Valuation Challenges When PEs Are Expanding: 2 Examples

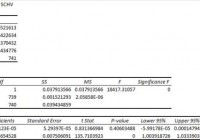

One hallmark of this secular bull market is expanding PE/cash flow multiples. Thus valuations based upon recent historical multiples can be deceiving. I give an example from one stock and one broad ETF. Everyone knows we have been in a cyclical bull market since the spring of 2009. I have argued elsewhere we are now in the early stages of a secular bull market that should continue well into the next decade. One argument supporting this view is to point out that the PE compression which characterized the earlier years of the 21st century has ceased. I shall illustrate this with a few charts shortly. Why is this important to investors? Many analysts judge the attractiveness of the market or a particular stock by comparing PE multiples (or cash flow multiples) with traditional and recent (say, the past decade) multiples. A stock selling at 45x earnings when historically it commanded a multiple closer to 18x is likely to be overvalued and less attractive as an investment or source of dividend income. If we are in a period of rising multiples, however, comparing current PEs to those of the past few years may make companies appear overvalued, when in fact they remain attractive investments going into a brighter future. We can use Teleflex (NYSE: TFX ) as an example. The Value Line chart below shows that TFX traditionally has commanded a cash flow multiple of 10.5x. Well above this (e.g. 2007) was an attractive time to sell, below it (e.g. 2003 and certainly 2009) were great entry points. What should we make of the current multiple, which is closer to 20x cash flow? (click to enlarge) source: Value Line The quick conclusion is that TFX is overvalued and buyers should not pull the trigger. But what if we are in a period of rising multiples, for reasons i made clear yesterday ( here )? This is even more likely given that medical technology is an emerging super field and has been a market leader for several years now. Combining fundamental analysis with charts and some technical snooping might shed more light, and useful trading information, on this challenge. The chart below shows that TFX has been in a bull market since 2009 and ascending in a broad channel as shown in white. If you look at the white channel, TFX touched the upper boundary (it was “overvalued”) in April of this year. But instead of selling off and churning like it did for almost two years back in 2010, the shares have worked their way higher. Maybe we should assume the price range is better defined by the red channel now. Oddly enough, that also suggests it is now fully valued. But the point where a prospective buyer might want to reacquire the shares is quite different. If the higher evaluation (red channel) mode is now in force, that price is approaching $100 as the new year unfolds. Using the old valuation channel, a buyer wouldn’t be interested until the price falls well into the $70s. This might be mere curve fitting but for the fact that broad indexes and ETFs such as the S&P500 Trust (NYSEARCA: SPY ) show almost exactly the same phenomenon. Compare the white and red channels in SPY below. (click to enlarge) source: freestockcharts.com Is this new channel reflective of higher valuations? Yes: (click to enlarge) source: etrade . While some expansion might have occurred in the early years of the bull market because earnings (the denominator in PE) are lagging indicators, it certainly is not the case now: corporate earnings growth is strong. And likely to get stronger! Already third quarter GDP growth came in at 5%, and second quarter GDP was revised higher. The full effect of lower oil prices still has to fully work into the economy, and the fiscal prudence of a Republican House (and now Senate) seems destined to continue. While it may be an ad hoc/seat of the pants process, investors would be well advised to revise their tolerable PE/cash flow multiples on stocks higher in the next few years. Get ready to buy Teleflex shares if a correction brings prices back to the high nineties.