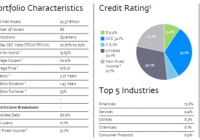

Summary TFCVX targets stressed and distressed securities, with more than half of the portfolio classified as “special situation”. Active management is a must in this area. The fund currently yields more than 10%. Third Avenue Focused Credit (MUTF: TFCVX ) is an aggressive high-yield bond fund with a focus on stressed and distressed securities. The fund seeks to deliver total return, not current yield. Strategy TFCVX’s strategy rests on what the firm calls the “Fulcrum Security…the most senior security that will likely convert into equity ownership in a restructuring.” Managers look for discounted debt securities that stand a good chance of being paid at par value in cases where the firm’s fortunes turn around, or stand a good chance of being converted to equity in a restructuring. They shy away from holding the highest-yielding debt in a company, since that debt could expire worthless, but they will also shy away from the lowest-yielding senior debt, since it doesn’t offer as attractive a yield. The fund’s sweet spot are the securities that turn into equity in a restructuring. Profit mainly comes from one of two paths: collect hefty coupon payments and see some gain on the principal, or get a controlling interest in a company as it emerges from bankruptcy or restructuring, with the opportunity for even larger upside. The big risks inherent in the strategy comes from the fact that it’s impossible to know which security will be the “Fulcrum Security” ahead of time, along with the difficulty in estimating the future value of a firm post-restructuring. Additionally, the fund is dealing in sometimes illiquid securities or opaque situations, such as a bankruptcy fight in court. Lead manager Tom Lapointe was named a 2014 Rising Star of Mutual Funds by Institutional Investor. He previously served as co-head of High-Yield Investments for Columbia Management. Portfolio As of December 31, TFCVX had $2.37 billion under management. The fund is fairly concentrated for a bond fund, with only 86 holdings. The top ten holdings accounted for 38.3 percent of assets . (click to enlarge) One of the portfolio statistics that sticks out is the $76.01 average price of securities in the fund versus the par value of $100, highlighting the fund’s ownership of distressed securities. Only 18.9 percent of the portfolio was in performing securities, with 51.7 percent classified as special situations. While TFCVX has a high yield today, the fund’s mandate and stated strategy targets total returns, which could involve holding non-income paying equities received as part of a restructuring. There is no guarantee of income, and income could decline substantially if bankruptcies increased and the fund converts debt to equity. Payouts have been in a general uptrend since inception in 2009, but this a period when the market for high-yield debt improved, allowing firms to restructure debt without declaring bankruptcy. Were there to be a period of economic stress or a deep recession, more of the fund’s holdings may become special situations, with debt converting into equity, lowering income payments. The fund’s mandate requires it to hold 80 percent of assets in credit instruments. Under the guidelines of this mandate, equity and convertible bonds acquired as part of a restructuring will be classified as credit instruments. Equities are currently only 13.7 percent of assets, but this could rise substantially under the funds mandate, materially impacting the fund’s yield. In a period of relative tranquility for high-yield debt, TFCVX has a 3-year standard deviation of 7.40 versus 4.83 for the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA: HYG ) and 2.85 for the Barclays U.S. Aggregate Bond Index. TFCVX has a 3-year beta of 0.01 versus the Barclays U.S. Aggregate Bond Index. HYG has a beta of 0.57 versus the same index. Compared to the Credit Suisse High-Yield Index, TFCVX has a beta of 1.16. The fund is volatile and correlated with high-yield bonds, but is less correlated to the overall bond market than other high-yield bond funds. TFCVX In A Nutshell This bit from the October 2014 shareholder letter shows why investors interested in the distressed debt market would do well to invest with capable managers (emphasis mine): We initiated a position in Ideal Standard in December 2013 at a 70% discount to where Bain had invested. We were able to accumulate 25% of the notes that we believed would be (and in the end were) the fulcrum (11.75% EUR Senior Secured Notes), buying from investors selling off the company on liquidity concerns. Up until this point this was a fairly routine investment. Complications started when the company went into reorganization and initiated an exchange offer that did not allow minority note holders, such as Third Avenue, to participate in the equity, and intended to leave us with a high-yielding fixed income instrument only. We contested this exchange offer and threatened a legal action in the US. This gave us leverage; we were able to negotiate revisions to the exchange offer that allowed us to get a 20% stake in the equity. The restructuring was completed in spring 2014. The recapitalization values the company at $500 million today. We believe this investment, a 2.1% position in the Fund as of October 31, 2014, has significant upside and limited downside. Investing in distressed debt requires a lot of homework, but even if an investor finds an undervalued security, courts and lawyers may change the facts on the ground. Small investors are unable to influence this process, but fund managers can and do influence these situations in favor of their investors. Managers are also able to grab opportunities that small investors cannot access. In another example from the shareholder letter , the fund made a bridge loan to a firm in distress, an investment opportunity that small investors cannot access on their own. Performance Warren Buffett famously said that the market was a voting machine in the short term, but a weighing machine in the long term. Third Avenue Focused Credit is a perfect illustration of this maxim at work because managers of TFCVX are engaged in long-term investments in distressed credit, but the securities they hold are subject to daily pricing. Since the outcome of distressed credit is highly volatile, with a high probability of bankruptcy, pricing of securities will be volatile. Even if investors have a high risk tolerance, they also need a long-term outlook in order to profit from the strategy employed by TFCVX because managers need time to unlock the fundamental value in these securities. As the case of Ideal Standard shows, it was not timing or even fundamental analysis that ultimately turned the position into a winner, but the threat of legal action. The value of securities held by TFCVX may be in “limbo” at times due to outstanding court cases and legal claims, leading to wild price fluctuations. Market prices for the debt held in TFCVX may deviate substantially from the underlying value, particularly when the resolution is unclear and the broader market is experiencing a bout of fear. The high-yield debt market is currently experiencing some risk aversion and the recent drop in TFCVX has led it to underperform the iShares iBoxx $ High Yield Corporate Bond ETF. (click to enlarge) The underperformance is due to the past seven months of turmoil in the high-yield debt market, influenced by the plunge in oil prices. To give a little clearer picture, in this chart, the red line represents the price ratio between HYG and the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA: LQD ). A rising line indicates HYG is outperforming. (click to enlarge) TFCVX is more sensitive to changes in investors’ risk appetites. Investors have gravitated towards investment-grade bonds and U.S. Treasuries over the past seven months, and the riskier TFCVX has suffered as a result. Fees And Expenses TFCVX has an expense ratio of 1.16 percent, which includes a management fee of 0.75 percent and a 12b-1 fee of 0.25 percent. This is a high fee relative to the high-yield bond category, but is not excessive considering the specialized nature of the fund. There is also a 2 percent short-term redemption fee on shares held less than 60 days. Conclusion TFCVX is a high-risk, high-potential reward fund. The fund opens a part of the debt market that is largely closed to small investors, one that can deliver attractive returns over the long term and add some diversification to an already well-diversified portfolio. Investors interested in TFCVX must be ready to sit through volatility. Many funds have short-term trading fees in order to reduce volatility, and TFCVX is no exception, but the negative effect from share redemptions would be amplified during a liquidity crunch in the high-yield bond market. Investors who are not comfortable with a long-term buy-and-hold approach would be better off in a more liquid high-yield bond fund. For those investors looking for total return and capital gains, TFCVX is a unique fund worth considering. The recent drop in price presents a good entry point for long-term investors. TFCVX has suffered due to risk aversion in the bond market, but the fund will rebound when demand for high-yield credit recovers. (click to enlarge) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.