Bonds To Bring Stability To Our 1% Portfolio

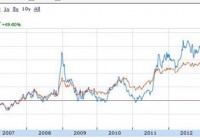

We are taking a bond position (low cost ETF) but not fully using our $180,000 allocated capital as bonds are too overbought right now. Hedging TIPS against US Treasury bonds is an option if you don’t want any to the corporate bond or short term bond sector. We now have $350k invested in our portfolio. Agricultural commodities are next on our radar. We have purposefully not invested in bonds thus far in our portfolio as I have been conducting extensive research into this area. To many, bonds are a boring vehicle as the returns are usually less than other asset classes. However they are vital in any portfolio as they bring stability and expectation as they are far less volatility than stocks. I am a firm believer that if you are approaching retirement, bonds should be a fundamental part of your portfolio and should outweigh your stock holdings. We have $180k to deploy in this asset class in our portfolio but we are not going to deploy all our available capital here just yet. Let’s go through this article and discuss why we are going to invest less and what bond vehicle(s) we are going to use in our portfolio. In a previous article, I spoke about portfolio re-balancing and position sizing in respective asset classes. I outlined that when an asset class becomes “Top Heavy” for us, we usually take some capital off the table and deploy that capital elsewhere in depressed sectors. Bonds have been on a glorious run for the past while with some analysts calling for a top anytime soon. Look at the charts below (10 year and 1 year) for (NYSEARCA: TLT ) and (NYSEARCA: IEF ) which are 20 and 10 year bond ETFs respectively. (click to enlarge) (click to enlarge) The 20 year bond has really outperformed recently with 28% gains in the last year alone which is extremely high for bonds. We do not want to deploy all our capital into this asset class just yet as I’m wary of the downside here. Nevertheless, the US bond bull may have many months and years to go as US dollar denominated funds are still seen as a safe haven by investors all over the world. We are not going to bet against the US government so $100,000 is going to be invested here instead of the allocated $180,000. So which bonds are we going to invest in? Let’s discuss. I looked first at “Treasury bills or T-bills”. These are short term instruments that don’t go beyond 12 months so they are essentially short term bonds. Next we have “Treasury notes” which mature from anything from one to ten years. These are good for income investors as the interest rate is fixed and you get interest payments every six months. Then you have our good old fashioned Treasury bonds, which are mid to long term (10 to 30 years). Finally we have TIPS, which are inflation adjusted. These bonds go up in value if inflation increases or down in value if deflation takes hold. TIPS are used by many professional investors as a hedge against long term treasuries. Long term treasuries usually fall in value (opposite to TIPS) when interest rates rise. This was an option I definitely looked at for our portfolio. However there are also corporate bonds where corporations pay you income in exchange for a fixed interest rate on your bond over a period of time. Blue chip US multinationals corporate bonds yield slightly higher returns than US Treasuries but since these bonds are related to equities, they also are more volatile. Another thing I am conscious of in our 1% portfolio is fees and commissions. Even though we are excellently diversified, we spend our fair share on broker commissions through the buying and selling of our underlyings. We currently have 40 positions in our portfolio and even though we have a very cheap broker, I hate giving money away. Also since bonds are far less volatile instruments than stocks, we will not be selling covered calls in this sector. The reward doesn’t justify the risk. Therefore I have decided to go with the Vanguard Total Bond Market ETF (NYSEARCA: BND ) and not go with multiple positions in this asset class. This asset class is to be our portfolio anchor. This ETF has returned 6% in capital gains over the last 5 years (see chart) and currently has a healthy 2% yield. What attracted me was the diversity (3000 US related bonds) and the expense ratio which is a very low 0.08%. (click to enlarge) So to sum up, we are investing $100k today into and holding for the medium to long term. If bonds start to lose value, then we have an extra $80k ready to deploy into this asset class if needs be. We now as of 20-01-2015 have in the region of $350k invested. (click to enlarge) Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague