Cold Weather Isn’t Enough To Turn UNG Around

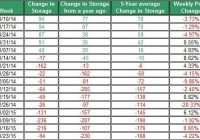

Colder-than-normal weather in parts of the U.S. wasn’t enough to bring back up UNG. This week’s extraction from storage was lower than the 5-year average. EIA still estimates this year’s natural gas demand in the residential and commercial sectors will decline. Next week’s EIA report is expected to show another lower-than-normal extraction from storage. The lower-than-normal extraction from storage and ongoing weakness in the oil market have contributed to the decline of The United States Natural Gas ETF (NYSEARCA: UNG ) to fall below $14 – its lowest price this year. Let’s examine the latest from the natural gas market. The cold weather, mainly in the Northeast, wasn’t enough to keep the price of UNG up as it fell by over 8% during the past week. In the past two months, UNG shed nearly 35% off of its value. This week’s withdrawal from storage was only 94 Bcf – this is below the 5-year average withdrawal, which was 168 Bcf. This comes after two consecutive weeks of above-normal withdrawals from storages. Source of data taken from EIA In next week’s EIA storage update, the extraction from storage could be again lower than the 5-year average – which is 165 Bcf for the last week of January. This is because last week’s deviation from normal temperatures was, on average, 5.93. The correlation between the deviation from normal temperatures and extractions from storage is high at 0.61. Thus, the higher-than-normal temperatures, on a national level, could tilt the scales towards a lower-than-normal withdrawal. Source of data taken from EIA If we were to assume the extraction from storage to remain, on average, 15% higher than the 5-year average, then the storage is likely to be slightly above the 5-year average by the time the extraction season ends in April. Source of data taken from EIA Despite the lower-than-normal extraction from storage, the weather is still expected to be colder than normal throughout the east coast, including in the Northeast over the next two weeks. Conversely, throughout the west coast, temperatures are still projected to remain above normal temperatures. Nonetheless, the uncertainty in the weather is still expected to be high during February, according to latest National Oceanic and Atmospheric Administration monthly report. So we could still see big swings in the price of UNG in the coming weeks. For now, the EIA still predicts that this year’s natural gas consumption in the residential/commercial sectors will decline in 2015. This could be due, in part, to lower demand for heating purposes during this year’s winter. Nonetheless, total consumption is projected to reach 73.8 Bcf per day this year – this is a 0.3% gain compared to the average consumption in 2014. The rise in demand is expected to come from industrial and electric power sectors. In the power sector, coal is being pushed out for natural gas. But it’s still used by major utility companies. Bear in mind, that if coal prices were to keep coming down, as they did in recent weeks, this could also play a secondary role in driving down prices of natural gas. Finally, the weakness in the oil market may have also contributed to the weakness of natural gas. In recent weeks, the linear correlation between oil and natural gas strengthened and reached 0.54 (this is for the past month) – this is a strong and positive correlation albeit this relation doesn’t hold up over extended periods of the time. This is yet another issue to keep in mind. After all, Goldman Sachs lowered its outlook for its U.S. natural gas for this year. This was due to deflationary pressure on prices – the pressure comes from low oil prices that are likely to cut down drilling and services costs, and thus reduce the cost per barrel for shale gas. In other words, Goldman Sachs thinks that drilling companies will drill where it makes fiscal sense to do so considering the current low oil prices; this will also result in lower cost of drilling for natural gas. The recent fall in UNG may have stemmed from the weaker-than-expected demand for natural gas, ongoing strong production and low oil prices. The uncertainty in the weather could still bring back up UNG for a short term. But for now, UNG is still expected to remain low for the season. For more see: A Couple of Notes on Oil