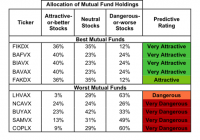

Best And Worst: All Cap Value ETFs, Mutual Funds, And Key Holdings

Summary All Cap Value ranks sixth in 2Q15. Based on an aggregation of ratings of 256 mutual funds. FIKDX is our top rated All Cap Value mutual fund and COPLX is our worst rated All Cap Value mutual fund. The All Cap Value style ranks sixth out of the 12 fund styles as detailed in our 2Q15 Style Rankings report . It gets our Neutral rating, which is based on an aggregation of ratings of 256 mutual funds in the All Cap Value style. There are no All Cap Value ETFs under coverage. Figure 1 shows the five best rated and five worst rated All Cap Value mutual funds. Not all mutual funds are created the same. The number of holdings varies widely (from 22 to 1148). This variation creates drastically different investment implications and therefore, ratings. Investors seeking exposure to the All Cap Value style should buy one of the Attractive-or-better rated mutual funds from Figures 1 and 2. Figure 1: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. LSV U.S. Managed Volatility Fund (LSVMX, LVAMX) is excluded from Figure 1 because its total net assets are below $100 million and do not meet our liquidity minimums. Advisors’ Inner Circle Frost Kempner Multi-Cap Deep Value Equity Fund (MUTF: FIKDX ) is our top rated All Cap Value mutual fund. One of our favorite stocks held by All Cap Value funds is Qualcomm (NASDAQ: QCOM ). Over the past decade, Qualcomm has grown after-tax operating profit ( NOPAT ) by 18% compounded annually. Every year since 2003, with the exception of 2008, Qualcomm has generated positive free cash flow , with a cumulative $27 billion in free cash flow over this timeframe. Economic earnings have also grown at a compounded annual rate of 20% and been positive in 15 of the past 17 years. Despite the excellent growth in the underlying business operations, the market has failed to properly value Qualcomm, creating a great investment opportunity. At its current price of ~$67/share, QCOM has a price to economic book value ( PEBV ) ratio of only 0.9. This ratio implies the market expects Qualcomm’s NOPAT to permanently decline by 10%. This seems unlikely given the strength of Qualcomm’s business. If Qualcomm can grow NOPAT by 10% compounded annually for the next six years , the stock is worth $108/share today – a 61% upside. Copley Fund, Inc. (MUTF: COPLX ) is our worst rated All Cap Value mutual fund One of the worst stocks currently in the All Cap Value style funds is Intersil Corporation (NASDAQ: ISIL ). We recently put ISIL in the Danger Zone , citing many of the problems below. Since 2006, Intersil’s NOPAT has declined by 24% compounded annually. Along with its declining NOPAT, the company’s margins have declined dramatically from a high of 19% in 2006 to their current level of 2%. Intersil’s ROIC has also declined to 0%, down from 8% in 2006. As a result, the company is extremely overvalued, with a PEBV ratio of 7.3. To justify its current valuation of $13/share, ISIL would need to grow NOPAT at 41% compounded annually for the next 13 years . This appears to very optimistic considering that ISIL has realized declining revenues since 2006. Figure 2 shows the rating landscape of all All Cap Value mutual funds. Figure 2: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figures 1-2: New Constructs, LLC and company filings D isclosure: David Trainer owns QCOM. David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: The author is long QCOM. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.