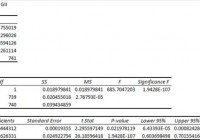

Summary The S&P has risen 171%. Time to start stock picking? Not necessarily. Let’s go back in time (15 years ago) to find a similar scenario, and let’s find out what John did. Our imaginary fellow investor from that time, John, made a decent amount of money by sticking to the plan and using common sense, while doing less and exposing himself to less risk. Since regular investors are really lagging behind, performing as good as the market is already setting you apart and makes you one of the top investors. My goal of today’s article was to figure out once and for all whether or not I should be going long – not by stock picking – but by buying an ETF of the S&P 500, so that I actually don’t have to do anything. If I had a dollar for every time I heard and read that “95% of individual investors don’t beat the market”, I’d have a lot of dollars. And yet still, while this seems to be a 100% accurate fact, I refused (until this point) to believe that I’m part of that 95% and hoped that I’ll beat the market over time. Does this make me an idiot or just a typical human being? I don’t know. But what I do know is that there are still a lot of stock pickers out there that are just as stubborn as me. 1 in 20 investors So once and for all, as you’re reading this, I hope you’ll realize that only 1 in 20 investors can select a portfolio of active funds that will outperform the market index over a 20-year period. That’s only a 5% chance of success, or a staggering 95% chance of failure. To put this in perspective: Being diagnosed with cancer in your lifetime: 1 in 2 for men, 1 in 3 for women Beating the house in a hand of blackjack: 1 in 2.2 A celebrity marriage lasting a lifetime: 1 in 3 Successfully climbing Mount Everest: 1 in 3 Living to 100 (if you’re 50): 1 in 8 Today’s article will answer a lot of questions for investing teens, investors in their twenties and even investors in their early thirties who are probably bothered by the same question: Should we be buying individual stocks that appear attractive/cheap after the 171% increase in the S&P 500? Or should we be afraid and wait for the next “big crash” before going long? Or should we just surrender to Mister Market no matter what, and start buying the index as a whole today through the oh-so simple S&P 500 ETF (NYSEARCA: SPY ) that follows the entire index, as we’ll be better off following the market in the long run? Let’s go back in time I believe that the only way to get a possible answer to this question is to present ourselves with a similar scenario where investors were probably also asking themselves the same thing, and then look at how things turned out for them if they had acted a certain way. In order to try and do this, I suggest we jump back in time. In fact, let’s jump back exactly 15 years ago to January 7, 2000. (click to enlarge) (Source: Yahoo Finance) The above graph is a representation of what investors were looking at, at that moment in time. SPY was up 215% since January 7, 1995, and was quoting at an all-time high. This reflects the current situation pretty damn well – if not better. (click to enlarge) (Source: Yahoo Finance) SPY is currently up 171% since its lowest point in February 2009, and is also quoting at an all-time high. So 15 years ago, I bet a lot of investors were wondering the same thing. Should we be stock picking? Or should we continue to follow the market. First of all, let’s just admit that deciding to get a position at an all-time high is never a pleasant occasion. It feels like shooting yourself in the foot. It feels like setting yourself up for losses. Especially when thinking about the typical sayings like: “Sell high, buy low” and “Be fearful when others are greedy and greedy when others are fearful”, which are clearly warning you not to get in at all-time highs after a 200% rally. Let’s meet John However, let’s just assume that one of our fellow investors (we’ll call him John for now) was ready to ignore all of his natural human responses/emotions and would just agree with the fact that 95% of individual stock pickers fail, and thus, that he is better off buying SPY no matter what. John feels that it is better to go with the market, “If you can’t beat them, join them”, right? Waiting for the next big correction before getting in seems to be silly, as no one knows when it’ll come. The strategy and situation of our imaginary investor John is the following: John just turned 20, and has decided that he wants to have a nice pension fund by the time he is 60, or perhaps have a nice pile of money by the time he is in his prime, let’s say, forty years old. This gives our investor friend a time horizon of at least 20 years, and when necessary, even 40 years. He then figures that he can miss at least $500 per month. John starts to deposit $500/month in SPY as of January 7, 2000, and will continue to do this at the beginning of each month. John is 35 Now, let’s take a look at how John’s simple strategy has played out so far – 15 years later. After 15 years, John has invested a total of $90.000 ($500 x 180) in the ETF, and the position seems to be worth $176.567,40 as of today. So without having to do anything special, except depositing $500 per month into the ETF (that was quoting at an all-time high when starting), he would have gained $86.567 if he were to sell today. (click to enlarge) John’s performance could have also been achieved if he would have chosen his stocks individually. However, he then needed to achieve an ~8.45% cumulative annual growth rate (see table below). Which is a rather hard thing to do for the average Joe in today’s market, right? ( Source ) Warren Buffett himself did only slightly better, growing Berkshire’s book value by 8.9% annually during the past 15 years. Thereby, let’s not forget that John has had 15 wonderful years. He never had to waste a single minute of his day in order to achieve this 8.45% annual growth rate. He never slept bad. He never worried that he would wake up and all his money would be gone. All he did was execute his simple plan. Let’s assume John is a smart guy Now, let’s assume that John is a smart guy like you and me, and that he tries to seize opportunities whenever they come along. So one day, he notices that his ETF is starting to drop due to the financial crisis. John thinks this is a temporary problem and decides to stick to the plan; in fact, he even tries to double his efforts, and decides to make a deposit of $1000 per month during 2009. (click to enlarge) By injecting an extra $6000 during the 2009 crash, John’s position is now worth a total $191.352,70, and has thus increased with $14.785 because of his extra efforts. John’s cumulative annual growth rate now lies at ~9.5% for the past 15 years, while doing nothing special except using his common sense. This is way higher than what average investors ( 2.6% ) have been achieving during the past 10 years. Conclusion Either you get a thrill out of proving others wrong and will try to actively beat the market – knowing that there’s a rather high chance you won’t beat it – or you’re just not bothered to achieve above-average results, and are happy with whatever the market does. However, as the average investor has achieved a 2.6% return for the past 10 years, and John has been able to scoop a 9.5% annual return by following the market, perhaps doing as well as the market has become an achievement of itself and is already making you special. Because of today’s analysis, I’ve decided to start depositing $500 into SPY each month as of now, as I feel that there is no downside in doing this in the long term. This way, some of my money will at least perform as well as the market. However, I will nonetheless continue to keep a portfolio full of individual stocks, as I also really enjoy investing actively. Even when this means that I’ll have a 95% chance of underperforming the market with this portfolio.