Value And Momentum In Sports Betting

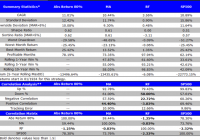

By Jack Vogel As noted through our previous posts, we are big proponents of Value investing and Momentum investing strategies. We even highlight the best way to combine value and momentum . However, there is a new paper by Toby Moskowitz, titled “ Asset Pricing and Sports Betting ,” which examines how size, value and momentum affect sports betting contracts: I use sports betting markets as a laboratory to test behavioral theories of cross-sectional asset pricing anomalies. Two unique features of these markets provide a distinguishing test of behavioral theories: 1) the bets are completely idiosyncratic and therefore not confounded by rational theories; 2) the contracts have a known and short termination date where uncertainty is resolved that allows any mispricing to be detected. Analyzing more than a hundred thousand contracts spanning two decades across four major professional sports (NBA, NFL, MLB, and NHL), I find momentum and value effects that move betting prices from the open to the close of betting, that are then completely reversed by the game outcome. These findings are consistent with delayed overreaction theories of asset pricing. In addition, a novel implication of overreaction uncovered in sports betting markets is shown to also predict momentum and value returns in financial markets. Finally, momentum and value effects in betting markets appear smaller than in financial markets and are not large enough to overcome trading costs, limiting the ability to arbitrage them away. Some Interesting Points The figure below explains the different price movements which are studied in the paper: The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Here are the T-stats for the momentum betas in the figure below: (click to enlarge) The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Analysis from the paper: A consistent pattern emerges for the Spread and Over/under contracts in every sport, where the momentum betas exhibit a tent-like shape over the three horizons—near zero from open-to-end, significantly positive from open-to-close, and significantly negative from close-to-end, with the initial price movement from open-to-close related to momentum being fully reversed by the game outcome. The patterns for the Moneyline contracts exhibit the same tent-like shape, but are less pronounced, consistent with the Moneyline perhaps being less affected by “dumb” money and more dominated by “smart” money. Then the paper shows the T-stats for the value betas in the figure below: (click to enlarge) The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Analysis from the paper: A consistent pattern is evident from the plots: a value contract’s betting line declines between the open and close and then rebounds between the close and game end, reaching the same level it started at the open. These patterns are consistent with an overreaction story for value, where value contracts, which measure “cheapness”, continue to get cheaper between the open and the close, becoming too cheap and thus rebounding positively when the game ends. This picture is the mirror image of momentum, where value or cheapness is negatively related to past performance, and hence the pictures for momentum and value tell the same story. (Though, recall the measures for value and momentum were only mildly negatively correlated.) Conclusion from the paper: Examining momentum, value, and size characteristics of these contracts, analogous to those used to predict financial market security returns, I find that momentum exhibits significant predictability for returns, value exhibits significant but weaker predictability, and size exhibits no return predictability. The patterns of return predictability over the life of the betting contracts—from opening to closing prices to game outcomes—matches those from models of investor overreaction. The results suggest that at least part of the momentum and value patterns observed in capital markets could be related to similar investor behavior. The magnitude of return predictability in the sports betting market is about one-fifth that found in financial markets, where trading costs associated with sports betting contracts are too large to generate profitable trading strategies, possibly preventing arbitrage from eliminating the mispricing. Our Thoughts: An interesting paper, showing that Value and Momentum work within the sports betting market, but the cost of trading on the signals is too large for profitable trades. This is probably why the “house always wins.” It’s a good thing I watch countless hours of sports to form my own “expert” opinions! Original post