Angie’s List Staring Down Facebook, Google In Home Spruce-Up Market

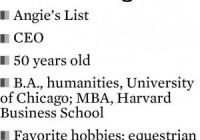

The provider of online home-improvement reviews, Angie’s List, is going up against some big guns. Angie’s List ( ANGI ), which made its IPO in 2011, lets people research, rate and hire local providers of home-improvement services. But with its original paywall for subscriptions prompting 90% of its traffic to flee from the site, Angie’s List this month announced the start of a fully free tier of service. Users have an option to upgrade to various paid tiers. The company’s announcement of its move to “freemium” came soon after social networking powerhouse Facebook ( FB ) released Facebook Professional Services, its own local business-listings and service-discovery program. Facebook says its offering can help users find anything from plumbers to pet services, plus get business ratings and reviews. That new entrant has heaped even more competition in the path of Indianapolis-based Angie’s List, whose rivals already include Amazon.com ( AMZN ), Alphabet ( GOOGL )-subsidiary Google and crowdsourced online-review site Yelp ( YELP ). Others vying for a piece of the action include privately-held websites Houzz, Porch and Thumbtack. This month, Angie’s List unveiled a new growth plan after it spurned a $512 million acquisition offer made in November by IAC/InterActiveCorp ( IAC ) subsidiary HomeAdvisor, another competitor in the estimated $400 billion home services market. Scott Durchslag became the second CEO for Angie’s List last September. The former Best Buy ( BB ) executive came aboard after company co-founder and Chief Executive Officer William Oesterle stepped down. IBD recently spoke with Durchslag about the company’s new effort to get business in the super-fragmented market for providers of online home-improvement services. IBD: How can Angie’s List go up against Facebook? Durchslag: Facebook or Google, they’ve both tried to do things in other spaces before. Services is a very different business than either Facebook or Google’s core businesses. You really need to have relationships with service providers and you need to be able to understand how to create and convey value to service providers. We’ve got 55,000 of them; they are a big part of our business. That is what Angie’s List has been doing for 20 years. We are actually in a pretty good position, I would say, to compete. I would be more concerned if I were somebody that was just in the “search and match” business alone, the way that some of our competitors are. Angie’s List has a very differentiated model because we have a membership model. I welcome the challenge, but I think in terms of the core value that we provide — especially the new strategy that we laid out in the “profitable growth plan” — (it) has us competing in each stage of the value chain, from search to match to hiring to payments to fulfillment. We’re going to be playing in all of those areas through our platform, really bringing together both existing and new service providers, existing and new consumers, and existing and new partners. Nobody else has an offering to match what we are trying to do. IBD: Can you give some examples of those partners? Durchslag: There are several different types. We segmented them to say we will have 10 or so exclusive partnerships with tight integration. We will probably have around 50 semi-exclusive and then will have hundreds that are open to integrate with us through the APIs (application programming interfaces) and the software developer kits that we put out. . . . A bank that would be able to do a refinance of a kitchen remodel project would be one type of privileged partnership that we could offer. Insurance companies — particularly homeowners insurance companies — would be another example. (They) would love to be able to access this massive, $400 billion, fragmented home-services market. And then in each category of building products, (partners) would have the chance to be able to get directly to high-end consumers or to our service providers. So imagine you’re a paint company or you sell shingles or you sell flooring. We have announced a partnership with Bluebook, which gives us thousands of price tasks in each locality where we can compete. (Bluebook International provides cost information on home improvement projects.) You can see a fair price curve and you’ll be able to see the bids you got on your project and how that compares against similar projects in your locality, so you have an idea of how good that price was. We’ll have other (services) like that. IBD : Your company rebuffed a buyout offer from HomeAdvisor, saying you could reap better results from a new business strategy. What is that new strategy? Durchslag: What I said was (any sale) was premature before we had a chance to come out with our “profitable growth plan” and make clear what the organic value of the company would be, in terms of: If we executed the turnaround plan, what would be the value of the business? So you need to have something to compare any kind of offer to, you can’t just look at an offer in a vacuum. We’re open to value-creation opportunities. But what we’re really focused on is executing the “profitable growth plan.” The way the strategy works in 2016 is all about strengthening the core. That’s where we are opening the paywall; we’re rolling out the new platform. We’re rolling out the new offers and getting our membership base transitioned from reviews as . . . the basis of payments into a whole broader set of things. And phase two (in) 2017 and 2018 is all about building that three-dimensional platform between consumers, service providers and partners. Only after we’ve done that do I think we’ve earned the right to go into adjacencies. Those will be looking at things like, potentially, international expansion. I don’t want to get any more specific than that. IBD: What makes you confident that the benefits of dropping the paywall can offset any revenue loss? Durchslag: There’s some momentum there to build upon; that will only accelerate dramatically once we take the paywall down, because I anticipate that traffic will explode. That will only drive more e-commerce and it will drive LeadFeed, which is our way of monetizing free users. So, when people come to us, they would have the chance to search, they would have the chance to hire through LeadFeed, they’d have the chance to shop through e-commerce. Those things all turn into revenue. There’s a lot we need to get done to execute the strategy. In the pilot markets we tested, we saw some very promising results. We saw registrations higher by three to four times in places where we had the reviews paywall. We saw people writing reviews three to four times more often. We saw contract value going up very significantly. We are working it from the consumer side first on what we are doing with the paywall. Then, we will (focus) on the service provider side, because you want to make sure when you get this avalanche of traffic and interest that you have enough service providers to service them, otherwise you overwhelm the service providers you’ve got and consumers don’t want to wait.