Investors Are Scared – Getting Long Volatility Again

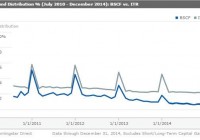

Last week I offered up a playbook for volatility for this year. Since that time I’ve shorted volatility and subsequently gotten long. I’ll continue to use a hedged position selling calls against the VXX until the volatility outlook changes. Last week I wrote a piece regarding volatility in the new year and my playbook for how to survive the strong moves up and down in volatility as measure by the short term VIX ETF (NYSEARCA: VXX ). At the time I had no positions as I was waiting for a more definitive move up or down in order to stake my claim on the VXX. I wrote I wanted to see a bigger move up before shorting and since the time the article was published, VXX has moved sharply to the upside to trade near $35 as I write this. So what have I done since the last article and what am I doing going forward? After being out of the VXX for a couple of weeks I actually decided to get short volatility after another move up following my article. I used the inverse short term VIX (NASDAQ: XIV ) ETF to do so to try and capture a move down in the VXX. I went long XIV on the 7th and captured a very nice move down in volatility only to have it reversed on Monday the 12th. After seeing the move down in volatility was short lived I closed my XIV position for a very small gain (after riding the XIV up and back down) and went long VXX again. Why did I go long? There is a lot of stuff going on in the financial world. Oil and other commodities continue to signal that a recession is coming, Greece is once again on the verge of breaking up the Euro and here at home, the market hangs on the Fed’s every word in terms of any potential volatility that could be introduced from the central bank raising rates and pulling stimulus. These factors make me think the likely move in volatility is up in the short term, not down. I’m currently long VXX while selling calls against my position. I did this for two reasons. First, in case I’m wrong, VXX can move down in a hurry and crush you. This is the same problem the short volatility ETFs have and that’s why I trade in and out so much and why you’ve got to be careful. The calls give me some cushion on the downside in exchange for taking away my upside in case volatility collapses. Second, I sold the calls simply because premiums are huge. Slightly out of the money calls can be sold for 5% of the ETFs price – for an option that expires in a week. Think about that one; that kind of yield for five or six trading days is unbelievable and it provides not only huge amounts of cash for your portfolio but a nice bit of protection to the downside. I went long VXX at $33.30 and sold weekly 33 calls against my position for $1.46, expiring four days after I sold them. Given the move up in the VXX to $34.40, I’ve given some upside away but I’m still collecting the huge premium in the meantime, offering 3.5% yield and some downside protection as I sold in the money calls. Given the outlook for continued volatility I think the best course of action going forward is hedged bets in the VXX. Last October and again in December of last year I went long the inverse VXX ETF (NYSEARCA: SVXY ) or the VXX itself with no protection as the situation warranted because I felt strongly I could predict what volatility was doing. But given all of the places we can expect news from in the short term, I don’t feel confident enough to just buy VXX or XIV. I like the covered call play on VXX right now but if VXX spikes to the high $30s, as I said in my last article, I’ll look at doing the same think with XIV. But for now, I’m long VXX until something changes and when it does, I’ll be sure to let you know. Additional disclosure: I’m long VXX hedged with short calls but may trade out of this position at any time.