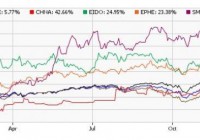

4 Outperforming Country ETFs Of 2014

Amid a myriad of economic and political woes, the stock markets across the globe have given mixed performances. While 2014 is turning out as another banner year for the U.S. stock market with multiple record highs on several occasions, international investing has not been so encouraging. This is especially true as Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ) targeting the international equity market has lost about 4% this year compared to a gain of 5.3% for iShares MSCI ACWI ETF (NASDAQ: ACWI ) , which targets the global stock market including the U.S. A strong dollar, Russia turmoil, slump in key emerging markets, sliding oil prices, speculation of interest rates hike faster than expected, and concerns over the global slowdown continued to weigh on the international stocks. Though developed markets started the year on a solid note, these lost momentum with Europe struggling to boost growth and inflation, and Japan suffering from the biggest setback following a sales tax increase in April that has pushed the world’s third-largest economy into a deep recession. Among developing nations, Russia has been hit hard owing to Western sanctions and a massive drop in oil prices while Greece saw another political chaos. On the other hand, India and Indonesia have shown strong resilience to the global slowdown driven by positive developments, election euphoria, new reforms and monetary easing policies. In particular, Chinese stocks have no doubt given impressive performances with the Shanghai Composite Index touching the major threshold of 3,000 for the first time in three years. The massive gains came on the back of speculation that the loose monetary policy measures will revive the dwindling economy and pump billions of dollars into the country. Additionally, growing investor confidence following prospects of a rebound in the Chinese economy, a stabilizing real estate market as well as the launch of the Shanghai-Hong Kong Stock Connect program propelled the Chinese stocks higher in recent months. There are several country ETFs that not only delivered handsome returns this year but also crushed the broad U.S. market fund. Below, we have highlighted a few of these strong momentum plays, which could be interesting picks for investors heading into the New Year. iShares MSCI India Small Cap Index Fund (BATS: SMIN ) – Up 48.3% This product provides exposure to the small cap segment of the broad Indian stock market by tracking the MSCI India Small Cap Index. Holding 180 securities in its basket, it is widely spread out across number of securities with none holding more than 2.67% of assets. Financials takes the top spot with one-fourth share followed by consumer discretionary (19.8%), industrial (18.4%) and materials (10.2%). The fund has been able to manage assets worth $24.1 million while sees light volume of about 16,000 shares per day. Expense ratio came in at 0.74%. SMIN is up over 48% this year and has a Zacks ETF Rank of 2 or ‘Buy’ rating with a High risk outlook. PowerShares China A-Share Portfolio (NYSEARCA: CHNA ) – Up 43.18% This is an actively managed ETF providing exposure to the China A-Share market using Singapore exchange FTSE China A50 Index futures contracts. The product is unpopular and illiquid with AUM of $5.3 million and average daily volume of around 8,000 shares. It charges 51 bps in fees per year from investors and has surged about 43% this year. iShares MSCI Philippines Investable Market Index (NYSEARCA: EPHE ) – Up 22.4% This product targets the Philippines stocks in the emerging Asia Pacific space and tracks the MSCI Philippines Investable Market Index. The fund has amassed $365.3 million in its asset base while trades a good volume of 236,000 shares a day. It charges 61 bps in annual fees. The fund holds a small basket of 43 firms with 61.5% of assets invested in the top 10 holdings, suggesting a high concentration risk. More than one-third of the portfolio is dominated by financials while industrials occupy the second position with 22.4% share. The fund has added over 22% this year and has a Zacks ETF Rank of 3 or ‘Hold rating with a Medium risk outlook. iShares MSCI Indonesia Investable Market Index Fund (NYSEARCA: EIDO ) – Up 20.76% This fund provides exposure to the Indonesian equity market by tracking the MSCI Indonesia Investable Market Index. Holding 102 securities in its basket, it is concentrated on both sectors and securities. The product puts about 44% in the top five holdings while financials dominates the fund’s return at 37.1%. EIDO is the most popular ETF with AUM of $578.4 million and average daily volume of nearly 665,000 shares. Expense ratio came in at 0.61%. The fund is up 20.8% so far in the year and has a Zacks ETF Rank of 2 with a High risk outlook. Bottom Line Investors should note that some specific emerging market ETFs have outperformed this year and will likely continue this trend in 2015. This is especially true, as a slump in oil price has created a major headwind for many key emerging nations or oil producing nations. Also, some developed economies are facing problems in reinvigorating growth.