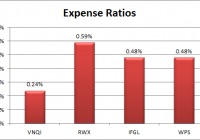

Summary Increasing rates on MBS will result in book value losses for the underlying mREITs. Increasing rates on the LIBOR curve will create gains to book value, but the LIBOR rate curve is increasing too much relative to the rates on MBS. Since REM is holding most of the mREIT industry, investors in REM could benefit substantially if interest spreads widened by MBS rates increasing by more than swap rates. One way that could happen for REM would be for the individual mREITs to repurchase their shares at a discount to book value rather than reinvesting in new MBS. A decline in buyers for new MBS would (at least in theory) result in new MBS being issued with higher rates or mREITs paying a smaller premium to face value. The iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ) is offering a beastly dividend yield, but the fund is delivering that massive yield through heavy investments in mREITs. Investors that aren’t familiar with mREIT industry need to learn the risk factors that are influencing REM. The biggest risk for investors in REM is that the value of the underlying holdings, the mREITs, could change quite substantially. The ETF holds a reasonably diversified batch of mREITs, though I wouldn’t mind seeing the ETF reduce the weight it puts on Annaly Capital Management (NYSE: NLY ), which is 14.44% of the assets of the ETF. The thing most mREITs have in common is that the RMBS (residential mortgage backed securities) is the primary investment tool. Some of them use other derivative investments, but the main exposure is the RMBS. Some mREITs are using larger positions on ARMS (adjustable rate mortgages), some focus on the 15-year RMBS or the 30-year RMBS, and some go into smaller segments of the market such as lending on jumbo mortgages or non-agency securities. When we boil it down, everything comes back to the rates on MBS and the spreads between short-term rates and long-term rates. Mortgage rates I grabbed the following chart to look for the latest rates across MBS: For 15-year and 30-year securities Interest rates have increased significantly since the end of the first quarter, but they ended the first quarter down from the start of the year. For ARMs The interest rate on new ARMs decreased during the first quarter and has been relatively flat during the second quarter. You might wonder why ARMs have seen interest rates getting soft while they are increasing on other securities. The simple reason is that mREITs are finding adjustable rate mortgages to be more attractive due to expected increases in the interest rates offered by the Federal Reserve. If the Federal Reserve is going to increase interest rates, then mREITs holding adjustable rate mortgages would theoretically be preferable in the short term since the rates they receive will increase. Share price declines Despite the mREIT sector taking a pretty bad beating on share price over the last year, investors in REM are actually flat on their investment because the dividends covered the decline in price. (click to enlarge) When investors hear the dividends are just covering the decline in share price, it may sound like a return of capital. That isn’t the case though. The underlying securities for the ETF are the shares in mREITs and many mREITs are trading at substantial discounts to their own book value. If investors could picture REM as an enormous mREIT with incredibly diversified holdings of the securities that the mREITs are holding, then REM would be trading at a substantial discount to book value. Since REM’s NAV is established by the share price of the mREITs, investors don’t see the huge discount when looking at REM. The mREITs hedge their exposure to rising interest rates through swaps, swaptions, and Eurodollar Futures. The chart below uses the latest publicly available data to establish the interest rates in the LIBOR market: (click to enlarge) The increasing LIBOR rates indicate that most mREITs will have substantial unrealized gains on their interest rate swaps. The gains on swaps should partially offset the losses they will report on MBS. The favorable development for mREITs is that the yield curve is becoming substantially steeper. The one-year rate has increased by about 11 basis points, but the rate on other years is increasing substantially more. An increase of 11 basis points is small relative to the increase in the rates on 15-year and 30-year MBS. On the other hand, the increase in interest rates during the quarter on maturities around 5 years is substantially less attractive. While the mREITs will see substantial gains on their interest rate swaps during the second quarter, initiating new swap positions will require paying these higher rates which in some cases are increasing by closer to 60 basis points. In my opinion, this is one of the biggest challenges to REM. A large portion of the holdings are mREITs that need positions in swaps with durations of 3 to 10 years and the interest rate due on those swaps has increased by more than the yield on MBS securities. Three possible favorable developments for REM REM would have enormous upside if three things happened. The first is that long-term MBS rates inch upwards and the second is that LIBOR rate increases for the first five years of the curve become substantially smaller. The gains on interest rate swaps are nice, but over the next few years, mREITs don’t want to find themselves paying higher rates on new swaps. The third option would be a way to cause the first two things to happen. If the mREIT industry saw substantially more repurchasing shares and less issuing shares, there would be a net outflow of money from the mREIT industry. That would be very beneficial to investors holding the entire industry, because the mREITs would have less capital available to bid for new MBS. A decrease in mREITs bidding on new MBS would mean less competition in that part of the market. Either MBS would be acquired at lower premium to face value or the originators of MBS would increase the interest rates they were charging borrowers to make the MBS more attractive to mREITs to encourage them to a pay a large premium to face value. Either paying a smaller premium to face value or having higher interest rates on the MBS would be extremely favorable developments for mREITs even though it would result in a loss on book value. The loss of book value would be material, but the increase in net interest margins would make dividends substantially more sustainable and encourage investors to buy the underlying mREITs to receive dividend yields that were both large and sustainable. In that case, an investor in REM would expect to see increases in share prices and in dividends. On the other hand, if LIBOR rates rise across the curve and MBS rates increase by less than the LIBOR rates, then the cost of financing for mREITs may increase by more than their yield on assets. Conclusion I’m bullish on the mREIT industry and expect positive returns to shareholders of REM over the next few years. I can’t provide an endorsement of the ETF because I believe the expense ratio is too high. There are a few competing ETF options, but none of them meet my threshold for attractive expense ratios and all of them have at least somewhat unfavorable weightings for the different mREITs in the ETF. Despite those concerns, it may be a good fit for the investor that wants exposure to the mREIT industry, but does not have a large enough portfolio to buy several positions in individual mREITs for diversification. For investors interested in my personal favorites, I like CYS Investments (NYSE: CYS ) and Dynex Capital (NYSE: DX ). I believe at the current discount to book value, American Capital Agency Corp. (NASDAQ: AGNC ) is also very attractive. I find Bimini Capital Management ( OTCQB:BMNM ) to be the most undervalued company in the space, but it is highly illiquid, and I like it for the external manager fees it receives rather than the composition of the portfolio. Disclosure: I am/we are long DX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.