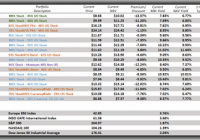

Summary Emerging Markets are no longer one cohesive group. The BRICs are each a separate investment case, heading in different directions. Smaller emerging and some frontier markets deserve investing consideration for their growth potential. EMFM appears to be the most compelling out of several ETF options available. Speaking on March 7, 2014, at the National Association of Pension Funds investment conference in Edinburgh, Laurence Fink, chairman and CEO of Blackrock (NYSE: BLK ) brought up the subject of emerging markets . “We talk about emerging markets as if they are one compatible, cohesive market – but within emerging markets we have some very good examples of well-run countries, and we have some real garbage… I do believe we will see much more granularity in the investment of the developing world and we will stop talking about emerging markets as an asset class.” As an example, Mr. Fink pointed to the way the UK investors have a different focus than those in the rest of Europe. Blackrock is one of the largest asset managers and the largest ETF provider in the world, and the words of its visionary CEO were heard loud and clear. The Decade of the BRICs To be fair, Mr. Fink’s idea was not new, but the market’s participants have been slow to recognize it until the recent few years. It’s hard to argue that the previous decade was the Decade of Emerging Markets, or more precisely, the Decade of the BRICs. Brazil, Russia, India, and China – the four largest emerging economies – have taken the lead, and others followed, creating a high correlation of returns throughout most of the 2000’s. The story in the past three years or so has been quite different. Chinese slowdown, highlighted by the real estate bubble and the shadow banking near-crisis, is well-documented. The growth potential is still there, but it’s not what it once was. Brazil has had its share of problems, where higher inflation, infrastructure problems, economically unfriendly government policies, lower commodity prices, and moderated growth had their negative effects on the economy and the local equity market. India, on the other hand, has enjoyed a significant resurgence last year following the election of President Modi. Investors see his proposed sweeping economic reforms a cause for optimism, driving Indian market to one of the best performances of 2014 around the globe. India is a major net importer of energy, which is another boon to its economy right now. Finally, Russia deserves a special mention. In April, 2014, I published an article entitled, Clear and Present Danger to the World Economy . Its basic and controversial thesis was that, in the wake of Russian annexation of Crimea, a huge macro shift was underway, which was likely to cause higher defense spending, European shift away from Russian gas, higher volatility in European equities and energy prices, and ultimately much lower Russian equities and ruble. The controversy came from the fact that the Russian equity market and ruble have already experienced a substantial slide in the previous 6-week period. Some Seeking Alpha readers felt that those were caused solely by the headline risk, that Europe and the US were too weak politically for economic sanctions and that the Russian market was ripe to buy on the dip. Perhaps that thesis is no longer controversial, as all these macro themes have been playing out nicely over these nine months, and the recent monumental crash in Russian market and currency have been exacerbated by the equally monumental and unpredictable oil market crash. There are now some voices, as there always are, that are calling the bottom of the Russian market. After all, their argument is that the oil slide has slowed down and can’t continue forever, while Russian equities are currently some of the cheapest in the world on the P/E basis, some with enticing dividend yields, to boot. However, I put myself squarely into the bearish camp yet again, arguing that the Russian equities are cheap for a reason. A short-term oil price bounce can certainly provide a short-term relief to the stocks, just like the Chinese currency support announcement and a Central Bank dramatic rate hike from 10.5% to 17% provided a short-term stub to the ruble’s collapse, but the macro situation has not changed. The Western sanctions are working well, the Russian economy is suffocating, Europe’s dependence on Russian gas is decreasing, and the 17% interest rate is destroying local businesses faster than falling oil. The coming downgrade of the sovereign debt to junk and likely bankruptcies of the more vulnerable Russian businesses [or government bailouts as they have already done, in fact, with Rosneft ( OTC:RNFTF )] will merely accelerate the process the way the oil collapse has. The dividends, too, are about 50% less enticing than a year ago when converted into dollars and can disappear at any moment as large payers start to run out of cash. And any recent rumors of possible easing of sanctions have been quashed, with political and military situation in Eastern Ukraine not only not getting better, but worsening and looking to get much worse yet before getting any better. In fact, sanctions will almost inevitably get tougher yet. The only possible remedies to the Russian economic malady would be either complete about-face on Ukraine and Crimea, wholesale replacement of government leadership, or dramatic and sustained surge in oil prices, and I consider all three highly unlikely in the foreseeable future. (click to enlarge) The State of Emerging Markets But I digress. Regardless of the special situation in Russia, it would appear that the BRICs are no longer leading, nor their returns are correlated to each other or to other emerging markets. The chart above shows a comparison of 3-year returns of the BRICs against S&P 500 and diversified Emerging Markets using ETFs as proxies. iShares MSCI India (BATS: INDA ) has clearly outperformed its peers, with iShares China Large-Cap (NYSEARCA: FXI ) not too far behind, lagging India in the past six months only, while Market Vectors Russia ETF (NYSEARCA: RSX ) and iShares MSCI Brazil Capped (NYSEARCA: EWZ ) have posted steep losses in the cumulative 50% range. The fact is that China now possesses the second largest GDP in the world, and the other three BRICs are also in the top 10 in the world, according to the World Bank . While GDP is not part of the standard definition of emerging markets, a case could be made that the BRICs no longer fit the category where investors expect higher rewards for higher growth, albeit at a higher risk. Most of the risks commonly associated with emerging markets are still there, but the growth may never be the same. It is also clear that investing in each of the BRICs should be considered separately, to Mr. Fink’s point. It doesn’t mean that there is no longer need for diversified emerging markets mutual funds of ETFs, such as the popular iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ) or Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) . Just as there’s a dedicated UK fund, there’s still a business case for investment in a Western European or Developed World Equity fund where a small portion will be allocated to the UK. But which time is now: to pick specific countries or go with a broad group? For the purposes of diversification and to minimize a small-country political, headline and currency risks, a broader group remains a prevalent choice. However, the country selection choice in such funds is of paramount importance. Another article I wrote over a year ago, Emerging Markets: The Next 11 – Where To Invest , makes a reference to N-11, the “next 11” emerging economies after BRICs. It was first presented nearly ten years ago by the former chairman of Goldman Sachs Asset Management Jim O’Neill, perhaps best known for coining the BRIC acronym. The list is still very relevant, although the investment options for some of these countries are very limited. Frontier markets – generally defined as less developed and smaller than emerging markets – have emerged (pardon the pun) in recent years as an alternative to investors seeking growth rates similar to the emerging markets of the past decade. The two broad, dedicated frontier ETFs available today – Guggenheim Frontier Markets (NYSEARCA: FRN ) and iShares MSCI Frontier 100 (NYSEARCA: FM ) – have had differences in performance, as the graph below shows, precisely due to the country selection. It’s worth noting that in May, 2014, due to MSCI change in its index methodology, Qatar and UAE have become Emerging Markets, and the FM ETF had to rebalance what was about a third of its portfolio previously. Perhaps one of the key issues of frontier markets from investing standpoint is the tradeability and liquidity of securities. Many countries have laws restricting foreign investment or trading on local exchanges. China has only recently opened access to their Mainland A-shares. Saudi Arabia may finally be opening their market to foreigners in 2015, and no less than 3 dedicated ETFs are in SEC registration – from Blackrock, Global X, and Market Vectors. What often happens is that ETFs have to use stocks traded on Western exchanges or even Western companies doing business in frontier countries rather than local pure plays, for the sake of lowering transaction costs, avoiding legal issues, and increasing liquidity. Searching Beyond BRICs As investors – and then ETF issuers – started to look beyond BRICs for growth, the boutique firm EGShares was first to bring such a fund to the market as early as August, 2012 – EGShares Beyond BRICs (NYSEARCA: BBRC ) . Its focus is on smaller emerging markets, as advertised, and excludes BRICs, South Korea, and Taiwan. The last two countries are considered developed by some methodologies, so that VWO based on the FTSE index excludes Korea, for instance. The largest countries represented in BBRC’s 90 holdings are, in order, South Africa, Malaysia, Qatar, Indonesia, Nigeria, Thailand, Poland, Turkey, and Chile. State Street soon followed with SPDR MSCI EM Beyond BRIC ETF (NYSEARCA: EMBB ) , but less successfully. Using MSCI Beyond BRIC index, this ETF has a similar country selection, except South Korea and Taiwan are included and combine for about 30% of the portfolio. Greece is also a constituent, albeit small, due to its downgrade to emerging markets by MSCI. BBRC currently has $281M of assets and charges 0.58% expense ratio, to EMBB’s only $3M and 0.55%. The latest newcomer in the category is the iShares MSCI Emerging Markets Horizon ETF (BATS: EMHZ ). It debuted in November, 2014, and is benchmarked against the MSCI Emerging Markets Horizon Index, which is designed to track the equity performance of the smallest 25% of countries by market capitalization in the universe of MSCI Emerging Markets Index countries. Naturally, this criterion excludes the BRICs. Mexico, Malaysia, Indonesia, Thailand, Turkey, Poland, Chile, Philippines, Qatar, Peru, Colombia, UAE, Greece, and Egypt are included in the benchmark. As the thinly traded fund is trying to pick up more than the $2.3M AUM it has accumulated so far, it sports the smallest expense ratio of its peers of only 0.50%. However, all these choices, while focusing on smaller emerging markets, completely disregard the promise of frontier markets. Best of Both Worlds Enter Global X Next Emerging & Frontier ETF (NYSEARCA: EMFM ) . Global X has carved out a nice niche in the ETF space specializing in smaller Emerging and Frontier Markets. It is no wonder then that they teamed up with German indexer Solactive , which is known for indexing alternative investments, to bring this ETF to market in November, 2013. The ETF and the underlying index also excludes BRICs, South Korea, and Taiwan, but includes quite a cross-section of Emerging and Frontier markets listed below, living up to its aptly chosen ticker. The portfolio consists of 218 stocks that represent 34 countries, making it much broader than the choices described above. Generally, the Frontier markets have shown low correlation to the developed world and among themselves, making their inclusion in portfolios more attractive. In particular, there’s a meaningful exposure to Africa and Middle East that other options lack. With the exception of South Korea (by choice) and Iran (by necessity), all the N-11 countries are included. That type of diversification means that no position takes up as much as even 2% of the portfolio, and the top 10 holdings account for only 14%. Some of the largest holdings trading in US include Argentinean e-commerce company Mercadolibre Inc. (NASDAQ: MELI ) and energy giant YPF SA (NYSE: YPF ), Panamanian airline Copa Holdings (NYSE: CPA ), and Mexican telecom America Movil (NYSE: AMX ). To bolster its investment case, Global X favorably compares EMFM portfolio’s revenue growth to that of EM or US small-caps, as well as EMFM’s population, market cap and GDP vs. the world. The fund has attracted a very healthy $136M in assets, with about average expense ratio for the group of 0.58%, despite a broader portfolio. A 1.70% dividend is also a nice bonus. New Registration On October 30th, 2014, iShares has filed for a new ETF registration. The iShares MSCI Emerging Workforce ETF is another potential contender in the space and takes a unique approach to developing-market investing that focuses specifically on demographics. The underlying index is derived from the MSCI Emerging + Frontier Markets Index and targets countries that have “favorable demographic criteria,” where the population’s average age skews younger and better educated as well as countries with high rates of urbanization and less reliance on agriculture. The prospectus noted that the index had 467 companies as of Oct. 1, and included the markets of Argentina, Brazil, Chile, China, Colombia, Egypt, Indonesia, Kuwait, Malaysia, Mexico, Peru, Philippines, South Africa and Turkey. Once the demographic-selection criteria are applied to achieve an initial list of markets, countries representing less than 0.25% of the index are removed, and weights of individual countries are capped at 20% of the index at rebalancing. (click to enlarge) Timing and Risks Developing Markets cumulatively did not have a good year in 2014. The strong dollar, falling energy and commodity prices, the spread of Ebola in Western Africa, and geopolitical threats with the rise of ISIS in the Middle East and the war in Ukraine have all been contributing factors. EMFM is not immune to these risks, and it’s basically flat over the last year, but it exhibits the lowest volatility of its peer group. At the onset of the new year, with the fund rebounding somewhat from the steep losses in the fall, now may be an opportune time for the long-term investor seeking growth away from the developed world and the BRICs. Conclusion Investors looking to add exposure to developing markets should look at options that exclude BRICs and consider each BRIC as a separate investment case. There are several ETF options in the space, with EMFM being perhaps the most compelling from the diversification, liquidity and risk/reward standpoint. Timing may also be right to consider adding it to one’s portfolio.