Best And Worst Q3’15: All Cap Growth ETFs, Mutual Funds And Key Holdings

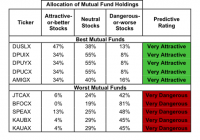

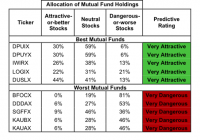

Summary The All Cap Growth style ranks sixth in Q3’15. Based on an aggregation of ratings of 0 ETFs and 494 mutual funds. DUSLX is our top-rated All Cap Growth mutual fund and KAUAX is our worst-rated All Cap Growth mutual fund. The All Cap Growth style ranks sixth out of the 12 fund styles as detailed in our Q3’15 Style Ratings for ETFs and Mutual Funds report. It gets our Neutral rating, which is based on an aggregation of ratings of 0 ETFs (no All Cap Growth ETFs are currently under coverage) and 494 mutual funds in the All Cap Growth style. See a recap of our Q2’15 Style Ratings here. Figure 1 shows the five best and worst rated All Cap Growth mutual funds. Not all All Cap Growth style mutual funds are created the same. The number of holdings varies widely (from 19 to 2177). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the All Cap Growth style should buy one of the Attractive-or-better rated mutual funds from Figure 1. Figure 1: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The AMG Renaissance Large Cap Growth Fund (MUTF: MRLIX ) is excluded from Figure 2 because its total net assets are below $100 million and do not meet our liquidity minimums. The DFA U.S. Large Cap Growth Portfolio (MUTF: DUSLX ) is the top-rated All Cap Growth mutual fund. DUSLX earns our Very Attractive rating by allocating over 47% of assets to Attractive-or-better rated stocks. The Federated Kaufmann Fund (MUTF: KAUAX ) is the worst-rated All Cap Growth mutual fund. KAUAX earns our Very Dangerous rating by allocating over 45% of assets to Dangerous-or-worse rated stocks while charging investors total annual costs of 4.45%. International Business Machines (NYSE: IBM ) is one of our favorite stocks held by DUSLX and earns our Attractive rating. Investors should view IBM as a mature cash cow in the tech sector. Over the past decade, IBM has grown after-tax profit ( NOPAT ) by 6% compounded annually. IBM still earns an impressive 13% return on invested capital ( ROIC ) and, over the past five years, has generated $57 billion in free cash flow . While the market worries about IBM’s ability to innovate, prudent investors are presented with a buying opportunity. At its current price of $155/share, IBM has a price to economic book value ( PEBV ) ratio of 0.7. This ratio implies that the market expects IBM’s NOPAT to permanently decline by 30%. However, if IBM can grow NOPAT by only 2% compounded annually over the next decade , the stock is worth $213/share today – a 37% upside. Martin Marietta Materials (NYSE: MLM ), is one of our least favorite stocks held by KAUAX. Since 2006, Martin Marietta’s NOPAT has actually declined by 2% compounded annually. In addition, its ROIC of 5% is well below the 11% achieved in 2006. However, after two years of NOPAT growth in 2013 and 2014, the market has driven MLM up 46%, a level that does not reflect the quality of its business operations. To justify its current price of $153/share, Martin Marietta Materials must grow NOPAT by 20% compounded annually for the next 18 years . Two years of NOPAT growth in 2013-2014 is a nice trend, but it still pales in comparison to the trend implied by the current market price. Investors should avoid MLM because the expectations embedded in the stock price are simply too optimistic. Figures 2 shows the rating landscape of all All Cap Growth mutual funds. Figure 2: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.