The 1 Page Portfolio Plan

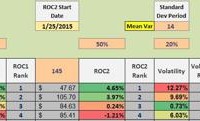

Long only, ETF investing, portfolio strategy, momentum “}); $$(‘#article_top_info .info_content div’)[0].insert({bottom: $(‘mover’)}); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function(){ setEvents();}); Develop a saving plan. Use four commission free index ETFs. Diversify without getting too fancy. Set up a momentum strategy not dissimilar to the Dual Momentum model. Challenged to simplify investing for a young person, the following is a one-page investment plan that anyone can follow. While each of the four principles can be expanded into multiple pages, here is the condensed version designed to meet the one-page challenge. The basic principles are: Save as much as you can as early as you can. Use index ETFs. Globalize diversification. Apply a momentum model. The importance of saving cannot be over emphasized as all that follows rests on this bedrock concept. To keep this “investment book” as simple as possible we use only four index ETFs and they are: U.S. Equities (ex. the Vanguard Total Stock Market ETF ( VTI)), International Equities (ex. the Vanguard FTSE All-World ex-US ETF ( VEU)), U.S. Bonds (ex. the Vanguard Intermediate-Term Bond ETF (NYSEARCA: BIV )), and U.S. Treasury (ex. the iShares 1-3 Year Treasury Bond ETF ( SHY)). These four ETFs are commission free with at least one discount broker and they provide global diversification, principle #3. Principle #4 is the most complex and needs a little explanation. Using an ETF ranking spreadsheet (one worksheet shown below), the portfolio is reviewed every 33 days. The four ETFs are ranked every review period and 100% of the portfolio is invested in the top ranked ETF. For investors not comfortable with investing 100% in a single ETF, even though the portfolio would be diversified over hundreds of stocks or bonds, the other option is to invest equal amounts in the top two ranked ETFs. SHY is included as a “cutoff” ETF to avoid major bear markets. (click to enlarge) Follow these four basic principles and you will outperform most professional investors. Disclosure: I am/we are long VTI,VEU. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague