Liquid Alternatives May Solve The Problem Of Stock-Bond Correlation

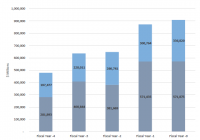

By DailyAlts Staff While everyone likes to see their portfolio rise in value, Cognios Capital senses something “artificial” about the current stock and bond markets. In a white paper published in June 2015 – before the Chinese stock market imploded and its government launched a series of proposals designed to re-inflate the overheated market – Cognios warned against the “unprecedented interventions” by central banks in North America, Europe, and Asia. What once was a choir of gold-bug cranks is now a common refrain of mainstream financial analysts: Stocks and bonds both face serious headwinds, and investors need to significantly reduce their expectations for future returns. This, of course, puts added emphasis on the emergence of liquid alternative investments – hence the title of Cognios’s white paper: Alternatives: An Answer to Risk Diversification . QE and the Search for Yield From the beginning of its quantitative easing program in December 2008 through its conclusion on Halloween 2014, the Federal Reserve’s balance sheet grew by a staggering $3.5 trillion – that’s $100 million more than the annual GDP of Germany, the world’s fourth-largest economy! Approximately $2.3 trillion of this total is comprised of U.S. Treasury bonds, as the Fed’s objective was to push down the risk-free rate of return and thereby encourage risk-taking in the stock market, under the idea that this would create a “wealth effect” for U.S. consumers. Of course, this has really resulted in excessive risk-taking, as stocks have reached historically dangerous valuation metrics and bond yields are at all-time lows, with nowhere to go but up. As of April 2015, the yield on 30-year U.S. Treasury securities was a paltry 2.75% – less than half its historic average of 5.54%. Cognios worries that the Fed may be forced to raise interest rates faster than currently expected, just like they did in 2004; and if they do, the results for Treasury bondholders would be staggering: According to Cognios, a reversion of the 30-year Treasury yield to its historical average over the next year would result in losses of more than 37% for the securities. Facing Reality The Federal Reserve overtly propped up bond prices and pushed down yields as part of its QE, but in doing so, they also caused stocks to rise. After all, by reducing the risk-free rate of return, the Fed effectively pushed money into stocks, and what’s more, low interest rates encouraged publicly traded companies to borrow money to pay dividends or buy back their own shares. By buying back their own shares, S&P 500 companies have created the greatest disparity between their market value and U.S. GDP in history. Cyclically adjusted price-to-earnings (“CAPE”) ratios are also near all-time highs, above 25.0. According to Cognios, whenever CAPE ratios have exceeded 25.0 in the past, the likelihood of the market generating positive returns of the next five years has been less than 50%. The Role of Alts Facing the reality that both stocks and bonds are likely to generate below-average returns over the next five years, investors are turning to liquid alternatives. These products, which emulate strategies once reserved for only high-net-worth and institutional investors, have grown to more than $154 billion in assets under management from less than $40 billion in 2008. Alternatives are designed to have low correlation to traditional assets such as stocks and bonds. Given the highly correlated nature of the stock and bond markets that has resulted from the Fed and other central banks implementing their own versions of QE, alternatives have the potential to provide upside participation in rising markets while offering downside protection.