Tag Archives: nasdaqclne

Clean Energy Fuels: Weighing The Pros Against The Cons

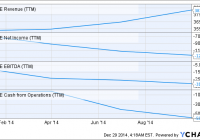

Summary Except for revenue, Clean Energy Fuels saw a decline in other key metrics in 2014. Clean Energy is burning through cash as it invests in infrastructure to tap the natural gas fueling market. Since natural gas-powered vehicles are expected to grow over 20 times in the next six years, it is important for Clean Energy to invest in infrastructure. Clean Energy, however, needs to make a quick turnaround in order to arrest a rapidly rising debt/equity ratio and a declining profit margin. It can be easily concluded that 2014 has been a year to forget for Clean Energy Fuels (NASDAQ: CLNE ), with the stock having depreciated almost 60%. This doesn’t come across as a surprise, because the company’s revenue growth hasn’t led to an improvement in its profitability. In addition, the company is burning through cash. The following chart will give us a bird’s eye view of Clean Energy Fuels’ problematic 2014. CLNE Revenue (NYSE: TTM ) data by YCharts But, the decline in Clean Energy’s net income, EBITDA, and cash from operations isn’t surprising at all as the company operates in an industry that’s making gains at a fast pace. According to Navigant Research , the global market for natural gas vehicles (NGVs) will reach 35 million units by the end of the decade, an impressive increase over 1.5 million units this year. Now, Clean Energy provides fueling infrastructure for these trucks. Considering the rapid pace at which the usage of NGVs is expected to grow in the future, Clean Energy needs to build up its infrastructure. This is the reason why the company’s financial performance has not been up to the mark this year, as it has aggressively invested in its infrastructure. But, the good thing is that it has positioned itself nicely for growth in the future. In fact, in 2015, its loss is expected to drop to $0.83 per share from the expected 2014 loss of $1.07 per share, translating into an improvement of 22.4%. Additionally, its revenue is slated to improve 15%. Moreover, for the next five years, Clean Energy’s bottom line is expected to continue improving at an annual rate of 25%. Factors Driving the Bullish Case The question is: Can Clean Energy actually achieve the expected growth rates? I think it can. The company recently closed two key strategic transactions with Mansfield and NG Advantage , and both these will allow it to tap key growth markets. NG Advantage has a robust compression infrastructure in place. As a result, it can provide cheaper natural gas for the facilities and vehicles of Clean Energy’s customers. Mansfield Energy, meanwhile, is a key behind-the-gate fuel provider in the U.S. It has partnerships with more than 900 petroleum hauling carriers countrywide. Through this venture, Clean Energy will operate closely with Mansfield’s haulers for transitioning their fleets to natural gas. Now, the addressable market opportunity that this joint venture has opened up is worth 3 billion gallons of diesel a year. In comparison, Clean Energy delivered 159 million gallons of natural gas in fiscal 2013. Hence, there is a big market that Clean Energy can tap as a result of the Mansfield deal. Apart from these partnerships, Clean Energy is also spending on the growth of its organic infrastructure. So far this year, Clean Energy has closed 49 station projects, and it has another 28 station projects under development. Driven by these infrastructure improvements, Clean Energy has been able to increase its customer count on the back of improved capacity. For instance, Clean Energy has signed a deal with Dillon Transport, and plans to open three truck-friendly public CNG stations to maintain Dillon’s expanding fleet of 200 natural gas trucks. Once fully deployed, these are expected to use 2.5 million gallons of fuel per year. The Bearish Case However, not everything is rosy about Clean Energy, as the following chart shows: CLNE Profit Margin ( TTM ) data by YCharts Clean Energy’s profit margin has been declining at a very fast pace, while its debt is rising at the same time. Presently, the company has total cash of $248 million, while its debt stands at $619 million. Also, as mentioned earlier in the article, it is burning through cash. The company’s operating cash flow is a negative $58 million in the past one year, while levered free cash flow is also negative at $121 million. Thus, if Clean Energy is unable to make a quick turnaround, its position might deteriorate further. This is a risk that investors need to be aware of. Conclusion As I mentioned in my bullish case, Clean Energy’s bottom line is expected to improve at an impressive pace. Given the prospects in the natural gas fueling market and Clean Energy’s own investments, there is a good probability that the company will be able to make a comeback in the future.