PPL Maintains Attractive Fundamental Outlook

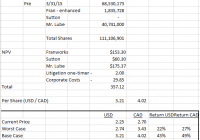

Summary PPL’s transformation into a regulated electric utility and constant investments are key positives of the stock. PPL will have a better rate base growth in the years ahead. The company’s shareholders will continue to enjoy healthy dividend growth in the years ahead. I reaffirm my bullish stance on PPL Corporation (NYSE: PPL ); the company has been executing correct growth efforts and its financial performance remains satisfactory. PPL’s initiative of investing heavily in energy infrastructure development projects is well in-line with its long-term growth generating strategy. Moving ahead, the company’s growth investments will serve as an important source of generating healthy sales and cash flows with rate base growth in the long run. Moreover, PPL has transformed itself into a 100% regulated utility with the spin-off of its competitive energy operations, which will provide stability to its future cash flow base and highlights the security of its consistent dividend growth. Furthermore, the stock offers a potential upside of approximately 18%, based on my price target, as shown below. PPL Is an Attractive Buy In the past few years, U.S. utility companies have been investing heavily in infrastructure growth and development projects. Given the fact that the U.S. electricity demand graph is expected to grow consistently, as shown in the graph below, I believe that ongoing hefty infrastructural development and growth-related investments by U.S. utility companies will serve as an important driver of their future earnings and cash flow growth. (click to enlarge) Source: bv.com As far as PPL is concerned, the company has been spending aggressively on infrastructural growth projects, most importantly to develop its transmission business. During 2Q’15, PPL has completed one of its major transmission business-related investment projects, the 500-KV Susquehanna-Roseland transmission project. This upgraded Susquehanna-Roseland transmission line will act as a model for its future transmission projects, which are lined up to improve the company’s transmission operations. Also, it will make PPL’s electric services more reliable in the long run. Moreover, the company’s 640-MW Cane Run unit 7, the first combined cycle gas plant in Kentucky, is also operational now. The unit has replaced PPL’s 800MW coal-fired generation as part of its plan to reduce its reliance on coal and move to energy efficient gas-powered units. Moving ahead, as the company continues to invest in its infrastructural development-related projects, I believe PPL’s rate base will decently grow in the years ahead, which will ultimately better its top-line, cash flows and earnings base. In its efforts to gain regulated rate base growth, the company filed a rate increase request to Pennsylvania Utility Commission (PUC) in which it is seeking an increase of $167.5 million in annual base distribution revenue on 10.95% ROE and 51.6% equity ratio on a rate base of $3.2 billion. This rate case hike request is backed by the company’s ongoing investments in renewing, strengthening and modernization of its distribution network. If approved, the proposed rate hike will add to PPL’s future top-line, earnings and cash flow base growth. Meanwhile, the company’s recently approved rate case increase of $125 million for KU and $7 million for LG&E will positively affect its top-line numbers. In addition, PPL’s effective transformation into 100% regulated utility after the spin-off of its competitive business operations has improved its risk profile. During the 2Q’15 earnings conference call, while talking about the strong growth prospects of its company, PPL’s CEO s aid : “…all of our utilities are investing heavily in infrastructure, producing robust rate base growth for PPL. In fact, organic growth in our domestic utilities is among the strongest in the U.S. utility sector with 8% to 10% earnings growth expected through 2017. We expect our combined rate base in the U.S. alone to grow by 47% over the next five years. That’s the equivalent of adding another major utility to our portfolio.” Given PPL’s transformation into a 100% regulated utility and also due to constant growth investments made by the company, I believe that its management’s anticipation of attaining an annual earnings growth rate of 4% to 6% through 2017 is achievable. Investors Remain rewarded at PPL The company has been sharing its success with shareholders through dividends. PPL had recently announced quarterly dividend payments of $0.3375, increasing the annualized dividend by 1.3% to $1.51/share . The company offers a dividend yield of 4.82% and has a low payout ratio of 56.40% . Owing to the company’s transformation into a regulated utility, which will provide stability to its top-line numbers and cash flows, I believe dividends offered by the company will grow consistently in future, which will portend well for its stock price. Analysts are also expecting a consistent increase in the company’s book value and cash flows per share, as shown in the chart below. (click to enlarge) Source: 4-Traders.com Price Target I have calculated a price target of $37 for PPL, using a dividend discounting method. In my price target calculations, I used cost of equity of 8% and nominal growth rate of 3%. The stock offers a potential upside of approximately 18%, as per my calculated price target, as shown below. 2015 2016 2017 Terminal value DPS (In-$) 1.47 1.53 2 41 Present Value of DPS (In-$) 1.36 1.31 1.59 33 Source: Equity Watch Calculations & Estimates Total Present Value of DPS = Price Target = $1.36 + $1.31 + $1.59 + $33 = $37/share Risks Given the fact that the U.S. government has become more concerned about limiting the effect of carbon dioxide emissions from electricity generation plants of utilities, the company continues to face increased risk of regulatory restrictions in the form of taxes and fines. Furthermore, unexpected political and environmental changes, irregular weather patterns and higher fuel costs are key risks that might hamper PPL’s future stock price performance. Also, I believe that any laxness exhibited by the management during the execution of its planned strategic growth plans, mentioned above, will result in the company’s failure to produce financial results, per the management’s estimates. Conclusion PPL has an attractive fundamental outlook. The company’s transformation into a 100% regulated electric utility and its constant investments to expand and improve the transmission business are key positives of this stock, which indicate that PPL will have a better rate base growth in the years ahead, which will portend well for its top-line and earnings base. Also, it will strengthen the company’s future cash flow trajectory. Owing to the improved outlook of PPL’s future cash flow base, I believe its shareholders will continue to enjoy healthy dividend growth in the years ahead. Moreover, based on my price target, the stock offers potential price appreciation of 18%. Due to the aforementioned factors, I am bullish on PPL. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.