Sky Solar: A Less Risky Way To Invest In The Growing Solar Industry

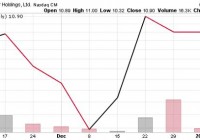

Summary The company is benefiting from increased electricity sales and is expanding its solar park assets. Sky Solar has a strong project pipeline and is focusing on the downstream project business. Expanding fast into the Chinese market under the supervision of a new management team. I ntroduction Sky Solar Holdings Ltd. (NASDAQ: SKYS ) is an independent solar power producer headquartered in Hong Kong. The company recently got itself listed on Nasdaq and trades with the ticker SKYS. Sky Solar owns and runs various solar parks across the globe. It has developed around 200 solar parks in Japan, Greece, Bulgaria, the Czech Republic, Spain, USA, Puerto Rico, Canada and Germany, which totals ~182 MW in capacity. The company’s business model is similar to TerraForm Power (NASDAQ: TERP ), which owns solar plants and derives money by selling the electricity to utilities. As the solar industry has rapidly expanded and matured, the independent solar power producer business model has developed rapidly. The company derives its revenue components from solar system and electricity sales. Sky Solar is gradually increasing its electricity sales, while decreasing the focus on system sales. Given the company’s widespread geographic base, growing solar industry and focus on long-term electricity sales and expansion in the growing Chinese market, I would recommend adding the stock to one’s portfolio. What I like about the company 1) Increasing its presence in China – Sky Solar very recently announced that it would be entering the Chinese Solar market , which is the largest in the world. The company has strong links in China with its management being Chinese. Sky Solar has plans of building and selling solar assets to the large state owned organizations. It is specifically looking for provinces, which have a power demand-supply imbalance. Another initiative is the launch of “Sky-Link,” which is a platform for analyzing industry data related to supply chain and solar project quality control. The company also is looking at moving senior leaders to China to expedite the processes. All these initiatives will help the company penetrate the Chinese market quickly. The company also is thi nking of expanding in Japan and South America. 2) Good Q314 Performance – The company reported revenues of $10.3 million, which increased by 26.1% y/y. The highest electricity sales were in the European region and the highest solar system sales were in the North American region. Gross margin was 47.9% in Q314, as compared to 10% in Q3 2013. This was mainly due to the shift from solar energy system sales business to electricity sales. Loss per share remained unchanged at $0.01, when compared to Q3 2013. The company ended the quarter with $33.2 million in cash and cash equivalents. Total borrowings amounted to $48.1 million. “Looking ahead, we are focused on development in several key geographies where we see strong growth potential, including Japan and South America. We believe our strong foundation in the most promising solar power markets will drive our growth in 2015 and beyond – Mr. Weili Su, founder and executive chairman of Sky Solar Source: Sky Solar Revenue Mix (million $) Q3 2014 Q3 2013 % increase/ (decrease) Electricity Sales 6.9 3.2 119 Solar system and Other Sales 3.4 5 -32.4 3) Increasing Electricity sales – The company is shifting focus gradually from solar system sales to IPP electricity sales. The electricity sales increased 119% on a yearly basis, comprising 67% of the total revenue in Q3 2014. The company plans to increase its solar park asset portfolio, which will further escalate electricity sales in the revenue mix. It is always beneficial to diversify, especially in the high beta solar industry. The company’s revenues are increasing from electricity sales and it is thus benefiting from this diversification. 4) Expanding Project Pipeline – As of November 2014, the company had 1.3 GW of projects at various development stages and more than 1 GW of projects in the pipeline. Sky Solar had 18.5 MW projects under construction in Japan and a 4.1 MW project under construction in Canada. 5) Additions to the Management Team – Sky Solar announced a change in its executive management team on December 22nd, 2014. Two of the positions will take care of the company’s new initiatives in China and thus help a smooth entry into the Chinese market. The new CEO Mr. Weili Su also is the founder of Sky Solar Holdings and has served as a director and secretary of the board for Yingli Green Energy (NYSE: YGE ). The company matched the necessary skill set with the job requirement, thus lending more efficiency into the processes. The company is backed by the China Development Bank (CDB), which gave it a $1.6 billion credit line in 2012 . SKYS Risks Competition – Sky Solar competes against major solar developers such as SunEdison (NYSE: SUNE ), as well as other major power producers such as Abengoa and EDF. The company also faces competition from the likes of mainstream solar companies like Jinko Solar (NYSE: JKS ) and Canadian Solar (NASDAQ: CSIQ ) specializing in the project development business. Falling Fossil Fuel Prices – While I don’t think it is a major issue, falling prices of crude oil, gas and coal is making solar less attractive as a power source. However, governments around the world are subsidizing and pushing for solar power because of its environmentally friendly nature and energy security. India recently raised its solar target from 20 GW to 100 GW by 2022. China too has signed an agreement with the US to increase the share of renewable electricity substantially by 2030. Stock Volatility – Solar shares are highly volatile and can see sharp declines and are not for the risk averse investor. Since November, SKYS has dropped to a low of $6 and a high of $14. The company could not raise $172.5 million that it targeted with a higher valuation and had to sell less number of shares at a lower price. Stock Price and Valuation Sky Solar is currently trading at ~$10.9, which is ~30% below its 52-week high. SKYS unlike other major solar companies such as YGE, Trina Solar (NYSE: TSL ) and Jinko Solar, has not been affected too much by the sharp stock price declines. The company’s revenues are dependent more on a long-term sale of electricity, which is more stable than sale of low-margin solar panels. The company has a market capitalization of $591.4 million. Sky Solar’s forward P/E is 16.8x, while P/S is 15.4x. The P/S might look expensive when compared to other Chinese solar companies. However, one should note the company makes most of its money through electricity sales, which happens over the 25-30 year life of the solar asset. Most of its investments happen upfront, while cash flows accrue over 25-30 years. I think SKYS provides a good diversification in a solar portfolio. SKYS has declined less than the other Chinese solar stock companies, which have fallen sharply due to the oil price decline. Like other power producers, the stock has more stable earnings compared to solar panel companies. (click to enlarge) Conclusion Sky Solar is not biased towards any particular solar supplier or technology and hence can easily choose from manufacturers and suppliers to match the best technology for its projects. The company is earning revenues from the downstream project business, which is expanding rapidly. IHS estimates that global solar demand will increase between 16-25% in 2015. The Chinese market is the largest one in the world with more than 10 GW to be installed in 2015. This shows that the company has a good market to expand into. Even mainstream solar panel manufacturers such as Yingli Energy and Trina Solar are diversifying into the solar project business because it is more profitable. Sky Solar also is b enefiting from increased electricity sales in its revenue mix. I think that the company has a good business model but given the depressed valuation of its peers, investors should wait for sharp price dips (stock dropped to $6 during December). With the company’s increased focus on the Chinese market and its strong project pipeline, I would recommend adding the stock during sharp dips.