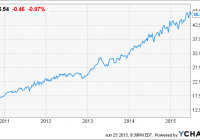

Just because Nestle is headquartered in Switzerland doesn’t mean that’s where their revenue is generated. The same is true for scores of other great European multinationals. Here’s how we’ve chosen to invest in them. Is Germany a bully, intent only upon establishing a new mercantilism using foreign labor and resources to create finished goods to sell back to their neighbors, which some might consider ersatz colonies? Is Greece a nation of lazy malingerers, who want only to borrow its way to a good time and let someone else foot the bill? So you might believe if you look only at the headlines, biased as they may be by one’s own geographic location or cultural heritage. The truth, as always, is far more complex. The first thing we need to understand is why the European Union (NYSEARCA: EU ) is seen as essential today. Its formation was not based on economic issues, but rather security issues. After two devastating world wars tore apart the infrastructure of European nations and left permanent scars upon its populace, those still alive swore they must never again allow their bickering to reach the point of open conflict. Understanding the following brief history of the past 60 years of discussions, negotiations, agreements, and treaties that have formed the European Union of today will help you place in context the Brexit and Grexit “crises” du jour. The creation of today’s EU has never been without missteps, arguments, or backsliding. Indeed, it has been quite the iterative process! Like Thomas Jefferson before them, a seldom-acknowledged intellectual forebear of the EU, the battered but still-standing leadership of many WWII combatant nations realized that an interconnected community that shared a somewhat common border, a few shared cultural traits, some degree of military cooperation and inter-operability and, most importantly, economic interdependence would be less likely to go to war against each other. Statesmen who transcend the title of politician began this crusade to get Europeans fused together. Giants like Winston Churchill, Konrad Adenauer of Germany, Paul Henri Spaak of Belgium and Jean Monnet of France all embraced the idea of a United States of Europe, with Churchill calling it just that. He was convinced that only a united Europe could come close to guaranteeing peace on the continent by eliminating intense nationalism once and for all. The EU of today, however, has evolved in baby steps, sometimes retracing, sometimes going sideways, but mostly moving forward closer to Churchill’s and these other founding fathers’ dream of a united, peaceful and economically prosperous union. Taken together, today’s EU has the highest GDP of any other “nation,” including the US, China, Japan, etc. Its first incarnation, in 1951, was the European Coal & Steel Community (ECSC,) a primarily economic union between just six nations: Belgium, France, Germany, Italy, Luxembourg and The Netherlands. In 1958, with expanded agreements signed at the Treaty of Rome, these six became the European Economic Community. During the 1960s, these ECSC countries stopped charging custom duties when they traded with each other. They also established joint control over food production which, contrary to the doomsayers’ predictions, crated agricultural surplus. As the decade progressed, the European Atomic Energy Community (Euratom) and the European Economic Community (EEC, or Common Market) were formed. These three became the new “European Community” (the EC,) with the goal of establishing a completely integrated common market and an eventual federation of Europe. By the 1970s and early 1980s, six more nations join this federation: Denmark, Greece, Ireland, Portugal, Spain, and the UK. Flexing its newfound muscle, EU regional policy starts to transfer huge sums to create jobs and infrastructure in poorer areas. In 1986, the Single European Act was signed. This was a treaty which defined the basis for a six-year program designed to overcome any problems with the free-flow of trade across EU borders and thus creates the ‘Single Market’. Concurrent with the collapse of communism across central and eastern Europe in the early 1990s, in 1993 the Single Market was completed with the “four freedoms” of: movement of goods, services, people and money. At the conclusion of and as a result of the Single Market agreements, the ‘Maastricht’ Treaty on European Union in 1993 was signed, creating a common currency, the “Euro,'” more than 40 years after the first steps toward European unity were taken by the early ECSC members. In addition to creating the common currency, Maastricht, still with just 12 Western European members, created the “convergence criteria” to ensure price stability within the Eurozone (the area in which the Euro is the common currency.) These criteria set limits on member states like… * The rate of inflation: Must be no more than 1.5 percentage points higher than the average of the three best performing (lowest inflation) member states of the EU. * Annual government deficit: The ratio of the annual government deficit to gross domestic product (NYSE: GDP ) must not exceed 3% at the end of the preceding fiscal year. If not, it is at least required to reach a level close to 3%. Only exceptional and temporary excesses would be granted for exceptional cases (as it has done for Greece repeatedly). * Government debt: The ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year. Even if the target cannot be achieved due to the specific conditions, the ratio must have sufficiently diminished and must be approaching the reference value at a satisfactory pace. * Long-term interest rates: The nominal long-term interest rate must not be more than 2% higher than in the three lowest-inflation member states. Two years later the EU gained three more members, Austria, Finland and Sweden. And that same year began the implementation of the “Schengen” agreements that allow people to travel without having their passports checked at the national borders. Initially signed only by the Benelux nations, Germany, and France, “Schengen” has huge political, economic and security implications, making them every bit as important as the creation of a common currency. Today there are 26 European countries that have abolished passport and any other type of border control at their common borders. This allows these nations to function effectively as a single country for international travel purposes. Not all EU nations participate, with the UK and Ireland opting out and 4 other member states (there are now 28 EU nations, 19 of which use the Euro) dragging their heels. But Norway, Iceland and Switzerland, all non-EU members, have joined the Schengen Area. I just completed a research and pleasure trip to Europe. My passport was checked once when I landed in Oslo, Norway. I then flew to Vienna, Austria, and traveled to Hungary, France, Belgium, The Netherlands, Germany and back to Norway by plane, train rental car and boat without ever having to show a passport. Only a side trip to the UK required that I show it once again. The European Union is a reality, but that reality is not written in stone – it is an ever-moving target. I personally believe Britons want to remain in the EU, but with somewhat more favorable conditions, and will vote accordingly. I personally believe the notion that a Greek exit would create a domino effect is overblown. Greece needs the EU far more than the EU needs Greece. Hopefully this brief overview will put in context that, for 60 years, there have been real and imagined crises, but the EU continues to move forward, albeit haltingly, to fulfill its founders’ dreams of a united, peaceful and economically prosperous union. Now, what you choose to buy in Europe is affected by the value of the Euro vis a vis the currencies of other regions with whom they trade internationally. The weaker the Euro, the cheaper European companies’ goods and services are in the target nations’ (those they export to) currencies. So a weak Euro is good for European firms that export a large proportion of what they produce and offer. Having just spent time, recently, on the European continent and in the UK, I am convinced, more than ever, that the best European firms have tightened their belts and are ready for serious competition. I’ve been to 21 of the 28 EU member states and each time I visit any of them, I am impressed with the rate of change I see. I said in a previous article, “As the Euro gains, European multinationals lose their pricing advantage. Long term, however, I believe this is a blip; the Euro will remain stable or even fall as the EU continues their QE. European companies will do better going forward. We’ll maintain or, if stopped out, re-enter these positions at what may well be better prices.” Since then our positions have merely marked time. HEDJ was 63.83 on May 5, when we published our May issue; today it is just 64.11. EUSC was 25.98 on May 5 and is 25.71 today. DXGE was 29.82 and is 29.41 today. (Prices as of the close 25 June, 2015.) I believe these ETFs are filled with great companies that are just marking time for awhile as they consolidate prior to their next move up. While the summer doldrums often strike across the planet, not just in the US, we’ll use any pullback to add to or re-initiate positions in some of these companies and ETFs. Wisdom Tree Germany Hedged Equity (NASDAQ: DXGE )’s largest 5 holdings are Daimler (parent of Mercedes, Freightliner trucks and more,) Deutsche Telekom, Bayer (known by most consumers for their aspirin but in fact a huge life sciences, polymer and chemicals company,) Allianz (the huge insurance and financial products company [and parent of PIMCO] that we like so much we own it directly in our portfolio,) and BMW. Wisdom Tree Europe Hedged Equity (NYSEARCA: HEDJ ) counts among its top 5 Anheuser-Busch Inbev; Spanish and Latin America telco Telefonica; Daimler; Unilever (parent of Dove, Axe, Ben & Jerry’s, Lipton, Vaseline, Hellman’s, Breyers, Q-Tips, Noxzema and scores of other products many Americans think of as “American,”) and Sanofi, one of the largest healthcare companies in the world. Wisdom Tree Europe Hedged Small Cap (NYSEARCA: EUSC ) is the only one whose top 5 will likely be unrecognized by most of us here in North America: Elisa Oyj is a Finnish telecom and data provider active in a number of markets; Bpost SA de Droit Public is the 51% Belgian government owned postal services firm; freenet Group is the biggest independent telecom in Germany; Mediolanum provides banking, insurance and financial products and services in Italy and abroad; and Lagardere is the 150-year-old content provider and distributor of both print and digital media. While the parent company’s name might not be a household word, it is the world’s 3rd-biggest trade book publisher with Hachette, Harlequin, Elle, Parents, Paris Match and many others that are readily recognized. We still own all three of these ETFs in our G&V Portfolio, along with AZSEY, BP and Norway ETF NORW among our European holdings. In the Aggressive Portfolio, we own Statoil and Petroleum Geo-Services, as well as international mutual funds with a strong European component. We like our current ratio of US and developed market securities; Europe is just entering its QE phase. As Registered Investment Advisors, we believe it is our responsibility to advise that we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice. Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund one year only to watch it plummet the following year. We encourage you to do your own due diligence on issues we discuss to see if they might be of value in your own investing. We take our responsibility to offer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we “eat our own cooking,” but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about. Disclosure: I am/we are long EUSC, AZSEY, HEDJ, DXGE, BP, RDS-B. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.