1.50 expectations as well as a beat for revenue as well. The company’s strength continues to be seen in Florida, where revenues/earnings continue to rise. The company’s results were helped by an improving Florida economy that led to more additions as well as a lot of strength in NextEra Energy Resources, which saw a 21% increase in revenue. The NEER division is the renewable contracted part of the business, and that type of growth shows just how in demand renewable energy is becoming. In this section, we will want to take a look at our last pricing analysis, update it, and determine what we believe is a fair value price for NEE. In order to price the company, we need to make certain assumptions. In our last two articles, we modeled revenue growth to continue at a clip of 4-5% per year, and we believe that level will maintain for the next several years. The gains we noted in our last article were not sustainable in NEER, and the results have already seen a 50% reduction QoQ. Most analysts are only modeling for 1% growth still for this year, but we are using an annualized figure. Utility revenue is fairly consistent. The key to the company is definitely margins. Operating margins are key to our DCF analysis. The coming has forecast that they will come in at the 22-23% in 2015, but I imagine this number will dip some with the onslaught of Hawaiian Electric when it is approved. In Q2, the company’s operating margins came in strong at 26% after 28% in Q1. For 2015, we believe 22-23% is a bit light, and we will increase our expectation to 25%. As for the HE deal, it should add roughly $4.5B in sales in 2016, but the company operates with a 10% operating margin. The deal is really essentially to take what is a tough market for making money, revolutionize it, and improve it. This plan, though, will take several years. Therefore, margins will drop in 2016 but gradually improve again through 2020. Taxes have averaged roughly 25% for the past five years, and it’s likely this will stay around 28%-30% over the next several years. We may see it jump even a bit more beyond 2016 when more solar credits are expected to expire. Depreciation will continue to grow at about the same rate as revenue growth. Capex should come down in 2015 to around $6B and again in 2016 to $4B.The $4B rate, though, is pretty standard for the company. Our WACC rate is 5% for discounting. When we use this math in our five-year DCF analysis, we were looking at a low-90s number. We have made some positive adjustments, and here is our projections: PROJECTIONS 1 2 3 4 5 2015 2016 2017 2018 2019 Income from Operations 4350 3654 3990 4347.2 4726.73 Income Taxes 1218 1023.1 1117.2 1217.2 1323.48 Net Op. Profit After Taxes 3132 2630.9 2872.8 3130 3403.25 Plus: Depreciation 2600 2700 2800 2900 3000 Less: Capex -3600 -3900 -4000 -4100 -4200 Less: Increase in W/C -100 -100 -100 -100 -100 Available Cash Flow 2,232 1,531 1,773 2,030 2,303 We don’t see any major change from our last model, so we are keeping our price target at $96. Margin drops in HE and getting regulations approved are key to this model. Additionally, if Florida and NEER stay very strong, the company could outperform our expectation for the current FY. Conclusion NextEra has interesting catalysts to 2015, but after a tremendous run in 2014, the company looks like its upside may be limited in the near-term. Recent issues in Hawaii Electric ( HE ) make me nervous, but the rest of the company’s business is extremely intriguing and strong, which neutralizes my fears there. Yet, we still don’t see the reason to buy when we are at sitting at 2.5+ times sales and the company has question marks outstanding.

NextEra Energy, Part 2: Leadership Seen In Diversity, Community, And Renewable Energy

Summary The company ranks very well in diversity hiring, community involvement, and renewable energy. The company does not rate well in women hiring, green productivity, and has limited information in other places. We believe NEE is overall a strong leader in social responsibility. In Part 1 of this article, we saw that NextEra (NYSE: NEE ) is, at this time, not a “buy” for us. We see the upper limit of 2015 pricing in the $105-$110 range, and that the company’s fair value sits in the mid-$80s. Essentially, the company is not a buy for us from a purely financial standpoint. In this part of our research, we will focus on the socially responsible aspects of the company. Our findings are very promising. Yet, failing to see an upside in general, we cannot make an overall positive comment. The company should be respected for its work in socially responsible ways. Socially Responsible Scorecard There are many ways to understand and develop socially responsible investing (SRI). What is “responsible” for each person is vastly different, and what might be “responsible” to one person might be “irresponsible” to others. That is the toughest part of investigating companies for SRI. While pure capitalism to some is the most responsible approach to business, others may see that this could harm other areas such as environmental stewardship or economic development. Others may believe too much capital invested into socially conscientious programs could hurt profits and investors. Therefore, we will try to present as much information as we can to render the best opinion possible. Overall, socially responsible investments are more about leadership and paving the way, rather than compliance. Compliance is doing what is required, while corporate responsibility is about leading and doing more than is required. Companies that lead are always the most respected in the long term, and we believe provide both a safe investment platform as well as peace of mind. The criteria we use to examine the company’s overall social responsibility theme are gender equality, employment and diversity, environmental stewardship, leadership values and community involvement. With all research, some areas have more quantifiable parts, while in other areas, there is not as much. We base our research in taking an aggregate look at leading think tanks, research firms and important websites that cover these topics. We split this research into the aforementioned topics to help create a more holistic opinion. Overview NextEra appears to be a leading firm in the SRI space with strong showing in many key areas. The company was rated as a coveted Ethisphere World’s Most Ethical Companies in the 2014 edition, which shows a dedication to be a leading firm that goes above and beyond compliance. They lead in a number of areas with diversity hires, green energy, and a clear intention for community involvement. The company’s CSR Hub rankings did not show a strong lead, but they were above average. Their “Overall” rating comes in at 60, while Employees and Environment lead the way at 66 and 64, respectively. The company is above average, according to the Hub. The company, though, has won many awards and is a leader in a space that is one of the largest polluters. When we search for companies, we look for the ones that are leaders in various areas of business. NEE appears to be that way. Take a look at the company’s awards here . Some of the most interesting awards we have seen are: — ServiceOne Award for Exceptional Customer Service — Best Employees for Healthy Lifestyles – The Fortunes’s Most Admired Companies Award: In 2014, NextEra Energy was named No. 1 among electric and gas utilities for an unprecedented eighth straight year on Fortune magazine’s listing of “Most Admired Companies.” In that same Fortune survey, the company was named No. 1 electric and gas utility in innovation, No. 1 in social responsibility and No. 1 in quality of products and services. Workforce – Diversity, Compensation, Gender Equality NextEra’s is actually quite strong in their approach to diversity, equality, and compensation, serving as a leader in the way companies should approach their workforce. We believe this is very socially responsible and commendable. The company has been recognized as a top leader in hiring veterans and Hispanics. The company has been recognized by Hispanic Business magazine since 2010 as one of the leaders in diversity hiring. As the award states, “(they) determine the list, the magazine analyzed data on companies’ boards of directors and leadership, recruitment, retention and promotion, marketing and community outreach, and supplier diversity.” As for veterans, ” Vetrepreneur magazine, the voice of the National Veteran-Owned Business Association, gave FPL honorable mention in its compilation of the 2011 Best 10 Corporations for Veteran-Owned Businesses.” The company rates well in other areas of its workforce as well. The Human Rights Campaign rates the company as a 70, which is a rating system for a companies rights to gay, lesbian, and transgender employees. The company has the same rights for same-sex partners as opposite-sex partners and spouses outside of relocation assistance. The company’s 70 rating puts them at the upper end of the rating scale. The company is recognized as well as being one of the companies to have non-discrimination policies for sexual orientation as well. The company didn’t have much information on gender equality for hiring, but the diversity aspect is very positive. As for worker compensation, the company rated a 58 by CSR Hub for worker compensation. The company, though, has positive ratings for safety and health benefits. The company won Best Employers for Healthy Lifestyles for the eighth time for “its ongoing commitment to promoting a healthy work environment and encouraging its workers to live healthier lifestyles. The company was one of just two Florida-based companies and one of only two companies in the energy sector to receive the 2013 Best Employers for Healthy Lifestyles® Award in the prestigious Platinum category.” What we are seeing from the company is a dedication to a workforce and a dedication to policy that promotes safety, diversity, and compensation. We believe this is a leader in this arena, and it complements well their placement as a leading green energy utility. Green Initiative The company has been most recognized for its leadership in green energy. The company is in one of the dirtiest industries, and their reputation is strong. Yet, there are some weaknesses/improvements that need to be made. For as many green awards as the company has won, there are still improvements to be made. Just take a look at this chart to start: (click to enlarge) Despite being labeled the “green” utility, the company is using nearly over 50% in natural gas still, and they also use over a quarter in nuclear, which has some very negative consequences on society if not managed properly as well as waste concerns. In face, the company is really only about 17% actual “green” energy. Further, the company is not the cleanest utility out here. (click to enlarge) The company is definitely one of the cleanest, but it is not as clean as some of the best, and that mix could continue to improve. The company is a “leader,” but we should also understand that this is a company that still uses 50% of their fuel in natural gas. Newsweek’s Green List ranked the company 209th on its Green List, which is one of the most comprehensive looks at companies in the marketplace. This list, though, ranks companies fairly across the board and does not quantify their industry. Naturally, a utility company is going to struggle. The company rated at only 10%, 18%, and 13%, on their energy, carbon, and water productivity out of 100%. The company rated very well, though, on reputation. Out of utilities, the company ranked 15th, which is not exceptional especially given their reputation. Also troubling was the company’s decision not to respond to the Carbon Disclosure Project since 2010. The company did rate an 82 in 2009, which is a decent rating. What is troubling, though, is the CDP is one of the leading, respected firms for rating company plans for carbon versus actual carbon productivity. It is not rating on a single scale but looking at all companies individually. Yet, the company has won numerous awards as you can see here . The company is continuously rated in the Dow Jones Sustainability Index and was rated the best utility for renewable energy by EI New Energy. The company has been rated well for its top electric fleet, and it is rated well for their care and dedication to trees. Overall, the company has solid awards and is rated decently, but we are not as sold as these awards given that some of the leading research gatherers have not gotten necessary information or rated it as well when compared to its competition. What is definitely positive is the company’s leadership that they are the top renewable energy producer. It is an industry that is still mostly based in coal, oil, and natural gas, so the company is better in that regard. Yet, the company’s efficiency ratings aren’t as strong, which is something to consider. Additionally, the nuclear energy angle is considered part of renewable energy, but we are not high on this form of energy due to the direct social risk from it that may be even higher than non-renewable sources. Overall, we would like to see a continued reduction in natural gas and increases in wind and solar power. The company is very low on coal, which is great, and they do help bring other utilities into the mix into these renewable sources. There is still much work to be done. Community Involvement NextEra appears to have a pretty comprehensive strong approach to community. Not only do they rate quite well on their diversity hiring, but they are also leading the renewable utility energy game, which is also positive for the community. Yet, the company also has a very comprehensive direct community plan to volunteer, donate, and be involved in their communities. The company’s 22,000 hours of volunteer time in 2011 in their community and a whole week called Power to Care show some definite leading energy being put back into the community. You can read more about the company’s difference making here . The company has a very progressive hiring plan also for military volunteers that falls into the company’s Diversity Inclusion division that we believe is really respectable. In November, the company was awarded an “Above and Beyond” award in Florida for their strong military hiring program. As a retail company as well, the company has won numerous awards for their customer satisfaction and service. The information we collected here was more limited, but the company definitely appears on the right track. The unseen benefits are what excite us most with their efforts in renewable energy and diversity leadership. Conclusion As you can see, NextEra is a leader in quite a number of areas of social responsibility, but we do have concerns in some areas. We would note they are one of the top companies that are public today, though. Right now, they rate high for us in social responsibility, but we are not as high on their price analysis. We would love to add them on any slight dip in valuation to a socially responsibly crafted investment plan. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.