Top Nontraditional Bond Fund Celebrates First Anniversary

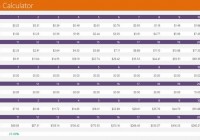

The Cedar Ridge Unconstrained Credit Fund (MUTF: CRUPX ) launched on December 12, 2013, and recently celebrated its first anniversary. Ten thousand dollars invested at the fund’s inception would be worth more than $11,092 as of December 22, according to data from Morningstar. This compares very favorably to the non-traditional bond fund category average, which would have seen a $10,000 investment grow to just $10,130 over that same time. Over the past year, the Cedar Ridge Unconstrained Credit Fund’s 11.58% annualized return through December 22 ranks it at the very top of Morningstar’s Nontraditional Bond category, above 319 other funds, including all share classes. The Legg Mason BW Alternative Credit Fund (MUTF: LMANX ) is the only other fund in the category with double-digit returns over the past year, and only one of its five share-classes has that distinction. “With this Fund we have created the opportunity for us to reach a vast audience of investors who are looking for exactly what we have done; deliver superior and uncorrelated investment returns,” said Alan Hart, Cedar Ridge’s CIO and the fund’s portfolio manager, in a December 21 press release . Mr. Hart wanted to thank the fund’s investors for making it a success, but noted that the best way Cedar Ridge can thank its investors is by continuing to deliver superior performance. In addition to Mr. Hart, the Cedar Ridge Unconstrained Credit Fund benefits from the portfolio-management expertise of Jeffrey Rosenkrantz, David Falk, Guy Benstead, and Jeffrey Hudson. The fund’s objective is to provide capital appreciation and current income by employing a credit long/short strategy. As of November 30, the fund was 69% long municipal bonds, 23% long corporate bonds, 23% short U.S. Treasurys, and 11% short corporate bonds, according to its fact sheet . The Cedar Ridge Unconstrained Credit Fund’s shares are available in investor-class (CRUPX) and institutional-class (MUTF: CRUMX ) shares; with net-expense ratios of 2.18% and 1.93%, respectively. The minimum initial investment for the investor-class shares is $4,000; while the minimum for institutional-class shares is $50,000. The 11.37% one-year performance of the investor-class shares trails the 11.58% gains of the institutional shares, but still outdoes all other nontraditional bond funds, regardless of share class. For more information, view the fund’s website .