Happy 1-Year Birthday HDLV And Quarterly Rebalance: Altria Out, CME In

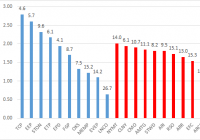

Summary HDLV has recently turned one year old and its performance since inception appears adequate, though data sources have been conflicting. The quarterly rebalance removed blue-chip favorites MO, VTR and ED, while introducing newcomers CME, PPL and WY. HDLV currently yields 9.7% on a 2x leveraged portfolio. HDLV: a one year review The ETRACS Monthly Pay 2xLeveraged US High Dividend Low Volatility ETN (NYSEARCA: HDLV ), incepted on Sep. 30, 2014, has recently turned one year old. Since inception, it (12.43%) has slightly underperformed two other 2x dividend ETNs, the Monthly Pay 2xLeveraged Dow Jones Select Dividend ETN (NYSEARCA: DVYL ) (13.66%) and the Monthly Pay 2xLeveraged S&P Dividend ETN (NYSEARCA: SDYL ) (12.72%), while outperforming the Monthly Reset 2xLeveraged S&P 500 Total Return ETN (NYSEARCA: SPLX ) (7.48%). Note that all of the 2x funds mentioned above reset their leverage monthly, rather than daily. The total return performances of the aforementioned fund since the inception of HDLV in Sep. 2014 are shown below, with the unlevered SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) (4.96%) shown for comparison. HDLV Total Return Price data by YCharts In terms of volatility, HDLV appears to have done the worst out of all the 2x leveraged funds. This is disappointing because HDLV purports to hold stocks that show lower volatility than the broader market. Part of this could be due to HDLV’s heavy concentration in interest rate-sensitive sectors such as telecommunications and tobacco (refer to my HDLV update article ” 10%-Yielding HDLV May Be A Good Choice If Interest Rates Remain Low “), which moved together during the significant interest rate gyrations witnessed throughout this year. HDLV 30-Day Rolling Volatility data by YCharts Interestingly, InvestSpy gives different results on both total return and volatility. According to InvestSpy, HDLV has produced both the highest total return and lowest volatility out of the four 2x leveraged funds since inception (note that the high volatility of SPLX may be distorted by its lack of liquidity). Related to this, HDLV also shows the lowest beta and daily variation. Moreover, HDLV produced the lowest maximum drawdown out of the four 2x leveraged funds. Ticker Annualized Volatility Beta Daily VaR (99%) Max Drawdown Total Return HDLV 24.50% 1.19 3.60% -18.00% 17.10% SDYL 26.80% 1.39 3.90% -21.40% 14.10% DVYL 26.60% 1.5 3.90% -22.90% 14.70% SPLX 72.30% 1.46 10.60% -29.20% 10.20% I wanted to confirm the data using a third source of information, but unfortunately Morningstar does not give volatility data or Sharpe ratios on issues less than 3 years old. Therefore, depending on the source of data used, HDLV could either be ranked first or third out of the four 2x leveraged funds for total return, and either first or last in terms of volatility. This could be due to differences in the way that total return and volatility is calculated for the different data providers. HDLV has also recently just paid out its 12th dividend since inception, giving it a TTM yield of 9.7%. HDLV quarterly rebalance: Altria out, CME in As has been described in my previous article ” Higher Dividends With Less Risk (Part 2): A Second Look At ETRACS 2x US High Dividend Low Volatility ETN “, HDLV applies both dividend yield and volatility screens in selecting constituents. The selected constituents are then weighted according to average trading turnover, a factor that correlates closely with market capitalization. The result is a highly focused portfolio, with over 60% of the fund being concentrated in the Top 10 holdings. Given this high concentration of holdings, I believe that it is worthwhile to analyze individual additions and removals to the index when it is rebalanced each quarter in order to give some insight into the nature of the portfolio. The latest quarterly rebalance was performed last week, and allocates 60.21% of the index to the Top 10 holdings. The following table shows the Top 10 constituents of HDLV for the previous quarterly rebalance (Jul. 17, 2015) compared to the most recent rebalance (Oct. 16, 2015). Oct. 22, 2014 Jul. 17, 2015 Name Ticker Weighting / % Name Ticker Weighting Verizon Communications Inc. (NYSE: VZ ) 10.00 Verizon Communications Inc. VZ 10.00 AT&T Inc. (NYSE: T ) 10.00 AT&T Inc. T 10.00 Philip Morris International (NYSE: PM ) 8.87 Philip Morris International PM 9.60 Duke Energy Corp (NYSE: DUK ) 6.61 Altria Group Inc. MO 8.61 Southern Co (NYSE: SO ) 6.16 Duke Energy Corp DUK 6.82 Welltower (formerly Health Care REIT) (NYSE: HCN ) 4.11 Southern Co SO 5.87 CME Group Inc (NASDAQ: CME ) 4.11 Ventas Inc (NYSE: VTR ) 3.92 PPL Corp (NYSE: PPL ) 3.98 Health Care Reit Inc (now Welltower) HCN 3.72 HCP Inc (NYSE: HCP ) 3.51 Consolidated Edison Inc (NYSE: ED ) 3.44 Weyerhaeuser Co (NYSE: WY ) 2.86 HCP Inc 3.17 Top 10 total 60.21 65.15 What are the major changes in this rebalance? Key additions. CME, PPL and WY have entered the top 10, and were newly added to the fund this quarterly rebalancing review. Key removals. MO, VTR and ED were removed from the top 10, and from the fund altogether this quarterly rebalancing review. The removal of MO is particularly significant because this constituted 8.61% of the total weight of the fund. As an owner of HDLV, I was interested to find out why MO was removed while peer PM was not, why VTR was removed but peers HCN and HCP were not, and why ED was removed by peers DUK and SO were not. MO vs. PM Over the past 3 months, MO has significantly outpaced PM on a price basis. MO data by YCharts This has caused MO’s dividend yield to drop to around 3.5%. Thus, I believe that MO was excluded from the index because it was not among the top 80 names by dividend yield (amongst the top 200 largest US companies). MO Dividend Yield (TMM) data by YCharts VTR vs. HCN and HCP On a price only basis, VTR has performed comparably with HCN and HCP over the past 3 months. Its yield also sits between that of HCP and HCN. VTR Dividend Yield (TTM) data by YCharts Moreover, VTR’s volatility over the past 12 months has been similar to its peers – recall (from my previous article) that HDLV selects 40 of the lowest-volatility stocks out of the aforementioned 80. VTR 30-Day Rolling Volatility data by YCharts When considering market cap, VTR’s market cap is smaller than HCN’s, but larger than HCP’s, thus I do not think that this was the factor for exclusion. Therefore, I do not know why VTR was excluded from the newest edition of HDLV, while HCN and HCP were not. My suspicion is that Solactive, the index provider, did not account for VTR’s spin-off of Care Capital Properties (NYSE: CCP ) properly, leading to aberrant yield or volatility statistics that disqualified it for inclusion. If so, that is a disappointment because I feel that VTR deserves to be included in this fund, according to my analysis of the index guidelines. ED vs. DUK and SO ED has outperformed DUK and SO over the past 3 months. Similar to the situation with MO, ED could have been removed from its index due to its declining dividend yield. ED Dividend Yield (TMM) data by YCharts The new Top 10 additions, CME, PPL and WY have TTM yields of 4.3%, 4.3% and 4.1%, respectively, all higher than ED. Summary While the removal of blue-chip favorites such as MO and ED from the index can be disappointing to some, investors may be somewhat comforted by the fact that the fund is simply “selling high and buying low” as it removes companies whose price has appreciated to such an extent that their yield falls below the threshold, while replacing these with higher-yielding companies whose recent fortunes may not have been as auspicious. At the same time, the fact that only the top 200 U.S. companies by market cap are considered for selection may limit, but not entirely prevent, “falling knife” situations in which an incredibly high yield can be a predictor for an imminent dividend cut. While HDLV does not screen for dividend growers, it is noteworthy that all companies in their Top 10 have positive year-on-year dividend growth (PPL squeaks by with 0.3% 1-year DGR). Moreover, the decision to exclude MLPs from the index, in spite of the massive MLP bull market that occurred until collapse in late 2014, appears to be brilliant in hindsight. On the other hand, the removal of VTR appears, as far as I can tell, to be a mistake. In terms of portfolio concentration, I feel that this quarterly rebalance has improved the diversification of HDLV. The Top 10 holdings account for 60.21% of the portfolio, down from 65.15%. In the Top 10, there is now only 1 tobacco company instead of 2, and only 2 healthcare REITs instead of 3. This leaves room for the addition of CME, one of the largest options and futures exchanges, and WY, one of the world’s largest private owners of timberlands. Meanwhile, the addition of PPL to the Top 10 at the expense of ED would be considered a wash. In terms of performance since inception just over one year ago, HDLV has done either better or worse than two other 2x dividend ETNs, SDYL and DVYL, depending on whether YCharts or InvestSpy is used, while it has performed better than SPXL according to both data sources. Its volatility has either been the best or the worst among the four funds, depending again on which data is considered. Finally, HDLV’s TTM dividend yield is 9.7%, which is significantly higher than SDYL at 5.8% and DVYL at 7.6%.