Solid Income Company With A Dividend Increase Coming Soon: American Electric Power

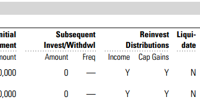

Summary American Electric Power has an excellent total return over the last 33-month test period. American Electric Power’s dividend is 3.9% and has been increased nine of the last ten years. American Electric Power can continue its steady upward trend of approximately 4% as it focuses on its $12.2 billion plan for regulated transmission and distribution assets. This article is about American electric Power (NYSE: AEP ) and why it’s an income company that’s being looked at in The Good Business Portfolio. American Electric Power Company is a utility holding company. The Good Business Portfolio Guidelines, total return, earnings and company business will be looked at. Good Business Portfolio Guidelines. American electric Power passes 10 of 10 Good Business Portfolio Guidelines. These guidelines are only used to filter companies to be considered in the portfolio. There are many good business companies that don’t break many of these guidelines but will still not be considered for the portfolio at this time. For a complete set of the guidelines, please see my article ” The Good Business Portfolio: All 24 Positions .” These guidelines provide me with a balanced portfolio of income, defensive and growing companies that keeps me ahead of the Dow average. American Electric Power is a large-cap company with a capitalization of $26.4 billion. AEP provides electric utility services to about 5.348 million customers in 11 states over a total area of 197,500 square miles. The company derived 25% of its consolidated system retail revenues in 2014 from its utilities in Ohio, 14% from Texas, 13% from Virginia, 11% from West Virginia, 11% from Oklahoma, 10% from Indiana, 5% from Louisiana, 5% from Kentucky and the remainder from other states. American Electric Power has a dividend yield of 3.9% and its dividend has been increased for nine of the last ten years. The payout ratio is moderate at 60%. American Electric Power therefore is not a growth story at this time but may be as the steady growth of the company continues. The dividend is expected to be increased at the end of October and is estimated to be increased $0.02/quarter or a 4% increase. American Electric Power income is good at $3.54/share which leaves AEP plenty of cash flow, allowing it to pay its high dividend and have a enough left over for its capital campaign I also require the CAGR going forward to be able to cover my yearly expenses. My dividends provide 2.8% of the portfolio as income and I need 2.2% more for a yearly distribution of 5%. American Electric Power has a three-year CAGR of 5% just meeting my requirement. Looking back five years $10,000 invested five years ago would now be worth over $18,255 today (from S&P IQ). This makes AEP a good investment for the income investor with its steady 4% dividend and earnings growth. American Electric Power’s S&P Capital IQ has a three-star rating or Hold with a price target of $55.0. This makes AEP fairly priced at present and a good choice for the income investor. Total Return and Yearly Dividend The Good Business Portfolio Guidelines are just a screen to start with and not absolute rules. When I look at a company, the total return is a key parameter to see if it fits the objective of the Good Business Portfolio. American Electric Power did better than the Dow baseline in my 33.0 month test compared to the Dow average. I chose the 33.0 month test period (starting January 1, 2013) because it includes the great year of 2013, the moderate year of 2014 and the losing year of 2015 YTD. I have had comments about why I do not compare the total return to the S&P 500 average. I use the Dow average because the Good Business Portfolio has six Dow companies in it and is weighted more to the Dow average than the S&P 500. Modeling the Dow average is not an objective of the portfolio but just happened by using the 10 guidelines as a filter for company selection. The total return makes American Electric Power appropriate for the growth investor with the 4% dividend good for the income investor. The dividend is lower than average and covered and has been paid and increased each year for eight years of the last ten years. DOW’s 32.5-month total return baseline is 25.71% Company Name 33.0 Month total return Difference from DOW baseline Yearly Dividend percentage American Electric Power 42.15% 16.44% 3.9% Last Quarter’s Earnings For the last quarter (July 2015) American Electric Power reported earnings that beat expected at $0.88 compared to last year at $0.80 and expected at $0.80 and revenue missed by $180 million. This was a good report. Earnings for the next quarter are expected to be at $0.95 compared to last year at $1.01. The steady growth in AEP should provide a company that will continue to have slightly above average total return and provide steady income for the income investor. Business Overview American Electric Power Company, Inc. is a utility holding company. It operates in five segments. The vertically integrated utilities segment generates, transmits and distributes electricity through AEP Generating Company, Appalachian Power Company, Indiana Michigan Power Company, Kingsport Power Company, Kentucky Power Company, Public Service Company of Oklahoma, Southwestern Electric Power Company and Wheeling Power Company. The Transmission and Distribution Utilities segment transmits and distributes electricity through Ohio Power Company, AEP Texas Central Company and AEP Texas North Company. The Generation and Marketing segment’s subsidiaries consist of non-utility generating assets, a wholesale energy trading and marketing business and a retail supply and energy management business. AEP Transmission Holdco is a holding company for AEP’s transmission joint ventures and AEP Transmission Company, LLC. The AEP River Operations segment transports liquid, coal and dry bulk commodities. With electric usage increasing in the United States the diversity of American Electric Power assets should allow the company to continue its growth and safely pay a moderately increasing dividend. Takeaways and Recent Portfolio Changes American Electric Power is a income company. Considering AEP’s steady slow growth and its total return better than the Dow average, AEP is a buy for the income investor. The only negative for AEP is when the Fed starts raising interest rates that will cause rising interest expense, giving AEP a headwind for a couple of years. AEP is not being added to The Good Business Portfolio right now since there are no open slots in the portfolio the Good business Portfolio is limited to 25 positions and AEP will be considered when there is an open slot. Of course this is not a recommendation to buy or sell and you should always do your own research and talk to your financial advisor before any purchase or sale. This is how I manage my IRA retirement account and the opinions on the companies are my own.