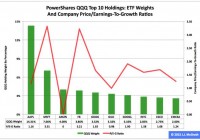

Summary Over the past 6 months the “Wisdom of Experts” Portfolio outperformed S&P500, 5.1% vs 1.1% in an equity market that largely traded sideways. AAPL and the pharma companies were the primary drivers of the outperformance of the portfolio for the past 6 month period. After a mid-year adjustment, Apple continues to be the largest component of the portfolio at 13%. Technology, finance, and large pharma comprise 90% of the updated portfolio vs 48% of these 3 sectors in the S&P500. In December 2014 we introduced a “Wisdom of Experts” portfolio based on the top picks of the 33 large cap funds scored by Morningstar as “5-star” funds. The concept we are testing is whether a top-performing portfolio can be constructed based on the top picks of the top fund managers. We won’t know the answer to this question for many years since we need to test the portfolio through bull and bear markets. But the journey has started and for the first 6 months of its existence, the portfolio has had the opportunity to perform in a market that traded sideways – and, for this short period of time, the portfolio outperformed the S&P500 based on total return, 5.1% vs 1.1%. Background – Portfolio Construction Morningstar ranks mutual funds with a star rating, with the very best funds rated with 5-stars. When we started the portfolio in Dec 2014 Morningstar rated 33 US-based large cap equity funds as 5-stars. From these 33 funds we took their top 10 holdings and scored the top holding as a “10,” the second as a “9” and so forth down to the tenth holding, which received a “1” score. We then added up all the scores and included the top 25 companies in our portfolio (the initial portfolio contained 27 companies since 3 tied for position 25). The percentage component for each holding was based on the overall score each company received. The current 5-star large cap US equity funds are presented in the table below. Over the past 6 months Morningstar downgraded 8 funds from 5-star to 4-star, so these funds are no longer included as we adjust our portfolio. On the other hand, 5 funds were upgraded to 5-star, so we now have 30 funds to re-adjust our 2Q15 portfolio. The updated portfolio, which we present at the end of the article, was generated from the top 10 holdings of these 30 funds using the same scoring system as outlined above. During the first half of 2015 the composite total return of these 30 funds was 2.7 % which slightly outperformed the S&P500 (1.1% total return). Morningstar 5-Star Large Cap US Equity Funds (date 6/30/2015) Fund Name Ticker Fund Category 2014 Performance % 2015 Performance to June 30 Alger Capital Appreciation ALARX Large Growth 11 7.3 Becker Value Equity Retail BVEFX Large Value 7 1.6 DFA Core Equity DFEOX * Large Blend 7 — Fidelity Advisor Large Cap FALIX Large Blend 6 3.0 Fidelity Puritan FPURX Mod Alloc 9 2.8 Fidelity Blue Chip Growth FBGRX Large Growth 12 6.5 Fidelity Growth Company FDGRX Large Growth 11 6.6 Fidelity Large Cap Stock FLCSX Large Blend 7 3.2 Fidelity OTC FOCPX Large Blend 14 4.8 First Trust Value Line Div FVD Large Value 12 -1.4 FPA Crescent FPACX Mod Alloc 5 0.1 Franklin Income A FKINX * Cons Alloc 1 — Guggenheim SP500Pure Growth RPG Large Growth 11 3.0 Janus Aspen Balanced JABLX Mod Alloc 6 1.0 JP Morgan US Equity JMUEX Large Blend 11 2.9 Mairs & Power Balanced MAPOX * Mod Alloc 6 — Mairs & Power Growth MPGFX * Large Growth 4 — Oakmark Large Blend OAKMX Large Blend 8 0.1 Parnassus Core Equity PRBLX Large Blend 11 -0.8 Powershares Buyback Achievers PKW Large Blend 8 2.6 Powershares Dynamic Large Cap Value PWV Large Value 8 -0.4 Powershares FTSE RAFI US 1000 ETF PRF * Large Value 8 — PrimeCap Odessey Growth POGRX Large Growth 12 4.5 Schwab US Fundamental Large Co SFLNX * Large Value 8 — Sequoia SEQUX Large Growth 5 11.2 TR Price Blue Chip Growth TRBCX * Large Growth 7 — TR Price Cap Appr PRWCX Mod Alloc 11 4.3 Vanguard Cap Opportunity VHCOX Large Growth 17 3.8 Vanguard Equity Inc VEIPX Large Value 8 0.3 Vanguard High Div Yield VYM * Large Value 10 — Vanguard Prime Cap Core VPCCX Large Growth 18 0.2 Vanguard Prime Cap Inv VPMCX Large Growth 18 1.3 Vanguard Wellington VWELX Mod Alloc 8 0.7 New 5-Star Funds in 1H2015 John Hancock Disciplined Value JVLIX Large Value — 0.6 JP Morgan Equity Income Select HLIEX Large Value — -0.3 JP Morgan Value Adv Inst JVAIX Large Value — 1.7 Laudus US Large Cap Growth LGILX Large Growth — 6.8 TR Price Value TRVLX Large Value — 1.8 Average 9 2.7 S&P 500 Index SPY 10 1.1 * Denotes funds that were downgraded from 5-star to 4-star in the past 6 months. Six-Month Performance of the “Wisdom of Experts” Portfolio The performance of the “Wisdom of Experts” portfolio since inception in Dec 2014 is presented in the Table below. Over the past 6 months the portfolio has outperformed the S&P 500, 5.1% vs 1.1%, based on total returns that include dividends. (Total returns are based on data from Morningstar). “Wisdom of Experts” Large Cap Portfolio – 1H2015 Performance (data from 12/31/2014 through 06/30/2015) Comments on 1H2015 Performance Two of the three top holdings of the portfolio had strong gains, AAPL and JPM, while MSFT fell slightly. Apple (NASDAQ: AAPL ) justified its selection as the #1 holding of the portfolio and was a key reason for the outperformance vs SPY. AAPL advanced 15% for the first half of 2015. Coupled with an 11% component of the portfolio, AAPL contributed to about one-third of the 5.1 % portfolio gain. Microsoft (NASDAQ: MSFT ) lost 3% over the first 6 months of the year, mostly treading water with the rest of the overall market. JP Morgan Chase (NYSE: JPM ), the third largest holding at 6.4%, contributed to overall gain of the portfolio with a solid 11% gain over the first half. The top performer of the portfolio over the first half of 2015 was Amazon (NASDAQ: AMZN ), advancing 41%. Healthcare comprised 26% of the portfolio but accounted for half of the 5.1% gain for the portfolio in 1H2015. Top performers included GILD, LLY, BIIB, and ACT (now AGN). Gilead (NASDAQ: GILD ) advanced 24% for 1H2015, helped by a sell off right before the end of 2014 when ABBV launched Viekira Pak and made a deal with Express Scripts to exclusively use Viekira Pak. GILD countered with several exclusive deals of its own and the launch of Harvoni in the US topped most analyst expectations in 1Q. Interestingly, however, GILD has dropped out of our portfolio (see below) in the mid-year update as the top funds have perhaps questioned the sustainability of HCV revenue and earnings moving forward. Eli Lilly (NYSE: LLY ), up 23% in 1H15, continues on a roll after a total return of 40% in 2014. LLY is included as a top 10 holding in only 5 of the 30 funds, but is one of the top 4 holdings in each of these funds, which is the reason for the overall high ranking of the company in our portfolio. Hopes are high for two drugs in development, evacetrapib, to lower cholesterol, and solanezumab, for Alzheimer’s. Leerink predicts a 50% probability of success for evacetrapib and a 20% to 30% probability of success for solanezumab. Biogen (NASDAQ: BIIB ) gained 19% in 1H2015 as excitement grew over its drug candidate that showed cognitive improvement in Alzheimer’s patients, the first drug candidate to do so in a meaningful way. As reported in a New York Times article , 166 patients with early stage disease participated in the study. While plaque was cleared and cognition was improved, the drug candidate caused brain swelling at the highest dose. Actavis, now renamed as Allergan with ticker AGN, gained 19% for 1H2015. This company has been built on acquisitions and is now a leader in both generics and proprietary drugs. In July 2014 Actavis acquired Forest Labs in the largest pharma M&A deal of 2014. In March of this year, Actavis completed the acquisition of Allergan to create a diversified global pharma company with $23 billion in annual sales. Dragging down the performance of the portfolio was LUV (-20%), perhaps expected after a run up of 121% in 2014, as well as the large oil stocks XOM (-9%) and CVX (-12%). PG also declined 10% as this large consumer staple company is shedding unprofitable brands and hoping to rekindle growth based on its most innovative products. Investors are perhaps wondering if this company continues to deserve its high P/E (20). As discussed below, both CVX and PG have dropped out of our portfolio at the 2015 mid-point portfolio re-adjustment. “Wisdom of Experts” Portfolio Adjustments, 2Q2015 As discussed in the background paragraph, the portfolio is comprised of the top holdings of 5-star large cap funds. These funds adjust their portfolios on a routine basis and report their holdings and percentage composition once per quarter. In addition, Morningstar has made several changes to their 5-star ratings. Nonetheless, the adjusted portfolio, as presented below, has not changed that drastically over the past 6 months. Mid-2015 Wisdom of Experts Portfolio Rank Ticker % of Portfolio Jun2015 % of portfolio Dec 2014 Dividend Yield %* Forward P/E* Beta 1 AAPL 13.0 11.2 1.5 13 1.07 2 JPM 6.4 6.4 2.3 11 1.37 3 WFC 6.3 4.4 2.5 13 0.83 4 GOOGL 6.0 5.0 0 17 0.86 5 MSFT 5.5 10.3 2.7 16 0.73 6 BIIB 5.1 3.5 0 25 0.58 7 FB 4.6 3.1 0 34 0.77 8 AMGN 4.5 4.6 1.8 15 0.63 9 AMZN 4.4 2.4 0 91 1.48 10 LLY 4.1 2.8 2.3 24 0.40 11 PFE 3.7 2.9 3.2 15 0.86 12 MRK 3.5 0 3.1 15 0.40 13 GE 3.1 2.8 3.4 17 1.56 14 JNJ 2.9 4.3 2.9 16 1.03 15 C 2.9 1.7 0.1 10 1.41 16 BAC 2.8 4.1 1.1 11 0.84 17 AGN 2.5 2.1 0 14 0.74 18 V 2.4 0 0.7 23 0.83 19 XOM 2.4 5.2 3.3 16 1.11 20 DHR 2.2 0 0.6 17 1.09 21 MA 2.1 0 0.6 23 1.36 22 RHHBY 2.1 2.7 2.8 26 0.78 23 LUV 2.1 2.2 0.7 10 0.86 24 TXN 1.8 0 2.5 17 1.16 25 IBM 1.8 0 2.8 10 0.86 Composite 1.6 19 0.93 SPY 1.9 18 1.00 *Dividend yield and forward P/E source: Morningstar. Companies in bold are new additions at mid-year readjustment. Apple remains the top holding of the portfolio, with its composition increasing from 11% to 13%. AAPL is the #1 holding in 8 of the 30 5-star funds and is a top 10 holding in 15 of the 30 funds. AAPL continues to be attractive to both value and growth fund managers. While MSFT is a significant component of the portfolio at 5.5%, its popularity among these top-rated fund managers has declined from 10% at the end of 2014. Eight companies dropped out of the portfolio: CVX, T, GILD, ORCL, PG, HD, TGT, and VZ. New additions included large pharma blue-chip Merck, industrial conglomerate Danaher, the credit card companies Visa and Mastercard, and the technology companies Texas Instruments and IBM. As shown below these changes increased the concentration of the portfolio, with 90 % of portfolio now comprised of technology, healthcare, and financial services vs 48% for SPY. Sector weighting of “Wisdom of Experts” Portfolio vs S&P500 Sector Wisdom Of Experts Portfolio Dec2014 Wisdom Of Experts Portfolio Jun2015 SPY Dec2014 SPY Jun2015 Technology 34 37 18 18 Financial services 17 24 15 15 Healthcare 26 29 15 16 Industrials 3 5 11 11 Consumer Cyclical 2 2 10 11 Consumer Defensive 5 0 10 9 Energy 8 2 8 8 Communication 5 0 4 4 Utilities 0 0 3 3 Basic Materials 0 0 3 3 Real Estate 0 0 2 2 Other Statistics of Portfolio Dividends Dividend yield of the portfolio has declined from 2.0% at inception in Dec2014 to 1.6% at mid-year and is now below the 1.9% yield of S&P500. Five companies in the portfolio have no dividend: GOOG, FB, BIIB, AMZN, and AGN. Beta Beta, a measure of volatility and risk, is slightly lower than S&P500 at 0.93 vs 1.00 for the benchmark. For this short period of time, then, the investor is benefiting from increased gains with no increase in risk. P/E The forward P/E for the portfolio is 19, very close to the S&P500 (18). Timeliness of Portfolio Adjustments One major drawback to this approach to portfolio construction and adjustment is that we do not receive real time updates of a fund’s holdings. Our portfolio cannot be nimble in making changes, as opposed to the funds which can buy or sell on real time news. Most of the funds update their holdings quarterly so we are always going to be a step behind the actions of the fund managers. As an example, our December portfolio had reasonable holdings of ExxonMobile and Chevron. Now XOM has dropped from 5.2% of the portfolio to 2.4% and CVX has completely dropped out. Fund managers may have made these changes early in 2015, but we are just now making the change to our portfolio. Nonetheless, 19 of the 27 companies that were included in the Dec 2014 portfolio are still represented today, so the portfolio does not have as much turnover or churn as might be expected. Summary The “Wisdom of Experts” is an eclectic collection of large cap companies which represent the best ideas of the best fund managers. For the first 6 months of its existence, an admittedly very short time frame, the portfolio has outperformed SPY, 5.1% vs. 1.1%. To compare to other averages, the Dow Jones Industrials, as represented by the ETF DIA, was flat for the first half of 2015. The Nasdaq 100 (NASDAQ: QQQ ) was up 4.0% over this time frame and was also aided by a large 14% holding in AAPL. Finally, only 5 of the 30 5-star funds had a better 1H performance than the “Wisdom of Experts” portfolio. But again, the journey is just beginning for testing if crowdsourcing the best ideas from the best fund managers is a viable investing approach. Going forward we plan to update the portfolio on a quarterly basis to capture changes made by fund managers in a more timely manner. Disclosure: I am/we are long GILD, AAPL, GE, JNJ, WFC, MRK, VZ, CVX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.