Fidelity Select Funds Portfolio Optimized For Low Volatility Performed Well In 2015

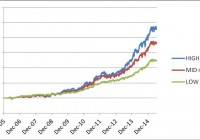

Summary LOW volatility portfolio: FIBIX, FSBIX, FSPHX, FSELX, FSCHX, FBMPX. MID volatility portfolio: FLBIX, FSBIX, FSPHX, FSELX, FSCHX, FBMPX. HIGH volatility portfolio: FLBIX, FIBIX, FSPHX, FSELX, FSCHX, FBMPX. The LOW volatility portfolio had a positive return so far in 2015 despite the interest rate uncertainty. In a previous article we presented the performance of a portfolio made up of five Fidelity select mutual funds. That portfolio had a stellar performance over the whole 27 year period starting in 1987. Back in July we decided to replace the GNMA fund (MUTF: FGMNX ) with two high quality government bonds. The performance of the two portfolios was discussed in the July article, the conclusion being that the new portfolio performed slightly better than the old one. In the first article I used a Relative Strength (RS) strategy based on a three-month look back evaluation period. In the second article I used a Mean-Variance Optimization (MVO) algorithm with 65-day look back evaluation period. While the MVO algorithm may approximate the RS algorithm if one selects the proper volatility target, the MVO strategy is very flexible, and it allows the investor to adapt it to the variable market environment. It turns out that during the first nine months of 2015 the RS strategy, as well as the Dual Momentum (DM) one, has performed poorly with a return of -15.22% for a 3-month look back, or -10.15% for a 12-month look back. The interested reader may verify the performance of Dual Momentum and Relative Strength on the portfoliovisualizer.com site. In this article we shall use only the MVO strategy and we want to emphasize the performance of the new portfolio during the first three quarters of 2015. We shall present three versions of this new portfolio for three levels of volatility: low, mid and high. The three versions are meant for investors with different risk tolerance. They also are meant for investors who may want to vary their risk level based on their evaluation of the markets. The portfolios are made up of the following funds: Fidelity Select Multimedia Portfolio (MUTF: FBMPX ) Fidelity Select Chemicals Portfolio (MUTF: FSCHX ) Fidelity Select Electronics Portfolio (MUTF: FSELX ) Fidelity Select Health Care Portfolio (MUTF: FSPHX ) Fidelity Spartan Long Term Treasuries Fund (MUTF: FLBIX ) Fidelity Spartan Intermediate Term Treasuries Fund (MUTF: FIBIX ) Fidelity Spartan Short Term Treasuries Fund (MUTF: FSBIX ) With the seven funds above, we created three portfolios to be used at three volatility levels: low, mid and high. All portfolios include the same four equity funds, but each one includes only two of the three treasury funds. The high risk uses FLBIX and FIBIX, the mid risk includes FLBIX and FSBIX, while the low risk has FIBIX and FSBIX. The data for the study were downloaded from Yahoo Finance on the Historical Prices menu for FBMPX, FSCHX, FSELX, FSPHX, FLBIX, FIBIX and FSBIX. We use the daily price data adjusted for dividend payments. The portfolio is managed as dictated by a variance-return optimization algorithm developed on the Modern Portfolio Theory ( Markowitz ). The allocation is rebalanced monthly at market closing of the first trading day of the month. In table 1 we present the performance of the portfolio for three levels of risk. Table 1. Portfolio performance from January 2007 to October 2015 TotRet% CAGR% VOL% maxDD% Sharpe Sortino 2015 return LOW risk 109.22 8.80 5.49 -7.50 1.60 2.10 1.75 MID risk 287.58 16.75 13.37 -16.97 1.25 1.69 -0.49 HIGH risk 569.16 24.26 20.22 -16.97 1.20 1.70 -2.45 The realized volatilities of the portfolios are in agreement with their names; the LOW risk had 5.49% annualized volatility, the MID had 13.37%, while the HIGH had 20.22%. Also, please notice the strong correlation between the returns CAGR and volatility of the portfolios. On the other hand, during 2015 the LOW volatility portfolio produced a positive return of 1.75%, while the MID and HIGH risk portfolio suffered negative returns. In figure 1 we show the graphs of the portfolio equities for the period from January 2007 to October 2015. (click to enlarge) Figure 1. Equity curves for three portfolios adaptively optimized for low, medium and high risk targets. Source: All charts in this article are based on EXCEL calculations using the adjusted daily closing share prices of securities. In figure 2, 3 and 4 we show the time variation of the percentage allocation of the funds for the period since January 2014 to October 2015. We opted for this shorter time period to get graphs that are easily readable. We are mostly interested in the allocations during 2015. (click to enlarge) Figure 2. Percentage allocation of the funds for low risk portfolio January 2014 to October 2015. One can see in figure 2 that most of the time the portfolio was invested about 50% in the short term treasury fund FSBIX. In figure 3 we show the time variation of the percentage allocation of the funds for mid risk. (click to enlarge) Figure 3. Percentage allocation of the funds for MID risk portfolio January 2014 to October 2015. (click to enlarge) Figure 4. Asset allocations for the portfolio adaptively optimized for the HIGH risk target January 2014 to October 2015.. Since July 2015 the high risk portfolio was invested 100% in treasuries; in FSLBX in July and August, and in FIBIX in September and October. The current fund allocations are shown in table 3. Table 3. Asset allocations for October 2015 FSELX FBMPX FSPHX FSCHX FLBIX FIBIX FSBIX LOW risk 0% 0% 0% 0% 0% 0% 100% MID risk 0% 0% 0% 0% 88% 0% 12% HIGH risk 0% 0% 0% 0% 0% 100% 0% Conclusion The low risk Fidelity select portfolio performed better than the mid and high risk portfolios. While the return of 1.75% is relatively modest, it is better than many other choices. The losses of the mid risk portfolio are very small at -0.49%, while the high risk portfolio lost the most at -2.45%. In hindsight, investing in a low risk portfolio was the better choice due to the fact that the market environment was very difficult since the beginning of 2015.