Will South Korean Equities Take Off After A Japanese Rally?

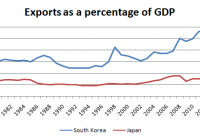

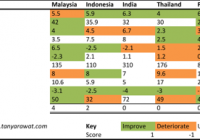

Summary Over the decades, the South Korean economy has become heavily dependent on exports. In recent years, strong won have not facilitated growth of South Korea’s GDP and the profitability of local companies. Korean equities trade at very low multiples that limit the downside risk. The introduction of any monetary stimuli could potentially kick off an equity rally. In that case, DBKO could be a winning security. Unlike Japanese stocks, the South Korean equity market has not performed well in recent years. While the most popular Japanese index, Nikkei 225, has appreciated more than 110% since the start of Abenomics in late 2012, South Korean KOSPI has gained almost nothing during the same period. Even though Japan and South Korea have much in common, they are very different in many aspects as well. For example, both countries are known for exporting high-tech products and high-quality vehicles. The South Korean economy is, however, much more reliant on exports, as demonstrated by the graph below. Data Source: The World Bank Strong won and stagnating profitability The reason behind the recent lackluster South Korean equity market returns lies in weak corporate profitability caused primarily by strengthening won. While earnings of companies listed on the First Section of the Tokyo Stock Exchange rose by 97.9% from 11/30/12 (the beginning of Abenomics) to 4/1/2015, earnings of companies included in the MSCI Korea decreased by 2.6% over the same period. It is not a big surprise that earnings of companies such as Samsung ( OTC:SSNLF ), LG Display (NYSE: LPL ), Hyundai ( OTC:HYMPY ) and Kia Motors ( OTC:KIMTF ) were significantly hindered by strong domestic currency as more than half of their revenue comes from outside of the country. Cheap valuation Based on PE multiples, South Korean equities remain incredibly cheap in global comparison. Over the above-stated period, PE of MSCI Korea has expanded from only 10.0x to 10.3x as price and earnings remained almost unchanged. To gain a better insight, PE of TOPIX has decreased from 15.0x to 14.9x thanks to strong corporate profitability due to weakening yen. Moreover, some sectors of Korea Exchange trade at extremely low multiples. This is specifically the case with autos, semiconductors, banks and IT, which last month traded with PE of 6.13x, 8.84x, 8.16x and 10.54x respectively. Some sectors like autos and banks traded even below their book value, with PBV ratios of 0.90 and 0.56 respectively. Will BOK follow in BOJ’s footsteps and introduce monetary stimulus? Without a doubt, the relative strength of South Korean won has been distinctively magnified by foreign quantitative easing programs. South Korea has suffered a great loss of its product competitiveness on overseas markets in particular against Japan. Because both countries compete in very similar markets, the BOJ’s aggressive quantitative easing program has been fatal to South Korean exports. Despite the BOK cutting interest rates to record low levels, the question remains: What will the central bank do after it runs out of its conventional monetary policy measures? We can only speculate for now, but I don’t believe that South Korea would abandon the global currency war if it realizes how important exports are for its economy. President Park stated recently at the National Assembly: We are standing at a crossroads, facing our last golden opportunity; which road we take will determine whether our economy takes off or stagnates. Now is the time for the National Assembly, the Administration, businesses and the people to come together as one and make dedicated efforts to resuscitate the economy. Graph: JPY/KRW since the start of Abenomics (click to enlarge) Source: Yahoo Finance Conclusion The launch of any quantitative easing from the side of BOK would be a bold turning point not only for South Korean won, but also for profitability of South Korean companies as more than half of their revenue comes from abroad. Therefore, subscribing to commentaries of BOK’s board members and closely monitoring the JPY/KRW currency pair can become a potentially rewarding activity. The largest and most liquid South Korea ETF is the iShares MSCI South Korea Capped ETF (NYSEARCA: EWY ), which seeks to replicate the MSCI Korea index. However, this is not a FX-hedged fund and its capital returns in case of introduction of any monetary stimulus would be diminished by currency losses for investors denominated in U.S. Hence, I would consider buying the other two funds – the Deutsche X-trackers MSCI South Korea Hedged Equity ETF (NYSEARCA: DBKO ) and the WisdomTree Korea Hedged Equity ETF (NASDAQ: DXKW ). They both have the same expense ratio of 0.58% and around the same percentage share of assets within its top ten holdings. The key difference between these two funds is in their holdings. Whereas DXKW consists of shares of only 47 firms, DBKO is diversified across 107 companies with significant exposure to Samsung Electronics, which accounts for a fifth of the fund’s assets. Top 10 Equity Holdings as of 17-Jun-2015 Name & Ticker Weight (%) Samsung Electronics Co Ltd 20.77 Sk Hynix Inc ( OTC:HXSCF ) 4.13 Hyundai Motor Co 3.25 Naver Corp ( OTC:NHNCF ) 2.82 Shinhan Financial Group Ltd (NYSE: SHG ) 2.75 Posco (NYSE: PKX ) 2.33 KB Financial Group Inc (NYSE: KB ) 2.31 Hyundai Mobis Co Ltd 2.25 LG Chem Ltd ( OTC:LGCLF ) ( OTC:LGCEY ) 2.13 Amorepacific Corp ( OTC:AMPCF ) 2.10 Data Source: Deutsche Asset & Wealth Management I believe that significant exposure to Samsung Electronics may pay off, as it is one of the most valuable brands in the world with a proven track record of sales CAGR 20.8% from 1989 to 2013 as well as above average earnings growth potential, currently trading at 9.4x PE. Therefore, I believe that DBKO is the single best security to own for eventual South Korean economy revival. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DBKO over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.