12% In 12 Years

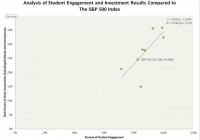

There are too many articles telling people they cannot beat the market. It can be done, and at only 80% in the market. During his seminars, Dave Ramsey often talks about averaging 12%, and critics say that is not possible. It is possible. With a little leg work, research, mathematical skills, and strategic allocation, there is a method that works, and a track record to prove it. It was a pretty simple idea in 2003, and I wanted to see if it would work. I wanted to see if it was possible to beat the market using some of the basic strategies I had studied. I had committed myself to studying Graham, Buffett, Fisher, Zweig, Dreman, O’Shaughnessy, and Domash, and was ready to get to work. I used some pretty basic concepts to find my stock selections. First, I used the old MSN Money Stock Screener, which no longer exists to screen for Bulletproof stocks as outlined by Harry Domash in his original book, Fire Your Stock Analyst . With that, I determined an intrinsic value of each stock using the techniques from Mary Buffet ‘s book , where she outlines Warren Buffet’s techniques for stock selection. With a list of stocks that had at least a 15% discount to intrinsic value, I allocated my Marketocracy Hybrid Fund portfolio in equal lots based on Large-Cap, Mid-Cap, Small-Cap and International. These were the initial companies I bought on January 30, 2003: Symbol Name Notes AJG GALLAGHER(ARTHUR J.) BFR BBVA BANCO FRANCES SA BPT BP PRUDHOE BAY ROYALTY CRRC COURIER CORP DECA DECOMA INTL ‘A’ Acquired by MG: CN DOM DOMINION RES BLACK WARRIOR TR HRL HORMEL FOODS IMH Invictus MD Strategies Corp Listed only in Canada IMO IMPERIAL OIL LTD ITT ITT Corp KNX KNIGHT TRANSPORTATION MHO M/I Homes Inc MRK MERCK & CO NAT Nordic American Tankers Ltd OTCQB: OTCQB:NOVC Novation Companies Inc OTC NTZ INDUSTRIE NATUZZI ADS PAA PLAINS ALL AMER PIPELINE PEP PEPSICO INC PII POLARIS INDUSTRIES PTSI P.A.M. TRANSPORTATION SVCS QSII QUALITY SYSTEMS OTCQB: OTCQB:RILY B. Riley Financial Inc SGP SCHERING-PLOUGH Acquired by MRK SSL SASOL LTD ADR THO THOR INDUSTRIES TSMA TESMA INTL ‘A’ Acquired by MGA OTCPK: OTCPK:VCYE Velocity Energy Inc OTC WCSTF WESCAST IND INC CL A Acquired by Sichuan I would say I was off to a pretty good start that first year with a 33.3% return, after fees and commissions. This compared favorably with the S&P 500 at 33.25%. By 2005, my strategy changed a bit to include a 20% allocation for the new bond ETFs from iShares . I wanted to mirror what I was doing in real life as much as possible, and I never looked back. Since I started this approach of finding undervalued stocks that are financially safe and undervalued, I have averaged 12.40% over the last 12 years. In the meantime, the S&P 500 averaged 9.54%. Think about that. Including fees, I have a strategy that beats the market by an average of almost 300 basis points over the last 12 years, and that includes a 20% allocation for fixed income. It also includes all fees and commissions that are bane of all managed funds. This is a strategy that has a 5.26 alpha, 0.73 beta, and a 1.58 gain/loss ratio. The data is here for all to see. So why did I bring up Dave Ramsey? When Ramsey speaks at his financial seminars, he always touts 12% as the average annual return for a particular mutual fund since 1934. Professionals in the field recognize the mutual fund he describes as American Funds’ Investment Company of America (MUTF: AIVSX ), and it has returned almost 12% since 1934. I, however, am one of many who have said he needs to stop saying 12%, especially since ICA has only averaged 9.15% since 2003. Since the market has historically returned 9% since 1871, that is a more reasonable target number. This is according to data from Nobel Laureate Robert Shiller. If one is willing to listen, there are strategies that will help one achieve 12%, or at least beat the market; the strategy described here is one of many. Frederik Vanhaverbeke describes how no less than 30 Wall Street Legends consistently beat the market. Again, it is a matter time and effort. Which equities are in the Hybrid portfolio now? Here are the top five: Symbol Name SHOO Steve Madden Ltd GOLD Randgold Resources WDR Waddell & Reed Financial CRUS Cirrus Logic SLW Silver Wheaton Why is this topic important? It’s important because the naysayers contend that one cannot beat the market, and just give up. They acquiesce and only use index funds. One can beat the market, but that only occurs if one is willing to put in the work. Happy investing. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.