New Normal Income

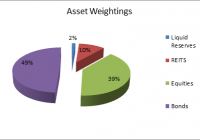

The State Street Fund is mainly comprised of the well-known SPDR ‘Sector Select’ funds. An Income Allocation fund provides better returns than a Government Bond fund. An Income Allocation fund is less risky than a high yield fund. Investors are living in interesting times. Before the 2008 credit crisis, the only mention of deflation might be heard or described in a television documentary. Deflation , as far as most people were concerned, was a thing of the past, the aftermath of an asset bubble combined with a naive economic policy. To be sure, deflation may have faded in living memory, but was still very much a reality of macroeconomics. Since 2008, many advanced global economies have been slipping in and out of deflation and their central banks have been walking a fine line on decisions to direct economic policy. The problem, it seems, is primarily due to a digitally connected, integrated global economy. Disinflation in one region will directly or indirectly affect interest rates and currency values in others. This ‘network effect’ has impacted individual investors who seek relatively safe income. However, to attain reasonable incomes, investors now must venture further out on the risk curve. This begs the question whether there’s some comfortable median, in particular, a way to reasonable returns without incurring high risk. State Street Global Advisors offers investors the opportunity to do just that; earn a steady stream of income with manageable risk through its actively managed SPDR Income Allocation ETF (NYSEARCA: INKM ) . According to State Street the fund’s objective seeks to: Provide total return by focusing on investment in income and yield-generating assets. The fund tracks primarily the MSCI World Index , and secondarily , Barclays U.S. Long Government/Credit Bond Index . According to the prospectus , the fund invests primarily in four different asset classes through exchange traded products (ETP): domestic and international equities; domestic and international investment grade and high yield debt securities; preferred and convertible securities and lastly, real estate investment trusts. Since the fund seeks to achieve its objectives through investments in Exchange Traded Products it is essentially a fund of funds. There are similar funds; however, SPDR’s Income Allocation ETF has the best short and long term returns when compared to the top three similar as summarized below: Fund and Inception 1 Month YTD 1 Year 3 Year Since Inception Types of Holdings SPDR (INKM) 4/25/2012 1.25% -0.35% 1.07% 5.10% 5.46 ETP; Reits convertibles, Equities PowerShares CEF Income Composite Portfolio ETF (NYSEARCA: PCEF ) 2/19/2010 -1.61 0.84 -3.04 5.52 6.41 ETP investment grade funds; high yield funds iShares Morningstar Multi-Asset High Income Index ETF (BATS: IYLD ) 4/3/2012 -0.55 -2.57 -2.65 4.15 5.21 ETPs, high yield fixed income funds (Data From State Street Global Advisor ) T he fund is compact, holding just 21 funds; 17 of those holdings are State Street Advisor’s SPDR funds . Of the top five holdings accounting for nearly half of the fund’s asset allocations, three are SPDR bond funds, one SPDR REIT and the WisdomTree Japan Hedged Equity ETF (NYSEARCA: DXJ ) . (Data from State Street) The fund’s heaviest allocation is in bonds, accounting for nearly half of the funds asset allocation. Of the 7 bond funds, 2 are U.S. Treasury bond funds, 10.83%; 2 are corporate bond funds, 14.32%; 1 high yield fund, 15.79%; 1 emerging market bond fund, 3.05%, and 1 convertible securities fund accounting for 5.08%, of total holdings. Hence, the fund is well diversified over the risk spectrum. The next heaviest allocation is in dividend generating equity funds. Of the 11 equity funds, 6 are international, 22.99%; three are SPDR ‘Select Sector’ funds, 6.09%; one SPDR preferred equity fund, 5.13% and one SPDR dividend fund accounting for 5.11% of the fund’s total holdings. Two SPDR REITs account for 10.27% of the fund’s holdings and lastly 1.34% is classified as ‘liquid reserves’. The question sure to arise is on the usefulness of allocating a fund of funds in a long term portfolio. The question may be answered when the long term investor makes a careful study of the global fixed income market. Most advanced economies are experiencing “disinflation’ or outright “deflation”. In order to prevent a deflationary spiral, central banks have gone to extraordinary lengths to depress deposit rates in order to direct liquidity into economies. These extreme efforts have met with some measure of success, but by far, have not returned fixed income markets to ‘normalcy’. Three recent notable examples of central bank actions in ‘secular stagnation’ economies are for instance, Japan’s unexpected expansion of its bond purchasing program in October of 2014 weakening the Yen to historic lows against major currencies; the ECB’s expansion of its bond purchasing program and depressing its deposit rate to -0.20%; most recently the People’s Bank of China reference rate reductions and an outright devaluation of the dollar pegged currency. The list is long and growing. Worsening the matter has been the commodity market collapse, particularly in crude oil and decelerating global demand. By all indication, the individual investor might, at the very best, expect a gradual return to normalcy, which might take several years. There’s a risk in being locked into historically low yielding high quality sovereign debt at the long end of the curve. Should sovereign rates return to normal after just a few years, the loss of principal on bonds purchased at the highs, would certainly result in a negative yield when held to maturity, particularly should inflation return to a 2% rate. On the other hand, should major global economies continue to struggle to “reflate”, even the most risky high yield bonds will experience declining yields. (click to enlarge) It has often been said that a ‘fund of funds’ results in over-diversification. In a new normal world, a fund of diversified fixed income funds, particularly if it’s actively managed such as the State Street Global Advisors Income Allocation Fund ETF is a far more holding tool for the individual investor, well diversified over many income producing sectors and, most importantly, diversifies risk as well. The fund has total net assets of $118.94 million distributed over the 21 holdings including the liquid reserves. The trailing dividend yield is currently 3.28% and the ETF shares currently are trading at its NAV price, hence neither at a premium nor discount to NAV; there are 3.80 million shares outstanding. The fund has a somewhat high management fee of 0.70% without any mention of waivers or cap. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.