ETFs To Hit $5 Trillion In Assets By 2020: PwC

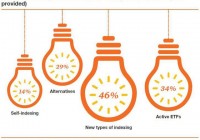

By Clayton Browne A new report from PwC highlights the ETF industry continues to mature Exchange Traded Funds (ETFs) have been only been around for two decades, but they have grown far beyond their initial function of tracking large indices in developed markets and have become an investment sector of their own. As of year-end 2014, ETFs now hold over $2.6 trillion of assets globally and continue to grow rapidly. In fact, PwC projects that the ETF space will top $5 trillion in assets by 2020. Tax and and audit consultancy firm PwC recently published a report titled “ETF 2020: Preparing for a new horizon”. The report is based on a survey of 60 financial industry firms including ETF managers , asset managers and service providers. Increasing segmentation in ETF sector The PwC report points to the increasing segmentation of the ETF market. Institutions are committing more assets as more and more firms find uses for them. Also of note: “The advisor market continues to evolve quickly, with ETF strategists playing a growing role in the U.S. market and now emerging in Europe . Segment and channel trends are largely driven by local considerations, so regional differences abound.” (click to enlarge) While the growth of ETFs has slowed in the U.S. in the last few years, the industry is still expanding in other regions (such as Europe and Asia). According to the PwC report non-traditional indexing is becoming more important in many markets, “while active ETFs are on the verge of radically changing the AM [asset management] industry in the U.S.” Non-transparent active ETFs potential growth area (click to enlarge) In a setback for the industry, two firms seeking approval from the SEC to launch non-transparent active ETFs, which would offer less than the current daily transparency of the portfolio holdings using a blind trust, were denied late last year. However, the sector did get some good news when SEC approved the request of another firm to launch a different type of non-transparent active investment product referred to as exchange-traded managed funds in November last year. The report notes that this new innovation has caught the eye of current and prospective ETF sponsors. The authors anticipate that firms will continue to seek approval to set up non-transparent active ETFs, and argue this “could provide another phase of growth and innovation in the coming years.” Issues facing industry PwC acknowledges that the ETF industry will face numerous challenges in the coming years. One potential issue is changing demographics forcing asset managers to design solutions suitable for a rapidly aging population. Technology is also likely to radically alter the way investment advice and products are evaluated and consumed, and ETF firms must be ready to evolve. The report also notes that regulatory constraints and distribution dynamics benefiting other investments may reduce growth in some markets. The increasingly saturated U.S. marketplace is also a major concern. Disclosure: None. Share this article with a colleague