Large Investors Hate These Mutual Fund Sectors

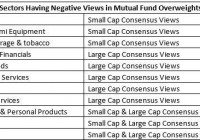

Previously we discussed sectors that made it to the love list of a Credit Suisse study titled ” Carving Up The Consensus: Comparing Hedge Fund, Mutual Fund, & Sell-Side Positioning By Industry Group, For US Large Cap & Small Cap “. Food and staples, retailing, real estate, pharmaceuticals, biotech and life sciences were loved across groups in the large cap category. For the small cap consensus, banks, health care equipment and services, and software and services enjoyed positive views. The analyst team for the study was led by Lori Calvasina and Sara Mahaffy, and they also found out sectors that were on the hate list of large investors. The research notes that it is difficult to find a consensus under all three sub heads – Sell-Side Ratings Relative to Market, Mutual Fund Overweights and Hedge Fund Net Exposure. However, Energy and Capital Goods in the large cap category had negative views under all sub heads. Sectors in the Hate List The list below shows those sectors that are on the hate list for Mutual Fund Overweights. Among these however, Energy and Capital Goods are the only sectors that were on hate list under all three sub heads for Large Cap Consensus views. For the small cap consensus views, there were no sectors that were in the hate list under all three sub heads. However, Household & Personal Products and Utilities were the other two sectors that had negative views under Mutual Fund Overweights for both Small Cap & Large Cap Consensus Views. What to Do with Funds? Energy The word “downturn” fits perfectly for the energy sector. Crude prices had slumped to below $50 a barrel. Thus, the profit margins of several players from the industry have seen massive declines. This has hit stock prices as well. The energy sector is definitely not a favorite of investors right now. Oil and natural gas prices – the backbone of the energy industry – have been disappointing them for quite some time now. Crude oil prices have nearly halved from the comparable period last year and natural gas prices have also remained low. Now, the Iran deal is a major headwind. After 20 months of negotiations, a nuclear deal has been reached between Iran and six world powers. Funds to Sell: BlackRock Energy & Resources Investor A (MUTF: SSGRX ) and Rydex Series Trust Energy Services A (MUTF: RYESX ) are two funds that investors may stay out of. Both these funds carry a Zacks Mutual Fund Rank #4 (Sell) . SSGRX invests a lion’s share of its assets in small cap companies related to sectors including energy, natural resources and utilities. SSGRX has lost 17.6% year to date and 45.2% over the last 1 year period. The 3 and 5 year annualized losses are 9.1% and 5.5%. It also carries a front end sales load of 5.25%. RYESX invests a majority of its assets in equities of small to mid-cap Energy Services Companies that are domestically traded. RYESX has lost 15.8% year to date and 47% over the last 1 year period. The 3 and 5 year annualized losses are 8.8% and 2.1%. It also carries a front end sales load of 4.75%. Capital Goods The other sector to have received an unfavorable rating under all three sub heads was Capital Goods. Coming under the broader Industrials sector, capital goods is defined by Investopedia as “category of stocks related to the manufacture or distribution of goods. The sector is diverse, containing companies that manufacture machinery used to create capital goods, electrical equipment, aerospace and defense, engineering and construction projects”. In first-quarter 2015, operating environment for the U.S.-based industrial equipment makers was difficult. Industrial production in the quarter declined 1% over the year-ago comparable period due primarily to weakness in the mining and utilities industries. Lower oil prices add to the woes, curtailing the capital expenditure on purchase of machinery and equipments. Funds to Buy: Fidelity Select Industrial Equipment Portfolio (MUTF: FSCGX ) currently carries a Zacks Mutual Fund Rank #1 (Strong Buy). Managed by the Fidelity Group, FSCGX invests at least 80% of assets in common stocks of companies principally engaged in the manufacture, distribution, or service of products and equipment for the industrial sector. FSCGX has returned 3.1% year to date and its 3 and 5 year annualized returns are 15.3% and 14.7%. It carries no sales load. Utilities Separately, the Utilities sector had an unfavorable rating for both small cap & large cap consensus views under the mutual fund category. The major headwind presently for the industry has less to do with its performance. A growing regulatory burden and increased debt loads remain a concern. But an even bigger issue is the interest rate backdrop, particularly with the Federal Reserve getting ready to start tightening monetary policy in the not-too-distant future. As high-yielding equity investments, utility stocks remain exposed to rising interest rates, as do fixed income investments. Higher interest rates mean increased cost of capital, a basic need of these operators given their ongoing need for investments. Just as their low-risk and high-yielding attributes make them a preferred choice during an economic down-cycle, a bullish economic environment makes utilities look a little wan and lusterless. Funds to Sell: The rate hike concerns are gaining strength as we move to the second half of the year, which is predicted by some to be the period to witness the rate hike. For investors not ready to take the risk, Rydex Utilities Advisor (MUTF: RYAUX ) and Gabelli Utilities AAA (MUTF: GABUX ) are two funds that they may stay away from. RYAUX carries a Zacks Mutual Fund Rank #5 (Strong Sell) and GABUX holds a Sell rank. RYAUX invests heavily in domestic equity securities issued by utility companies. It also holds derivatives, focusing on options and futures. RYAUX has lost nearly 8% year to date. Annual expense ratio of 1.84% is higher than the category average of 1.18%. GABUX invests a large share of its assets in domestic or foreign utility companies. GABUX focuses on acquiring common stocks which offer dividends. GABUX has lost 4.4% year to date. Annual expense ratio of 1.36% is higher than the category average of 1.18%. Link to the original article on Zacks.com