The Attractiveness Of Farmland And Other Alternative Asset Classes

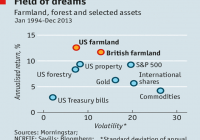

Summary Over the last ten years, the returns on more exotic alternative investments like farmland, rare coins and stamps comfortably beat the returns on the S&P 500 Index. Moreover, based on a risk-return trade off, exotic alternative asset classes also come out on top. This in contrast to more traditional alternative asset classes like commodities, hedge funds, and private equity, which have performed poorly over the last decade. Finally, although investing in exotic asset classes is much less straightforward than investing in equities and bonds, there are certainly opportunities available. Recently, The Economist published an insightful graph that showed that not equities or real estate, but farmland, was the best investment in the last few decades. And, while forestry also earned a spot in the graph, The Economist could have gone a little bit further by adding other, more exotic investment classes as well. (click to enlarge) Adding Coins, Stamps and Wine No worries, with a little help from Bloomberg, I constructed an ‘Economist-like’ chart that, next to farmland and forestry, also includes fine wine, stamps and rare coins as exotic investments. To put things into perspective, I also added ‘traditional’ alternative asset classes like commodities (NYSEARCA: DJP ), gold (NYSEARCA: GLD ), hedge funds and private equity (NYSEARCA: PSP ). Equities (NYSEARCA: SPY ) and bonds (NYSEARCA: BND ) are also included. I intended to add art as well, but art is a bit of an outlier. First, who can actually afford a Monet or Van Gogh? Second, only pieces that are actually sold get to enter the leading index (Moses MEI). This implies that the most traded (and most popular) art works are overrepresented in the index. Hence, the index comes with a classical example of ‘selection bias.’ Finally, most art investment funds are scheduled to retire in the coming years. Farmland tops the list Let’s focus on the alternatives that do make the cut. The graph below shows that, over the last ten years, farmland realized the best return with an average of 17% per year. While less exuberant than farmland, the realized returns on gold, rare coins and stamps (all roughly +10% per year) are also pretty impressive. All of these alternative investments comfortably beat the 8% annual return on the S&P 500 index over the last decade. The two remaining exotic alternatives, forestry and wine, realized an average return almost equal, but also just above, that of equities. (click to enlarge) The return data lead to the straightforward conclusion that, at least over the last 10 years, these exotic alternatives performed very well. This cannot be said of the more traditional alternative investments. While ‘smart’ investors were probably laughing at you if you didn’t add any commodities, hedge funds and/or private equity to your portfolio, these investments didn’t get you anywhere from a return perspective. Private equity performed the least worst, with an average annual return of just 2%, way less than government bonds, for example. Commodities actually yielded a negative return. Of the more ‘familiar’ alternatives, gold was the only one to keep up. Risk and Return Profile So far, I have focused on return data only. However, as risk and return often go hand in hand, a ranking based on the Sharpe ratio (return divided by standard deviation) gives a more complete overview of the relative attractiveness of assets. The graph below shows the Sharpe ratios of the different asset classes over the last ten years. (click to enlarge) As much as a ranking based on the Sharpe ratio is the sounder one, the results are not that different. Most exotic alternatives rank well on their risk-return profile. Farmland, forestry and stamps take three out of the four top spots. Government bonds move up the ranking due to their low volatility. And, as before, gold is the only one of the more traditional alternative investments to do well. Hedge funds, private equity and commodities remain far behind. Based on the risk and return data, investment classes like farmland, forestry, rare coins and stamps are very attractive alternatives. However, there are a few things to keep in mind. First, a period of ten year is not that long from an investment perspective. Things could be different for other time spans (data issues arise, however, for longer historical periods.) Second, most of these exotic alternatives suffer from sticky prices (valuation changes are artificially slow). This means volatility estimates are too low in most cases. That said, the Sharpe ratios suggest it would take a serious volatility increase to push the exotic alternatives down the ranking. Investment Opportunities Now I guess many investors will anticipate another, third factor to keep in mind when looking at these exotic investment alternatives. And that is, availability. Because, how do you invest in (a diversified basket of) farmland or forestry, for example? While this question is totally legit, getting exposure to these alternatives is nowhere near as straightforward as investments in equities and bonds, there are possibilities. Some of them are actually listed. Farmland Partners (NYSEMKT: FPI ) acquires high-quality primary row crop farmland located in agricultural markets throughout North America. Adecoagro (NYSE: AGRO ) from Brazil and Cresud (NASDAQ: CRESY ) from Argentina, invest in farmland and crop production activities in South America. And there are more of these companies around the globe. They are mostly located in emerging markets, as most of the arable land can be found here. On top of that, there are dozens of private investment companies like the Hancock Agricultural Investment Group or Duxton Asset Management from Australia that also offer investment opportunities in farmland or forestry. For other exotic alternatives there are opportunities as well. For example, Stanley Gibbons Investment is a leading company focused on investing in stamps and rare coins. For wine, there is a whole range of private investment funds available. Examples are the Wine Asset Managers, The Wine Investment Fund and Lunzer Wine Investments. But there are many, many more. These companies select, buy and store a variety of wines and save you the hassle of doing this all by yourself. Hence, some of these companies do not only invest in wine but also in whole vineyards as a means of diversification. Mind you, the companies mentioned above are just examples of possibilities to invest in more exotic investment classes like farmland, stamps and wine. You should conduct your own research to find out if these companies offer investment opportunities suitable for you. Investing in these alternatives will require some serious ‘due diligence.’ But, with the disappointing returns of traditional alternative investments in mind, that effort could turn out to be rewarding! Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.