The Gone Fishin’ Portfolio: 14 Years Of Market-Beating Returns

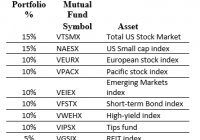

I’ve always been fascinated by ‘Couch Potato’ portfolios, those where you invest in index mutual funds and rebalance only once per year. In the early 2000’s I read about the ‘Gone Fishin’ Portfolio. ‘Gone Fishin’ was intriguing because it is based on the work of Harry Markowitz, who won a Nobel Prize in 1990 for Modern Portfolio Theory – now known as asset allocation. Asset allocation is the process of developing the most effective – optimal – mix of investments. In this case, optimal means that there is not another combination of asset classes that is expected to generate a higher ratio of return to risk. Quite simply, it’s breaking down your portfolio into different baskets, or classes of investments, to maximize returns and minimize risk. Asset allocation is based upon the principal that non-correlated investments of varying risk, when astutely mixed together, will smooth out the volatility (or variability) of your returns. And the best part about it is that it also increases your returns. Alexander Green of The Oxford Club took the work of Markowitz and gave it a name – ‘The Gone Fishin’ Portfolio.’ The allocations are: So we have 30% U.S. Stocks, 30% International Stocks, 30% Bonds, then 5% REITs and 5% Gold/Precious metals. A nice well-balanced portfolio. Advantages of the ‘Gone Fishin’ Portfolio, and other Lazy portfolios, are that they help address four major investment risks: Being too conservative. Being too aggressive. Trying and failing to time the market. Using expensive fund managers (Recommend Vanguard funds) Back 14 years ago when I first heard of the Gone Fishin’ Portfolio, I thought that replacing the index funds with active managers (while keeping the same % allocation) might even be better than this passive index approach. I knew lots of great fund managers whom I thought would beat their index in the long term, so why not utilize their expertise within the Gone Fishin’ framework? I called this creation the ‘Masters Select’ Gone Fishin’ Portfolio. I then created an Excel spreadsheet to track both styles, and have updated it each January for the last 14 years. Here’s the ‘Masters Select’ Gone Fishin’ Portfolio I set up 14 years ago: So you can see in most cases I replaced the passive index fund with a favorite active manager. Fairholme Fund for the Total U.S. market, and Third Avenue Value for small caps. Matthews Asian Growth & Income for the Pacific stock index. And Third Avenue Real Estate replaced the REIT index. Back 14 years ago I could not identify a worthy active manager for the European or Emerging Markets indices, so I left these as the passive index. For Bonds, I took the combined 30% allocation and divvied it between two excellent bond managers – Bill Gross of Managers Fremont Bond, and John Hussman of Hussman Strategic Total Return. And I replaced the normal Gone Fishin’ precious metals fund with a broad commodity fund. I’ve been tracking the results of both the official Gone Fishin’ portfolio and my ‘Masters Select’ version. Here are the results. The standard Gone Fishin’ portfolio has performed as advertised, soundly beating both the S&P 500 and a 60/40 Stock/Bond portfolio. On a risk-adjusted basis the Gone Fishin’ portfolio does extremely well (the whole idea behind Markowitz theory), with the drawdowns in bad years less than the stock market. My ‘Masters Select’ Gone Fishin portfolio did even better than the Markowitz model. Half the time (7 of 14 years) it beat the other three portfolios, and had a total return better than the standard model. I should emphasize I did not replace an active manager during the entire 14 year period, so there’s no bias there. Of course perhaps I was lucky (or good) with the picks. Further, by using active managers, I realize I was introducing ‘tracking risk’ to the portfolio, where a manager strays away from the intended index. Nevertheless it paid off to combine these pros with a Nobel prize-winning framework. Of some concern – the Gone Fishin’ portfolios started off with a blast, beating the S&P 500 for 10 straight years (2001 – 2010). But since then they have underperformed. This also happened in the late 1990’s when the S&P 500 was in its strongest bull phase and international stocks were out of favor. We seem to be in a similar era right now and I expect the underperformance to be temporary. One other concern I have with the ‘Masters Select’ Gone Fishin’ concept is the fund size. Fairholme Fund and Third Avenue Value have grown incredibly in the past 14 years. Size is an anchor to performance, particular with small-cap funds. If I started this today I may choose a few different funds, or a combination of active funds.