Why Lower Inflation In India Is A Good Sign For International Investors

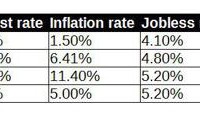

With lower inflation in India than previous years, HSBC forecasts the Indian rupee will remain highly stable this year, reducing exchange rate risk for investors. The Sensex stock market index has vastly outperformed that of Brazil, China and Russia – India’s stock market offers very attractive growth prospects. As an English-speaking country and a centre of technology worldwide, I believe India is at a distinct competitive advantage relative to its peers. Of all the four BRIC economies, I believe that India in particular has the potential to become the most powerful emerging market in the world by 2040. The country has never been over-reliant on manufacturing to sustain economic growth – India’s English speaking workforce along with the country’s status as a major technology give its economy a distinct advantage compared to that of Brazil, China and Russia. In particular, with India now set to meet inflation targets, this could mean very good news for international investors looking to get in on the India growth story. In comparing inflation rates across the BRIC economies, we can see that China has the lowest inflation rate currently at 1.50%, with Russia having the highest inflation rate at 11.40%. India’s inflation rate stands at 5.00%. Inflation is clearly an important consideration for international investors. As an American investor (or a European one, in my case), inflation has a direct impact on exchange rates – higher inflation typically results in a lower exchange rate as consumers stop spending due to higher prices. If this is the case, then a weakening Rupee means that our investment is worth less in dollars or euros. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Sources: Trading Economics In terms of inflation rates, India has been successful in bringing inflation down from a previous rate of 8% in 2012. All else being equal, China would appear to look more favorable as a lower rate of inflation would not have as great an impact on investment value. However, deflation is currently more of a concern in China and this could also lead to exchange rate risks for international investors. Moreover, we can see that of the four emerging stock market indexes, the Indian Sensex Index has vastly outperformed those of China, Brazil and Russia: (click to enlarge) Source: Yahoo Finance Additionally, HSBC projects that the Indian rupee will continue to maintain strength, as lower oil prices will continue to lead to improvements in current account and inflation targets. HSBC reports that the rupee is expected to oscillate between 62.5 and 63 to the dollar this year, which should lead to a high degree of exchange rate stability for international investors. I expect that the long-term outlook for India’s stock market will remain positive due to effective management of inflation and strong fundamentals – stable exchange rates and inflation management means that the Sensex is likely to experience less volatility than that of other emerging markets. In conclusion, India’s use of effective monetary policy in reducing inflation to sustainable levels is clearly working. This is especially significant to international investors who are looking for stable returns yet vibrant growth. Additionally, given that the Sensex has vastly outperformed the stock indexes of the other BRIC economies, I am highly optimistic on India’s growth story going forward. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague