A Hedged ETF Strategy For Rising Interest Rates

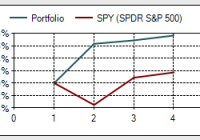

The 10-year Treasury Yield at 1.8% is 1.2% below where it started 2014. Forecasts that rates would rise in 2014 were very, very wrong. With the 10-year yield now at a record low level, the probability of rising rates from here are better. Outlined below is a hedged strategy using short and long bond ETFs to profit from rising long term interest rates. In one of my accounts I hold about 20% in cash that I did not want to put into the equities market. My plan is to hold that money as available investment capital for the next time the equities market experiences a strong correction. In the current 0% interest on cash environment, I started to think about ways to put that money to work in a relatively low-risk way. I am also concerning about the effects of rising interest rates on the overall value of my income focused equity holdings. With the current level of interest rates paid on bonds, you need to take on quite a bit of duration to earn any meaningful rate of yield and I am unwilling to go 100% into a bond ETF with the prospects of higher interest rates somewhere in the not to distant future. In contrast, an inverse Treasury bond ETF will gain value when interest rates rise, but does not pay any income and will lose value if rates continue to decline. My research led me to try set up a combination investment of a bond ETF and an inverse Treasury bond ETF. The plan is to sell off the inverse ETF in stages as interest rates rise, reinvest the proceeds into the bond fund to generate a growing income stream from the bond ETF. The goal is to end up a few years down the road with the initial investment amount intact and all of the money in the bond ETF earning a higher yield than what is currently available in the market. Half of the cash in the account has been employed into this strategy. To put the strategy in play I initially selected the Schwab U.S. Aggregate Bond ETF (NYSEARCA: SCHZ ) and the ProShares Short 7-10 Year Treasury (NYSEARCA: TBX ) . SCHZ currently yields 2.03% with an average yield-to-maturity of 2.56%. Expenses are 0.06%. TBX is intended to provide a one-times inverse return of the Barclays U.S. 7-10 Year Treasury Bond Index and has expenses of 0.95%. Over the last year, the yield on the 10-year Treasury has declined by about 100 basis points (1.00%). For that period, the SCHZ share price appreciated by 4.50% and the TBX share price declined by 11.35%. With dividends reinvested for SCHZ you have roughly a 2 to 1 inverse return differential between TBX and SCHZ. Since I expect interest rates to increase over the next few years, my initial plan was to split the invested capital 40/60 between SCHZ and TBX. I started to leg into the two ETFs at the beginning of this year. At that time the 10-year Treasury carried a 2.12% yield, down 0.88% from where it started 2014. As the first two weeks of 2015 unfolded, the Treasury yield marched steadily lower. As the price of TBX dropped, I made two buy trades to establish an initial position. A point of interest, TBX is thinly traded and day only limit orders at or near the low end of the bid/ask spread typically get filled. When the 10-year yield dropped below 1.9%, I got more aggressive and I made two purchases of the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT ) , spread a week apart. TBT is a longer duration bond, leveraged ETF, so will change value at about 4 times the rate of TBX. With the 10-year yield setting record lows, I decided that there is an opportunity to make a relatively quick profit on an interest rate bounce off the 1.77% T-note yield bottom set on Thursday, January 15. Now with the full planned amount invested in the three ETFs, I am much more aggressively skewed towards rising interest rates than I initially planned. Here are the percentages invested in each ETF: SCHZ: 35% TBX: 48% TBT: 17% Currently, the total value of the three funds down 1.3% from the amounts invested. From this point, the plan is to profit from rising interest rates. As the share price of TBT rises, it will be sold off first with the proceeds invested into SCHZ. Even a modest rate climb back about 2% for the 10-year will turn this into a profitable trade. The SCHZ and TBX positions will be managed based on an expected slow 2-3 year rise in interest rates. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague