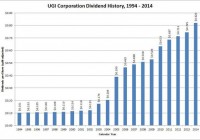

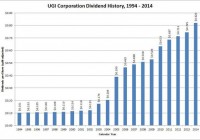

About UGI Corporation UGI Corporation (NYSE: UGI ) is a holding company that through its subsidiaries distributes, stores, transports and markets energy products to customers across the United States and Europe. UGI distributes liquefied petroleum gases (LPGs), provides natural gas and electric service, and generates electricity to retail customers. The company is also a regional marketer of energy commodities, and HVAC, refrigeration and electrical contracting services. UGI has several subsidiaries through which they do business. UGI’s domestic propane business is primarily conducted through AmeriGas Partners (NYSE: APU ), which supplies LPGs to over 2 million customers across all 50 states. UGI Utilities serves about 600,000 natural gas utility customers in eastern and central Pennsylvania and western Maryland. In fiscal year 2014, UGI Utilities sold or transported over 192 billion cubit feet of natural has through its gas main distribution system. UGI Energy Services markets and distributes natural gas, electricity and liquid fuels to about 19,000 customers in the mid-Atlantic region of the United States. UGI serves the international market through UGI International, which serves the European market through three subsidiaries: Antargaz, Flaga, and AvantiGas. Antargaz serves France and the Benelux countries; the company sold over 300 million gallons of LPG through retail outlets to customers in these markets. Antargaz has over 230 thousand customers across these countries. Flaga ditributes LPGs throughout the Eastern European and Nordic markets and sold over 230 million gallons of LPGs to 70 thousand customers. AvantiGas serves the United Kingdom LPG market and sold over 145 million gallons of LPGs in fiscal year 2014. Each of these subsidiaries is either the leading or one of the leading LPG distributors in their respective markets. UGI also has a small LPG distribution business in China through a majority-owned partnership. UGI has stated that it is committed to delivering 6 to 10% EPS growth and 4% annual dividend growth. For UGI’s 2014 fiscal year (which ended Sept. 30, 2014), revenues were $8.28 billion and operating income was $1.01 billion, up 15.0% and 21.0% from FY2013, respectively. Earnings per common share were $1.92 in FY2014, up 20.0% from FY2013. UGI is also meeting its dividend growth objectives; see below for more details. The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol UGI. UGI Corporation’s Dividend and Stock Split History (click to enlarge) UGI has increased dividends at an average annual rate of over 9% for the last five years. UGI has paid dividends since 1885 and increased its dividends since 1988. UGI pays dividends on the first day of January, April, July and October. The company traditionally increases its dividend in the second quarter of the calendar year, announcing the increased dividend at the end of April and with the stock going ex-dividend in mid-June. In 2014, UGI announced two dividend increases; the first, a 4.5% increase, came in the second quarter and the second, a 10.6% increase, came in the third quarter. UGI paid a total of 74.5 cents per share in 2013 and 82 cents in 2014 – a net increase of 10.07%. I expect UGI to announce their next increase at the end of April 2015. UGI’s dividend growth year-to-year has fluctuated greatly. Between 1992 and 2002, UGI increased its dividend very slowly, with annual growth in the low-to-middle single digit percentages. Offsetting this were large dividend increases from 1987-1991 and 2003-2006. The net result is that as you over greater periods of time, the compounded dividend growth rates decrease. UGI’s 5-year compounded annual dividend growth rate (CADGR) is 9.19%, its 10-year CADGR is 7.24%, its 20-year CADGR of 5.08%, and its 25-year CADGR is 4.92%. UGI has split its stock 5 times since 1987. The most recent stock split was a 3-for-2 split in August 2014. Prior to that, UGI split its stock 2-for-1 in September 1987, May 1990 and May 2005, and 3-for-2 in February 2003. For each share of stock you owned in 1987, you would now have 18 shares of UGI stock. Over the 5 years ending on December 31, 2014, UGI stock appreciated at an annualized rate of 22.50%, from a split-adjusted $13.77 to $37.98. This significantly outperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time. UGI’s Direct Purchase and Dividend Reinvestment Plans UGI has both direct purchase and dividend reinvestment plans. The plans are very favorable to investors, as UGI covers all the fees when you buy shares, whether through direct purchase or dividend reinvestment. If you’re a new investor, the minimum initial purchase is $1000. For additional direct purchases, the minimum is $25 for purchases by either check or automatic debit. When you sell your stock, you’ll pay a sales fee of either $15 or $25 (depending on the type of sell order) plus a processing fee of 12 cents per share. Helpful Links UGI Corporation’s Investor Relations Website Current quote and financial summary for UGI Corporation (finviz.com) Information on the direct purchase and dividend reinvestment plans for UGI Disclosure: I do not currently have, nor do I plan to take positions in UGI.