An Introduction To Merger Arbitrage And Available ETF Options

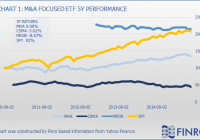

Summary Everyone is fascinated by Merger Arbitrage. This is an introduction. You have a few options ETF wise. Find out why I don’t like them. I recently discussed gaining exposure to spinoffs through an ETF. If gaining exposure to such deals passively is a good idea, one might ask whether other “Hedge fund strategies” can be attained through ETFs. We’ve all heard of famous billionaire arbs such as John Paulson (although he didn’t make his billions with merger arbitrage), and we might be tempted to have a go at such strategies. In this article I will: Go over the basics of merger arbitrage for readers who are not familiar with the practice. (If that’s not you, skip below.) Highlight the main risks linked to the strategy. Take a look at two Merger ETFs and the construction of their underlying indexes. Explain why I don’t think such ETFs make a good addition to your portfolio. THE BASICS Merger arbitrage attempts to profit from merger activity through spreads between offer price and trading price. Here is a simple example which expresses the strategy. Company A is trading at $10 a share. Company B is trading at $20 a share. Company B offers to buy company A, offering owners one share of Company B for each share of Company A. Following the announcement company A’s stock surges to $15. If the deal goes through, owners of Company A will have a security which is worth $20 today. To lock in the $5 spread between current price and offer, investors can go long A, and Short B; simultaneously buying the same asset for $15 and selling it for $20. Why would a security trade for $15 if someone is going to pay you $20 for it, and how do we interpret this? For a number of reasons, which we will discuss further, the deal might not go through. In such a case, the target’s (Company A) stock will usually fall back to pre-merger announcement prices ($10 in our example). Therefore the price at which a security a security trades between the acquisition’s announcement and its completion reflects the odds the market assigns to a deals completion. The basic math is: [(Current Price)-(Price before deal announcement)] / [(Offer Price)-(Price before deal announcement)] In the case of our example: (15-10)/(20-10)=50% As a deal gets closer to going through, you can expect the spread between security A and B to diminish. Whether A goes up, B goes down, or they meet somewhere in the middle, going long A and short B would net a profit as both prices converge. Since deals can go south for a number of reasons, investors must determine when the odds the market gives any given deal don’t match their own estimation of the odds. If an investor believes our deal has a 70% chance of being completed, the trade would seem attractively priced today (70%> 50%) and he could take a long position in A and a short position in B. Likewise if an investor believes our deal has only a 30% chance of being completed, he might view today’s price as expensive, and decide to go short A and long B, on the basis that the spread could get wider. Since large initial increases in shares of the target firm occur after the announcement, the downside if the deal doesn’t go through is usually larger than the possible gain (the spread). So there you have it. This traditional strategy is mostly used in the case of a stock for stock offer. In the case of a cash only offer, shorting the acquirer will be of no use in capturing the spread. THE RISKS While being a risk arbitrageur seems like an interesting strategy since your simultaneous long and short positions reduces your systematic exposure, many things can go wrong. The returns are mostly deal driven, so risks come primarily from regulation and financing issues. Even if most mergers are allowed by regulators, it is imperative to assess antitrust concerns before regulators rule. In deals where antitrust issues are a primary concern it is likely the spread will narrow shortly after the deal has been approved by regulators. There is no free lunch here, investors must do their own research and due diligence to assess how these issues can impact the deal’s timing and viability. Regulators being fun as always, might also cancel the deal for many other reasons, such as nationalistic concerns. Also if part of the deal involves a cash transaction, financing issues must be taken into account. Which Banks are working with both companies? Is financing secured, or likely to be? Merger Arbitrage returns are negatively skewed. If deals go through, small consistent gains are made, but investors are exposed to large losses when they run in to problems. In other words, large upswings occur a lot less than large downswings, distributing the returns somewhat as such. So as I mentioned above, the real opportunity lies in detecting deals where the probabilities of a deal going through are significantly different than what the market price implies. On Seeking Alpha, Chris Demuth does a great job at getting all the M&A info and ideas you need. But we do both agree on one point, Merger Arbitrage is research intensive. MERGER ETFS Given the extensive research required, you might be tempted to gain exposure to merger arbitrage plays through ETFs. Here is a brief overview of two of them, the IQ ARB Merger Arbitrage ETF (NYSEARCA: MNA ) and the Proshares Merger ETF (BATS: MRGR ). The IQ Merger Arbitrage ETF tracks the IQ Merger Arbitrage index which is a rule based index which seeks to gain exposure to companies all over the world in which a merger or acquisition announcement has been made. The index is rebalanced monthly, and excludes deals which have an offer price inferior to the price of the stock prior to the announcement. If the implied probability of completion is less than zero or greater than 100%, the positions will be held until the deal completes or 180 days pass after the announcement. When an implied probability is between 0 and 100, existing positions will be held for up to 360 days. Here are a few key points to keep in mind: Long positions in the target only Equity Hedge achieved through shorting sector or regional ETFs Cash exposure is kept in short term treasuries. No qualitative assessment of individual deals. No stock can be above 10% of the index. MNA data by YCharts The Proshares Merger ETF tracks the S&P Merger Arbitrage index. A maximum of 40 long positions and 40 short positions are included in the index at any given time. Deals are subject to liquidity and sizing constraints (Must be bigger than $500 mi). Everyday, if a new merger is announced, the position is added to the index. If there are already 40 positions, the position with the weakest performance since inclusion in the index is removed and is replaced with the new one. A few things to remember: Long and short positions in individual stocks are taken, unlike MNA. When included into the index, positions are sized at 3%. Like MNA this is a rule based index with no qualitative analysis. SPY data by YCharts MY TAKE ON THESE. MNA data by YCharts Let’s start with what is to be liked. Both ETFs are diversified and give exposure to a bunch of deals worldwide. Over the last 3 years, we can say that MNA has achieved its objective of attaining consistent absolute returns with little correlation to traditional equity markets. On the other hand MRGR has produced negative returns overall. And I believe this underperformance -as in less than 0%- is due to a structural problem in the Index’s construction. If 40 positions already exist when a new deal arrives, the deal with the worst performance is excluded. This defies the underlying logic if capturing the spread in the current price and offer price: To capture it, you hold until completion or until completion is totally priced in! As such MRGR might be discarding the most lucrative deals because of a structural flaw. MNA has its own flaws. By using ETFs as a hedge, you are partially removing market risk, but not locking in a spread between a target and an acquirer. In the case of an all stock offer, if the acquirers price was to converge towards the targets price rather than the other way round, you wouldn’t profit. But my main problem re$mains the ignorance of risks. Successful M&A investing revolves around finding mispriced deals to go long or short. In both of these indexes you don’t account for the annualised return which is possible, and you don’t stack it up against the risks. CONCLUSION As such I chose to not invest in either of these ETFs. If I had to chose, I would pick MNA, although I am not a fan of its structure, it is less harsh than that of MRGR. Target companies tend to depend on event risk more than market risk, so shorting out market exposure does allow for exposure to M&A deals, even though it doesn’t do so in an ideal manner. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.