The Rolling Stones Understand Long-Duration Investing

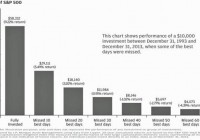

Summary Many investors have short-term horizons. Short-duration investors can miss major market gains. We think long-duration investing creates wealth over long periods of time. Time is on my side, yes it is. Time is on my side, yes it is. Now you all were saying that you want to be free But you’ll come runnin’ back, You’ll come runnin’ back, You’ll come runnin’ back to me. It’s only after the animals are out of the barn that investors want to close the door. This means attempting to make most of the money from participating in common stocks, but somehow regularly going to cash in the worst declines. Consider the aftermath of the 2007-09 financial meltdown and bear market, when asset allocators first looked to those active equity funds which weathered the 2008 storm the best. You want to make money in stocks, but you “want to be free.” So it seems that every time there is a substantial bear market in U.S. stocks, market timing pops to the center of the investing conversation. At Smead Capital Management, our 34 years of market observation has yet to find anyone or any system which did this successfully. The chart below shows why “time is on my side” for the long-duration investor: (click to enlarge) You’re searching for good times but just wait and see, You’ll come runnin’ back, You’ll come runnin’ back, You’ll come runnin’ back to me. Once market participants decide they want to be involved in a bull market, they have a tendency to seek out the most exciting growth companies of the era. Warren Buffett cautioned, “Investors should remember that excitement and expense are their enemies.” Fama-French, Bauman-Conover-Miller, David Dreman and Francis Nicholson all proved academically that the cheapest stocks outperformed the average and the most expensive stocks over one-year and multiple-year time periods. At Smead Capital Management, we strive to be long-duration investors in the shares of companies which are both quantitatively cheaper and qualitatively above average in significant ways. We expect over time that investors will “come runnin’ back” into ownership of businesses which match our eight criteria for stock selection. It takes contrarianism and patience. One of the best examples of the combination of cheapness and quality we’ve seen was four years ago in the pharmaceutical/biotech industry of the S&P 500 Index. In the key areas of profit consistency, free cash flow and balance sheet, these were stars. And they were priced as if they’d never have another new product. In case anyone wonders, the humility and contentiousness of these kinds of situations can take three to five years to play out. We were fortunate to have some other parts of our portfolio succeeding for us back then, and a loyal/patient group of long-duration investors along for the ride. Go ahead baby, go ahead, go ahead and light up the town! And baby, do anything your heart desires Remember, I’ll always be around. And I know, I know like I told you so many times before You’re gonna come back, Yeah you’re going to come back baby In the current environment, investors’ “heart desires” are to have the comfort of being in every sector and every company of the S&P 500 Index, so that they are sure to have some winning tickets in the horse race. They are “lighting up the town,” and seem able to benefit from the cost advantage inherent in indexing. For those who don’t have access to a high-margin-of-safety/long-duration investing discipline or the predilection to practice one themselves, owning numerous un-meritorious and overpriced companies mixed in with a minority of worthy ones provides a minimally adequate way to participate for the long term. How many investors send their kids off for higher education with instructions to accept way less than excellent long-term academic results from the least expensive college? We believe that “time is on the side” of the long-duration investor who applies quantitative and qualitative screening and the long-term holding of common stocks. When the S&P 500 Index stumbles, like it did after the tech bubble broke in 2000, “we’ll be around” and expect many index investors are “going to come back baby.” Remember what John Maynard Keynes said about investing, “[Investing] is the one sphere of life and activity where victory, security and success is always to the minority and never to the majority. When you find any one agreeing with you, change your mind.” Passive investing in the U.S. large-cap equity space appears to no longer be in the minority, as this year’s overwhelming money flows have proven. We are not bothered even if the current trend continues, because our long-duration goals include “victory, security and success.” The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.