PPL Corp. To Reward Investors In 2015

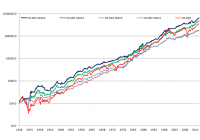

Summary A low treasury yield environment and efforts to reduce competitive energy operations will support PPL’s performance. Efforts to reduce competitive energy operations will positively affect bottom-line numbers and cash flows. PPL is likely to give full-year 2015 earnings guidance during its Q4 2014 earnings call. Utility stocks’ high dividend yields make them attractive investment options for dividend-seeking investors. The utility sector, including PPL Corp. (NYSE: PPL ), performed better than the S&P 500 in 2014. The outperformance of the utility sector was mainly due to the low treasury yield environment. In 2015, I believe PPL will deliver a healthy financial performance due to the ongoing low treasury yield environment and efforts made by the company to lower its competitive energy operations, which will bode well for its EPS. The company has been aggressively working to sell and reduce competitive energy operations, as the competitive energy operations remain challenging. Also, the company offers a healthy dividend yield of 4.3%, supported by its cash flows, which makes it a good investment option for dividend-seeking investors. All Set for 2015 In 2014, the utility sector performed better than the S&P 500. The better performance can be mainly attributed to the low treasury yield environment. In 2015, the utility sector will continue to deliver a healthy performance due to the low yield environment and efforts undertaken by utility companies, including PPL, to reduce their competitive energy operations. The following table shows the performance of the S&P 500, the utility sector ETF (NYSEARCA: XLU ) and PPL. S&P 500 XLU PPL 2014 Performance 12% 25% 22% Source: Bloomberg.com. Due to the weak commodity prices and capacity revenues, competitive energy operations of U.S. utility companies have remained challenging in recent years. In the current environment, utility companies are choosing to reduce their competitive energy operations and making efforts to grow regulated operations. PPL has also been expanding its regulated operations and reducing competitive energy operations, which will positively affect its EPS. The company opted to spin off its competitive energy business operations. The spin-off is expected to be completed in the first half of 2015. The spin-off will allow PPL to focus and expand its regulated business operations. The company is anticipating cost savings of $75 million from the transaction. Also, PPL has finalized a deal to sell its Montana hydro assets to NorthWestern Energy for $0.9 billion . PPL is expected to use cash from the sale to invest in the expansion of its regulated operations. Separately, PPL is taking measures to expand its regulated transmission operations. The company has announced its plans to build a transmission line, and is expected to make capital expenditures of approximately $5 billion over the life of the project. The company has planned to start building the line in 2016-17, and it should be in service by 2023-25. The capital expenditure PPL is planning to make will positively affect its top- and bottom-line growth in the long term. The company will have 100% exposure to regulated business operations in the coming years, which will positively affect its financial performance. The chart below shows that the company has been making consistent and aggressive efforts to reduce its competitive energy operations, and PPL’s regulatory rate base is expected to grow by 6.3% on average from 2014-18. (click to enlarge) Source: Company reports. As the company is expanding its regulated business and is in the planning phase, it will give its 2015 EPS guidance range in the Q4 2015 earnings call next month. Also, the company is likely to update its long-term EPS guidance, which I believe will be in a range of 4%-6%. Along with the earnings growth potential, PPL offers a safe dividend yield of 4.3% , backed by its cash flows. Its attractive dividend yield makes it a good investment for dividend-seeking investors. The company has consistently increased dividends over the years. In the coming years, dividends offered by the company will grow as an increase in its regulated operations will portend well for its bottom-line numbers and cash flows. The following chart shows the dividend per share, dividend payout ratio and dividend coverage ratio for PPL from 2012-2014. (Note * Dividend coverage ratio = operating cash flow/annual dividends, and 2014 figures below are based on estimates). Dividend Per Share ($) Dividend Payout Ratio Dividend Coverage* 2012 $1.44 60% 3.3x 2013 $1.47 60% 3.25x 2014* $1.49 64% 3.2x Source: Company reports and calculations. Conclusion PPL is set to deliver a healthy performance in 2015. The low treasury yield environment and efforts to reduce competitive energy operations will support PPL’s performance in 2015. The company’s efforts to reduce competitive energy operations will positively affect its bottom-line numbers and cash flows. Also, the company is likely to give its full-year 2015 earnings guidance during the Q4 2014 earnings call, which will improve earnings visibility and bode well for the stock price. Also, the stock offers a safe dividend yield of 4.3%. Due to the aforementioned factors, I am bullish on PPL.