Best Performing Technology Mutual Funds Of Q2 2015

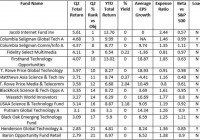

The technology sector’s earnings results have not been very encouraging this time. For the week ending Jul 17th, a good deal of tech results drove markets as earnings results and management commentary were mostly positive. However, the following week many earnings reports dampened investor sentiment. Apple did beat expectations although the surprise wasn’t as dramatic as it has been in the past. Nonetheless, excluding Apple, the tech sector’s earnings performance was weaker. In regard to mutual funds, Morningstar data showed that Technology sector mutual funds gained 1.64%. Though this return looks dismal, its compares favorably with the fact that it was one of the 6 among 15 Sector Equity Funds to have finished in the green. While it was the 5th best gainer among the Sector Equity Funds category, the technology sector ranked 14th among all categories of funds. Markets had a dismal run in the second quarter; wherein the S&P 500 and Dow declined 0.2% and 0.9%, however the Nasdaq did gain 1.8%. In the first half of 2015, fund inflow slumped 36% year on year to $143 billion. This significant decline was largely due to the dismal trend in the second quarter; wherein inflows were down to $41 billion through Jun 17, comparing unfavorably with the $102 billion of inflows in the first quarter. Tech Q2 versus Q1 Performance Coming back to the tech sector, 126 funds out of the 201 funds under the study finished in positive territory. The average gain for these 126 funds was 2.4%. While one fund had break even return, the remaining 74 funds posted an average loss of 1.2%. As for individual technology mutual funds, the best gain was 9%, which came from the ProFunds UltraSector Mobile Telecommunication Fund (MUTF: WCPIX ) . WCPIX requires a minimum initial investment of $15000. The J acob Internet Fund (MUTF: JAMFX ) was the next best gainer. JAMFX gained almost 6% and it has a minimum initial investment of $2500. Looking back at the first quarter performance, the tech sector’s gain was 3% compared to 1.64% this time. WCPIX was also the best gainer in the first quarter by gaining 13.2%. However, WCPIX has not been able to continue the momentum and has lost over 3.3% in July. The Firsthand Technology Opportunities Fund (MUTF: TEFQX ) was the next best gainer in the first quarter and had gained 8.6%. Of the 199 funds under the study in the first quarter, 184 funds had finished in positive zone with an average gain of 3.6%. One fund had break even return, and the 14 funds that finished in the red had average loss of 1.2%. Returns from the top 15 technology funds in the first quarter were also decently above the sector’s 3% return. The average gain for these top 15 performers in first quarter was 5.7%. The average gain of the best 15 fund performers for the second quarter stood at 3.7%, a decent decline from the first quarter performance. The Tech Sector’s Q2 Scorecard (as of Jul 29) Total earnings for the 75.6% of the Tech sector’s market cap in the S&P 500 that have reported results are up 1.9% on 3.5% higher revenues, with 67.6% beating EPS estimates and 55.9% coming ahead of revenue estimates. The sector’s earnings and revenue surprises are about in-line with other historical periods, though the growth rates are notably on the weak side, despite Apple’s (NASDAQ: AAPL ) strong contribution. Once again, Apple plays a key role in the sector’s result. Taking Apple out, the technology sector’s earnings would be down 6% on 2.1% lower revenues. However, Apple’s results and guidance were not enough to impress investors this time. Revenue guidance came in short of the street. The year-over-year comps were all good (except iPad, which dropped to its lowest level in four years), but some of the sequential comps and the billion dollar capex reduction could indicate weakness. As for other key players, Intel’s results were helped by a higher gross margin, higher other income and lower tax rate. For Netflix, international revenue strength was greater than domestic, although both were up double-digits. Foreign exchange headwinds affected Google. The company has a sizeable international business, so the impact of the stronger dollar can’t always be mitigated by its hedging programs. Yahoo’s second-quarter revenue exceeded the Zacks Consensus Estimate although earnings fell short. Top 15 Technology Mutual Funds of Q2 2015 Below we present the top 15 Technology mutual funds with best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. Q2 % Rank vs Objective* equals the percentage the fund falls among its peers. Here, 1 being the best and 99 being the worst. A good thing about the list is that the majority of these funds carry favorable Zacks Mutual Fund Rank . This heightens the possibility of these funds continuing their uptrend. Remember, the goal of the Zacks Mutual Fund Rank is to guide investors to identify potential winners and losers. Unlike most of the fund-rating systems, the Zacks Mutual Fund Rank is not just focused on past performance, but the likely future success of the fund. The Columbia Seligman Global Technology Fund (MUTF: SHGTX ), the T. Rowe Price Global Technology Fund (MUTF: PRGTX ), the BlackRock Science & Technology Opportunities Portfolio (MUTF: BGSAX ) and the USAA Science and Technology Fund (MUTF: USSCX ) carry a Zacks Mutual Fund Rank #1 (Strong Buy). Meanwhile, the Columbia Seligman Communications and Information Fund (MUTF: SLMCX ), the Fidelity Select Multimedia Portfolio (MUTF: FBMPX ), the Matthews Asia Science and Technology Fund (MUTF: MATFX ), the Putnam Global Technology Fund (MUTF: PGTAX ) and the Black Oak Emerging Technology Fund (MUTF: BOGSX ) currently hold a Zacks Mutual Fund Rank #2 (Buy). Among these funds, SHGTX, PRGTX, MATFX, BGSAX, USSCX had also featured in the list of best performing technology mutual funds for the first quarter. Jacob Internet Fund Inv and Firsthand Technology Opportunities have also managed to feature in both the lists. However, while JAMFX carries a Zacks Mutual Fund Rank #4 (Sell), TEFQX holds a Zacks Mutual Fund Rank #5 (Strong Sell). Funds such as the T. Rowe Price Media And Telecommunications Fund (MUTF: PRMTX ) , the Henderson Global Technology Fund (MUTF: HFGAX ) and the Baron Opportunity Fund (MUTF: BIOPX ) also carry a Zacks Mutual Fund Rank #4. Separately, the Wasatch World Innovators Fund (MUTF: WAGTX ) has a Zacks Mutual Fund Rank #3 (Hold). Link to the original post on Zacks.com