Tag Archives: french

The Arbitrage Opportunity In European Real Estate

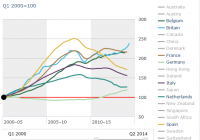

The huge spread between European government bonds and property yields support higher real estate prices. ECB quantitative easing will keep mortgage rates low. The declining unemployment rate in the Eurozone supports the housing market. Real estate in Europe hasn’t been doing so well last year, with the exception of the U.K. and Germany (see chart below from The Economist ). In this article I will show you that this trend will change in 2015. I believe that the tide started to turn since the ECB decided to do ” whatever it takes ” to defend the euro and proposed their expanded quantitative easing strategy in January 2015 . Since 2012 and especially since that announcement in 2015, government bond yields in Europe have been declining at a supernatural rate, especially in Spain (see chart below from Yardeni ). We are now at a point where some maturities have negative bond yields. What is most interesting to note is that bond and bank deposit rates are very low at this moment, while the commercial real estate yields are very high. This translates into a huge spread compared to the historic average and that is why real estate in Europe is a very good place to invest in right now. This arbitrage opportunity should be chased by every real estate investor. Let’s show this arbitrage with the following example: French real estate. When we look at the yields of office spaces in France (Paris), we have a current yield of 6.6% (See chart below from Real Capital Analytics ). Compare this to the current 10 year French government bond yield of about 0.5% and you will have a spread of 6%. This is enormous and I expect that investors will re-allocate away from European government bonds towards European property markets. This re-allocation will in turn support the housing market in Europe. Another example, Spain has an office yield of 5%, while the 10 year government bond yield is at a mere 1.3%. As a result, we already see that the Spanish real estate is bottoming out. In fact, a recent report from the Official House Price Index published by the National Institute of Statistics (INE) indicated that Spanish real estate prices have increased 1.8% in 2014. (click to enlarge) This key reversal in real estate is supported by an improving unemployment rate picture (see chart below from Eurostat ). The unemployment rate in the U.K., Spain, Greece and the European Union as a whole, has dropped since the ECB announced its policies in 2012 (which coincided with the decrease in government bond yields in Europe). As the employment picture improves, real estate will be more affordable to the middle class. This will benefit housing prices. (click to enlarge) More importantly, with the start of ECB quantitative easing in March 2015 (which will last till end of 2016), mortgage rates will continue to be low, following the suppressed Euribor rates. At this moment short term Euribor rates are in negative territory ( one month Euribor is negative , see chart below from Homefinance.nl ) and I expect that longer term Euribor will go into negative territory as well. Historically, these events are unseen. So how do investors get into European real estate? I recommend the iShares Europe Developed Real Estate ETF (NASDAQ: IFEU ). This ETF seeks to track the investment results of an index composed of real estate equities in developed European markets. It is currently invested in 88 European real estate stocks and real estate investment trusts (REITs). Its top holdings are given below . IFEU’s country weights include U.K. 38.3%, France 22.3%, Germany 9.5%, Sweden 6.5%, Switzerland 5.7%, Netherlands 4.7%, Belgium 3.0%, Luxembourg 2.3%, Austria 1.8%, Guernsey 1.5%, Spain 1.5% and Finland 1.3%. When we look at the performance of the ETF, we see an annual return of around 10%, which is pretty high (see performance chart below from iShares ). Other investment option is the Kennedy Wilson Europe Real Estate PLC ( OTCPK:KWERF ), which is mostly active in the United Kingdom, Ireland and Spain. The performance is similar, but you will have more exposure to these 3 countries. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Is This The End Of Nuclear?

Cost overruns are causing problems for utilities committed to nuclear power. Solar costs are falling and should go below those of nuclear by 2025. Long-term uncertainty is already causing pain among suppliers to the nuclear sector. Without a lot of fanfare the sunset of the nuclear power era seems to be approaching. One news peg here comes from France, the most nuclear-dependent country around, where Areva ( OTCPK:ARVCF ) is buckling after announcing a 4.8 billion Euro ($5.3 billion) loss. Delays in building a Finnish power plant are blamed, and the French government (which holds an 87% stake) wants its biggest company, the utility EDF, to step into the breach. That’s not how we roll in the U.S., but U.S. utilities tied to nuclear power are also dealing with delays and overruns over nuclear reactors. Southern Co. (NYSE: SO ) thinks a three-year delay at its Plant Vogtle could cost $8 billion and Southern wants to claw back $240 million from its suppliers, Westinghouse Electric ( OTCPK:TOSYY ) and Chicago Bridge & Iron (NYSE: CBI ). The plants were supposed to go online in 2016 and 2017. Now 2019 and 2020 look more like it. Southern CEO Thomas Fanning continues to make happy talk, calling nuclear economics “compelling,” but Wall Street is starting to back away slowly. Even China is starting to back away. This is reflected in Southern’s recent price action. All utility stocks have been falling recently as interest rates rise, making their yields look less attractive. But over the last 12 months XLU (NYSEARCA: XLU ), an ETF tracking the sector, is up 10.5%. Southern, meanwhile, is up only 6.5%, and since the sector’s fortunes peaked in late January it’s down almost 14%. Contrast that with the performance of Pacific Gas & Electric (NYSE: PCG ), which uses a lot of solar power in California, up 22% over the last year and down less than 8% from its peak. (XLU is down 9% from the peak.) Southern’s nuclear “running mate” is South Carolina’s SCANA (NYSE: SCG ), which owns 55% of a nuclear facility near Jenkinsville, whose construction is now being inspected by the Nuclear Regulatory Commission, creating delays. Its partner in that project has had to go to the market for another $1.2 billion in bonds and while the Department of Energy has recently opened up $12.5 billion in loans for nuclear projects, congressional critics are getting their knives out. Can a cry of “nuclear Solyndra” be far behind? While the long-term costs of nuclear power still appear attractive – the industry estimates them at just 2.4 cents per kilowatt-hour — their advantage over natural gas continues to decline, and the cost of new facilities continues to rise. Nuclear plants suffer from the “bathtub problem” — risks are great at the start and end of a plant’s useful life, and that’s where many plants are today. Meanwhile, costs for renewable energy, like wind and solar, continue to fall like a knife. All-in costs for a solar installation are estimated to fall below those of other power sources by 2025. If you bid out a solar plant against a nuclear plant today, in other words, the nuclear plant will win. But what if you do the same exercise in two years? Or four? Or 10? You can re-allocate capital from solar in 10 years if you’re wrong. If you make the wrong decision on nuclear, on the other hand, you’re committed. Because nuclear plants have to be calculated over generational time frames, and financed over those time frames, uncertainty is rising, and uncertainty is the enemy of a positive decision. Deutsche Bank now predicts solar will become the “dominant” form of electricity generation by 2030 — in nuclear power time frames that’s next week. What happens when Southern Co. wakes up in 10 years and sees that solar or wind is substantially cheaper than the nuclear energy its bondholders are on the hook for over the next 20 years? That’s a nightmare no other utility executive wants to visit. That is what’s causing the sunset of nuclear power. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.