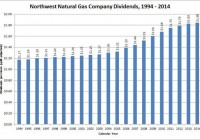

Summary Natural gas and electric utility Chesapeake Utilities has generated impressive historical earnings growth by focusing on capital investments at the expense of dividend payouts. This strategy is set to continue driving earnings growth, as the company invests in high-demand regulated operations and its strong Florida service areas. Florida’s economic and population growth will provide long-term support for the company’s earnings, while cold winter weather in the state will help in the short term. The company’s shares are overvalued at present, but have demonstrated substantial price volatility. Potential investors are advised to watch for a dip that creates a more attractive purchase opportunity. There aren’t many names in the utilities sector that have outperformed the S&P 500 since the start of 2011 by as much as natural gas and electricity distributor Chesapeake Utilities (NYSE: CPK ). Then again, not many utilities firms have increased their annual EPS by 30% over the same period (see figure). Chesapeake has managed to achieve substantial earnings growth in a normally slow-growth sector by investing heavily in its regulated services and identifying high-margin unregulated but related areas to operate within. Historical growth rates are no guarantee of future earnings, however, and it is fair to ask whether the company will be able to continue growing at its recent pace. This article evaluates CPK as a potential long investment opportunity. CPK data by YCharts Chesapeake Utilities at a glance Chesapeake Utilities is a Delaware-based public utility that distributes natural gas, propane, and electricity in multiple service areas on the Eastern Seaboard. It conducts its operations via five regulated wholly-owned subsidiaries and four unregulated wholly-owned subsidiaries. Of the regulated subsidiaries, Chesapeake Utilities is the oldest, and it distributes natural gas to 58,000 residential, commercial, and industrial customers in Delaware and Maryland. Sandpiper Energy distributes natural gas and propane to 11,000 residential and commercial customers in Maryland. Florida Public Utilities deals with multiple types of energy resources, distributing natural gas to 73,000 residential, commercial, and industrial customers throughout the state, electricity to 31,000 customers in north Florida, and propane to 16,000 Florida customers. The subsidiary has achieved rapid customer growth over the last 15 years, as the state’s population has increased by more than 23%. Finally, the last two regulated subsidiaries, Eastern Shore Natural Gas and Peninsula Pipeline, are engaged in the transportation and delivery of natural gas – the former in Delaware, Maryland, and Pennsylvania, and the latter in Florida. The first of Chesapeake Utilities’ unregulated subsidiaries is Sharp Energy, which distributes propane to 37,000 residential, commercial, and industrial customers in Maryland and Pennsylvania. Xeron markets natural gas liquids across the U.S., while PESCO markets natural gas in Delaware, Maryland, and Florida. Grove Energy conducts CNG conversion services in Florida. Finally, Aspire Energy, which was acquired earlier this year for $52.8 million in cash and shares as Gatherco before being renamed, conducts midstream natural gas gathering, processing, transportation, and marketing services in Ohio. Chesapeake sold its IT services subsidiary BravePoint last year, and now only engages in energy and energy-related operations. The company has benefited from a combination of favorable regulatory schemes, as well as growing populations and economies in its service areas over the last several years. These advantages have enabled it to report record earnings in the last eight consecutive years, as its annual EPS has increased at an 11.6% CAGR since FY 2010. The company’s ability to generate high ROEs, with annual ROEs of 11.6% from FY 2010 to FY 2012 and 12.2% since FY 2013, has also contributed to this earnings growth. Earnings growth has in turn led to steady, if underwhelming, dividend growth of 23% (or 5.5% CAGR) since FY 2010. The dividend growth rate has sped up recently, however, achieving 6.5% in FY 2015. The current annual dividend of $1.15/share equates to a modest forward yield of 2.1% at the time of writing. While this low yield is due in part to the company’s impressive share price performance since FY 2010, it also reflects the fact that Chesapeake maintains a low dividend payout ratio (see figure). While disappointing to dividend investors, the relative lack of dividend payments has enabled the company to increase its capex by 108% over the same period. CPK Dividend Yield (TTM) data by YCharts Q1 earnings report Chesapeake Utilities reported impressive Q1 earnings back in May that beat on both lines . The company’s revenue came in at $170 million, down 8.8% YoY from $186.3 million, but beating the consensus estimate by $8.3 million. Revenue from the regulated segment increased by 7.3% versus the previous year to $109.6 million, due primarily to customer growth and an increase to its Florida rate base. The unregulated segment’s revenue fell sharply by 24% to $60.5 million, as the average price of propane during the quarter fell by 59% compared to the previous year. Lower energy prices more broadly caused the company’s cost of revenue during the quarter to fall by 20% YoY, allowing operating income to increase by 19% over the same period. The regulated segment’s operating income increased by $1.1 million, which the company attributed to the Florida rate base increase, customer growth, and the cold weather during the quarter. The unregulated segment’s operating income increased by $4.4 million, driven by the cold weather – with the average temperature being 14% colder than normal – as well as the presence of strong propane retail margins during the quarter. Retail fuel margins were strong across energy sectors, and the propane market was no different. Net income rose to $21.1 million YoY from $17.7 million (see table), resulting in EPS of $1.44 versus $1.22 the previous year, which beat the consensus by $0.28. Both the YoY increase and the beat were primarily attributable to the strong retail propane margins, which boosted EPS by $0.21. Service expansions and natural gas demand growth – the former resulting from the company’s previous capex, and the latter resulting from population growth in its service areas and the cold winter – contributed another $0.10 to EPS. Higher labor and maintenance costs offset these increases by $0.09. Chesapeake Utilities Financials (non-adjusted) Q1 2015 Q4 2014 Q3 2014 Q2 2014 Q1 2014 Revenue ($MM) 170.1 120.4 91.6 100.5 186.3 Gross income ($MM) 77.7 57.0 45.6 47.4 70.7 Net income ($MM) 21.1 10.1 3.2 5.1 17.7 Diluted EPS ($) 1.44 0.69 0.22 0.35 1.22 EBITDA ($MM) 46.3 26.9 16.2 19.3 40.0 Source: Morningstar (2015) Chesapeake Utilities announced multiple investments that were underway during Q1. First, it closed on the Gatherco acquisition – an investment that it expects to be accretive to earnings during the current fiscal year. Management stated that Gatherco was primarily limited before the acquisition by a lack of capital, and is therefore optimistic that it could, in turn, result in additional future earnings growth. The company is also constructing a 20 MW natural gas CHP system in Florida for a total cost of $40 million, and it has already started to sign long-term contracts for the facility’s outputs. Finally, the company is also investing $30 million in new natural gas transmission service infrastructure in its Mid-Atlantic service area to meet additional demand from existing customers. Outlook Chesapeake Utilities is continuing to invest heavily in both its existing infrastructure as well as new capacity. Management expects capex to rise to $223.4 million in FY 2015, compared to the annual average of $94.8 million over the previous three years. These investments will be financed via a combination of debt and equity so as to maintain the company’s existing debt-to-equity ratio. With only $16.2 million in cash on hand at the end of the quarter, this additional financing will be necessary. That said, its balance sheet has plenty of room for additional debt; the company reported $158.1 million in long-term debt and another $75.9 million in short-term debt at the end of Q1. The unemployment rates in the company’s main service areas are something of a mixed bag at present. While the rates in Delaware, Maryland, and Florida have all declined since FY 2010 (and those in the first two were never that high to begin with – see figure), Florida’s rate has lagged behind the U.S. average since last year. Delaware’s rate also increased recently for the first time since the beginning of 2013. A brighter picture is presented by economic growth in the service areas, however. GDP growth has increased in all three states since the beginning of 2013 (see second figure), while that of Florida, which is an increasingly important contributor to Chesapeake’s earnings, almost reached 5%. Furthermore, population growth in Florida shows few signs of slowing as Baby Boomers reach retirement age and move south. Very recent changes to the unemployment rate aside, then, Chesapeake’s service area economies should support continued earnings growth so long as the company continues to make the investments necessary to meet increased demand. Delaware Unemployment Rate data by YCharts Delaware Change in GDP data by YCharts Florida can also be expected to provide a short-term earnings boost this winter due to the presence of El Niño, which is expected to make its strongest appearance in the last 50 years . The event has historically been associated with much colder-than-average winter temperatures in Florida, especially during Q1 . We are talking about Florida, of course, so even very cold temperatures compared to the long-term average will result in a smaller increase to natural gas demand than even a smaller average temperature reduction in Delaware or Maryland would. Florida’s contribution to the company’s total heating degree days in recent years has not be inconsequential, however, and El Niño can be expected to have a positive impact on its earnings as a result, albeit not a major one. Valuation The analyst earnings estimates for Chesapeake Utilities in FY 2015 and FY 2016 have increased substantially in response to its better-than-expected Q1 results and continued investment in high-demand areas. The FY 2015 consensus estimate has increased from $2.54 to $2.77 over the last 90 days, while the FY 2016 estimate has increased from $2.72 to $2.82 over the same period. The achievement of both estimates would push the company’s streak of record annual earnings to ten, while also representing double-digit earnings growth. Based on a share price of $54.51 at the time of this writing, the company’s shares trade at 18.3x trailing earnings and 19.7x and 19.3x forward earnings for FY 2015 and FY 2016, respectively. These valuations are very high, both relative to other electric and natural gas utilities and the company’s own respective 5-year ranges (see figure). The company’s shares are overvalued at this time, although I would not categorize them as very overvalued due to its large future earnings growth prospects. Potential investors should note that the company’s emphasis on earnings growth rather than dividend growth has resulted in a substantial degree of share price volatility over the years, providing more opportunities to buy during a downturn than is common in the broader utilities sector. CPK PE Ratio (TTM) data by YCharts Conclusion Chesapeake Utilities has managed to achieve very impressive earnings growth over the last decade by opting to fund growth via investments in high-demand utility service areas and unregulated acquisitions, rather than distributing the majority of its net income to investors. While this focus has left it with one of the less attractive dividends in the sector, it has also enabled the company to create a virtuous earnings cycle as it continues to increase its capital expenditures in growth areas. The company’s expanding footprint in Florida will provide its earnings with both short-term support resulting from an expected cold winter, as well as long-term support due to that state’s expanding population and economy. I do not recommend that potential investors initiate long investments in Chesapeake Utilities at this time, but that’s only because its shares are overvalued relative to future earnings growth. That said, the company’s share price has a history of volatility, and potential investors should be prepared to move quickly in the event that its shares become attractively valued. A move below $45, or 16x FY 2016 earnings, would make for such an opportunity. While this wouldn’t result in undervalued shares, the company’s potential earnings growth mitigates the need for a substantial margin of safety. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.