Recent Volatility Providing Potential Buying Opportunity In The Biotechnology Space

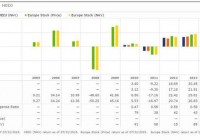

Summary IBB was pulled back roughly 20% from its 52-week high this week with shares plunging from $400 to $320 per share during the recent market weakness. Persistently low oil prices, fear of an imminent rate hike and weakness in China have indiscriminately pulled down all indices over the past week. These external events are largely extraneous to the biotechnology sector and thus may present a buying opportunity throughout pullbacks if adding to a position or initiating a new position. Medical and prescription drug expenditures are projected to grow at an average rate of 5.8% and 6.3% annually through 2024, respectively. Taken together, this may present a potential buying opportunity especially given the recent market volatility. Introduction: The confluence of persistently lower oil prices, fear of an imminent rate hike and more notably weakness in China have indiscriminately plummeted all indices over the past week. These external events are largely extraneous to the biotechnology cohort yet this group has been taken along for the downhill ride with the broader indices. The biotechnology sector has been on an unprecedented performance streak in both annual and cumulative performance over the past 10 years and accentuated during the latest 5 year timeframe however lately this streak has been tested during the recent market volatility. The biotechnology sector can be highly volatile, however I posit that this cohort has not only established itself as a secular growth sector but these latest events are unrelated to the biotech sector and thus this recent pullback may provide a potential opportunity to add to a current position or initiate a position over time as this correction unfolds. Using The iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) as a proxy, based on annual and cumulative performance throughout both bear and bull markets, IBB may provide the opportunity investors have been waiting for in the face of the current market downturn. IBB is touched down to register a 20% decline from its 52-week high, shares have plunged from $400 to $320 at one point per share during the recent market weakness, presenting a potential buying opportunity. Growth expenditures as a rational for buying on major pullbacks: Per the Centers for Medical and Medicaid Services, medical expenditures are projected (from 2014 through 2024) to grow at an average rate of 5.8% per year. This translates into 1.1% faster than GDP throughout this time period thus the healthcare expenditures as a percentage of GDP are expected to rise from 17.4% in 2013 to 19.6% by 2024. Despite several years of growth below 5%, health spending is projected to have grown 5.5% in 2014. Faster health spending due mainly to ACA health insurance coverage and rapid growth in prescription drug spending. The domestically insured is projected to have increased from 86% in 2013 to 89% in 2014 as 8.4 million individuals are projected to have gained coverage. Post 2014, national health spending is projected to grow at a 5.3% clip in 2015 and peak at 6.3% in 2020. Given these projections, this scenario bodes well for the biotechnology sector as more individuals have access to health coverage and prescription drugs. In terms of prescription drug expenditures, spending is projected to have grown 12.6 percent in 2014 to $305.1 billion. Driving growth were new specialty drugs and increased prescription drug use among people who were newly insured. Prescription drug spending growth is projected to average 6.3% annual growth from 2015 through 2024. Taken together, as the biotechnology sector continues its innovation and continuous supply of medications to treat and cure many different diseases coupled with the growth in overall medical spending may present an investment opportunity especially given the recent market volatility. Secular growth case for buying on major pullbacks: In addition to case outlined above (e.g. highlighting the disconnect between the events bringing down the broader indices and the biotechnology sector on a whole) the biotech sector has displayed its resilience in both bear and bull markets with secular growth. The returns for IBB have been very impressive in both annual and cumulative performance, unparalleled by any major index. Over the past 10 and 5 year time frames, IBB has posted cumulative returns of over 360% and 325%, respectively. These results are unrivaled by any major index, outperforming on a 10 year cumulative basis of 295%, 240% and 300% for the S&P 500, Nasdaq, and Dow Jones respectively (Figure 1). These returns are accentuated during the previous 5 years. IBB notched cumulative returns of 325%, outperforming the S&P 500, Nasdaq and Dow Jones by 245%, 215% and 265%, respectively (Figure 2). IBB has cumulatively outperformed all indices by roughly 3-fold and 2.5-fold over the 10 year and 5 year time frames, respectively (Figures 1 and 2). (click to enlarge) Figure 1 – Google Finance comparison of IBB returns relative to the S&P 500, Nasdaq, Dow Jones over the previous 10 years (click to enlarge) Figure 2 – Google Finance comparison of IBB returns relative to the S&P 500, Nasdaq, Dow Jones over the previous 5 years IBB has displayed impressive resilience in the face of the market crash in 2008, the bear markets of 2011 and the very volatile market thus far in 2015. During the market crash of 2008, IBB posted an annual return of -12.2% while the S&P 500, Nasdaq and Dow Jones posted returns of -37.0%, -40.0% and -31.9%, respectively (Figure 3). During the bear market of 2011, IBB posted an annual return of 11.7% while the S&P 500, Nasdaq and Dow Jones posted returns of 2.1%, -0.8% and 8.4%, respectively (Figure 3). Thus far during the highly volatile market of 2015, IBB posted an annual return of 13% while the S&P 500, Nasdaq and Dow Jones posted returns of -5.8%, -0.8% and -8.6%, respectively (Figure 4). These data suggest that IBB outperforms during bear markets and thus has established itself as a secular growth sector and in the face of unrelated economic events may provide a buying opportunity. (click to enlarge) Figure 3 – Morningstar comparison of IBB annual returns relative to the Nasdaq over the previous 10 years (click to enlarge) Figure 4 – Google Finance comparison of IBB annual performance thus far in 2015 relative to the S&P 500, Nasdaq and Dow Jones Conclusion: As the confluence of these economic events seemingly disconnected in bringing down the biotechnology sector coupled with expenditure growth in overall health and prescription drug spending, it may be a good time to consider capitalizing on this correction via adding to existing positions or initiating a new position in this cohort given this opportunity. Being opportunistic and capitalizing on the recent volatility on pullbacks to slowly add to or initiate a position may be the opportunity investors have been waiting on to pounce on IBB. Data suggests, provided a long-term position that volatility within the biotech sector is negated by its long-term performance that is unparalleled by any major index. This sector provides high returns unrivaled by any major index with moderate risk (based on its resilience during the bear markets of 2008 and 2011 and thus far in 2015) and volatility. IBB may be providing investors with a great opportunity to add or initiate a position for any long portfolio desiring exposure to the biotechnology sector with a long-term time horizon given the recent market conditions. References: CMS.gov Statistics Trends and Reports Disclosure: The author currently holds shares of IBB and is long IBB. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I wrote this article myself and it reflects my own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, I value all responses. Disclosure: I am/we are long IBB. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.