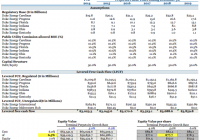

Duke Energy Corp. (NYSE: DUK ) Q2 2015 Earnings Call August 06, 2015 10:00 am ET Executives Bill Currens – Vice President-Investor Relations Lynn J. Good – President and Chief Executive Officer Steven K. Young – Executive Vice President and Chief Financial Officer Analysts Dan L. Eggers – Credit Suisse Securities (NYSE: USA ) LLC (Broker) Shahriar Pourreza – Guggenheim Securities LLC Greg Gordon – Evercore ISI Julien Dumoulin-Smith – UBS Securities LLC Steven I. Fleishman – Wolfe Research LLC Christopher J. Turnure – JPMorgan Securities LLC Michael J. Lapides – Goldman Sachs & Co. Jonathan P. Arnold – Deutsche Bank Securities, Inc. Ali Agha – SunTrust Robinson Humphrey Operator Good day and welcome to this Duke Energy Second Quarter Earnings Conference Call. Today’s conference is being recorded. At this time, I would like to turn the conference over to Mr. Bill Currens. Please go ahead, sir. Bill Currens – Vice President-Investor Relations Thank you, Shannon. Good morning, everyone, and welcome to Duke Energy’s second quarter 2015 earnings review and business update. Leading our call is Lynn Good, President and CEO, along with Steve Young, Executive Vice President and Chief Financial Officer. Today’s discussion will include forward-looking information and the use of non-GAAP financial measures. Slide 2 presents the Safe Harbor statement, which accompanies our presentation materials. A reconciliation of non-GAAP financial measures can be found on duke-energy.com and in today’s materials. Please note that the appendix to today’s presentation includes supplemental information and additional disclosures to help you analyze the company’s performance. As summarized on slide three, Lynn will begin with an update on our principal strategic, operational and financial activities since our last call, then Steve will provide an overview of our second quarter financial results, including updates on economic activities within our service territories, as well as conditions in Brazil. With that, I’ll turn the call over to Lynn. Lynn J. Good – President and Chief Executive Officer Good morning, everyone, and thanks for joining us. Before I start today, I’d like to take a moment to introduce Doug Esamann. Doug recently joined our senior management team and will oversee our Indiana, Ohio, Kentucky and Florida utilities. Doug has over 30 years of experience with Duke Energy, most recently as the President of our Indiana utility. Doug’s depth of regulatory experience as well as his customer and strategic focus complements our leadership team. We look forward to introducing Doug to many of you over the coming months. Now, to the quarter. We are midway through 2015 and continue to execute our operational and strategic growth objectives while positioning the company to meet our financial objectives for the year. This morning, we reported second quarter 2015 adjusted EPS of $0.95, which is consistent with our plan. Our regulated and commercial businesses have performed well over the first half of the year. Additionally, we have completed the sale of the Midwest Generation and the purchase of the NCEMPA assets ahead of schedule. This has allowed us to effectively offset the challenging business environment in Brazil. As a result, we remain confident in our ability to achieve our full-year 2015 earnings guidance range of $4.55 to $4.75 per share. In June, we completed our $1.5 billion accelerated stock repurchase ahead of schedule. Further, last month, we announced that the Board of Directors increased the quarterly dividend to $0.825 per share doubling the annual growth rate to around 4%. This increase reflects our confidence in the strength of our core business and our cash flows. Our balance sheet provides continued support for growth in the dividend. For the past 89 years, the dividend has demonstrated our commitment to delivering attractive total returns to shareholders. I am pleased with the company’s operational performance during the quarter, particularly our response to the extended heat wave in the Carolinas in June. Temperatures were in the upper 90s for much of the month and our system met the increased demand for our customers. In June, we used a record monthly amount of natural gas, approximately 25 Bcf, surpassing the previous month high of 20 Bcf set in July of 2014. Additionally, our nuclear fleet delivered a record second quarter in terms of net megawatt hours of generation. Nuclear capacity factor was around 95% during the month of June. Lastly, our field operations teams met customer needs during the stress of the summer heat and storms. Our ability to meet extreme demand conditions demonstrates the quality of our operations. We’ve made significant headway on other strategic and regulatory priorities, which I’ll briefly cover on slide five. These priorities include investments in new generation, infrastructure and a focus on environmental compliance. Beginning with our investments in new generation. Just last week, we closed on the $1.25 billion acquisition of jointly owned generating assets from the North Carolina Eastern Municipal Power Agency. We closed ahead of schedule, after receiving the required approval sooner than expected. This reflects the mutually beneficial nature of the acquisition and the widespread support we received here in North Carolina. We immediately began supplying power to the 32 municipalities through a long-term wholesale contract. In 2015, we expect a $0.04 earnings per share benefit based upon an expected full year EPS impact of around $0.07 to $0.08. During the second quarter, we also announced the $1.1 billion Western Carolinas Modernization Project. This project includes the early retirement of our Asheville coal plant, which will be replaced by a new 650 megawatt combined-cycle gas plant. We will also build new transmission assets that will improve reliability in the region. Finally, we will install solar generation at the site. The new gas plant is expected in service by the end of 2019 and the entire project will likely be completed by 2020. Before construction begins, various regulators including the North Carolina Department of Environment and Natural Resources and the Carolinas Utility Commissions will need to approve the plan. Our commercial renewables business continues to deliver on its capital growth projects. In April, we completed the 200-megawatt Los Vientos III project in South Texas, which is now delivering power under a long-term contract with Austin Energy. In July, we announced acquisitions of an additional 70 megawatts of solar capacity in California and North Carolina. Our commercial renewables business now has more than 2,000 megawatts of capacity in operation. In July, FERC approved our application to acquire the 599 megawatt combined-cycle Osprey gas plant in Florida from Calpine. The Florida Public Service Commission also voted to approve the acquisition. We remain on track to close by January of 2017 when our existing PPA with Calpine terminates and we have a need for additional generation capacity. Also in Florida, we announced an agreement to purchase a 7.5% stake in the Sabal Trail gas pipeline from Spectra Energy for $225 million. Similar to the Atlantic Coast Pipeline, the Sabal Trail investment will be a part of Duke’s Commercial portfolio. The pipeline is expected in service by the end of 2017 and will serve the growing natural gas needs in the state, including our 1,640 megawatt Citrus County combined-cycle plant, which is expected to be online in 2018. Duke Energy Florida and Florida Power & Light have entered into 25-year capacity agreements with the pipeline. Moving to Indiana, in May, we received an order from the Indiana Commission on the transmission and distribution infrastructure plan. The Commission denied our proposed $1.9 billion investment because they would like to see greater detail. We are working on a revised plan, which we expect to file with the Commission by the end of 2015. Modernizing our electric grid will provide great benefits to customers in Indiana, ultimately increasing reliability, decreasing the duration of power outages and improving customer communication. In the second quarter, we made significant progress on coal ash management activities. In May, we began moving ash at our River Bend site in North Carolina after receiving state permits. We are now excavating ash at three sites in the Carolinas. In June, we announced recommendations to fully excavate 12 additional ash basins in North Carolina, bringing the total ash in the Carolinas we have slated for excavation to about 30%. The remaining ash basins are being further studied to determine appropriate closure methods. We are pursuing solutions that balance safety, environmental stewardship and cost effectiveness. Given our efforts over the past year, we are ahead of the curve in adapting to changing regulations our industry faces with ash management. On the subject of environmental rules, on Monday, the U.S. EPA finalized a Clean Power Plan, a regulation aimed at reducing carbon emissions from existing power plants 32% by 2030. The guidelines issued this week are more than 1,500 pages long and among the more complex rules in recent history. This rule sets state specific reduction targets and builds upon the substantial progress we have already made to reduce our environmental footprint. Since 2005, we have reduced our total carbon dioxide emissions by 22% through retirement of older coal units, the transition to cleaner burning natural gas, as well as investments in renewables and energy efficiency. Our plans continue to move us toward a lower carbon future. We will work constructively with our states to identify solutions that preserve the reliability and affordability our customers expect. As we continue to modernize our system, managing energy diversity will be an important consideration. As I look back over the first half of 2015, I am pleased with what we’ve accomplished on multiple fronts across the business. I’m even more pleased with the groundwork we’re laying for the years ahead. We’re making strategic long-term investments that will benefit our customers and communities in addition to supporting growth for shareholders. We’re developing and executing strategies that will position the company well in a rapidly changing industry. Now, I’ll turn the call over to Steve to discuss the quarter in more detail. Steven K. Young – Executive Vice President and Chief Financial Officer Thanks, Lynn. Today, I’ll review our second quarter financial results and discuss the economic conditions in our service territories. I will also provide an update on the accounting and expected costs for our coal ash management activities and review our results in Brazil. Let’s start with the quarterly results. I will cover the highlights on slide six. For more detailed information on segment variances versus last year, please refer to the supporting materials that accompany today’s press release. As Lynn mentioned, we achieved second quarter adjusted diluted earnings of $0.95 per share compared to $1.11 in the second quarter of 2014. On a reported basis, 2015 second quarter earnings per share were $0.78 compared to $0.86 last year. A reconciliation of reported results to adjusted results is included in the supplemental materials to today’s presentation. Regulated Utilities adjusted results declined by $0.09 per share, primarily due to a prior year favorable state tax settlement, planned timing of O&M cost and higher depreciation and amortization. O&M cost increased this quarter due to the planned timing of outages across the generation fleet and approximately $0.05 due to nuclear outage cost levelization impacts recognized in the prior year. This is the last quarter in which we expect nuclear outage cost levelization to be a significant driver over the prior year results. We are on track to achieve our targeted full-year O&M budget and continue to look for opportunities to reduce costs. These negative drivers were partially offset by higher margins, resulting from growth in wholesale contracts and weather normal retail sales. We had favorable weather in the quarter as a significant heat wave gripped the Carolinas in June. Weather added around $0.03 over last year’s second quarter and $0.06 compared to normal conditions. We also experienced higher earnings of $0.03 this quarter from pricing and riders, primarily due to increased energy efficiency programs. International’s quarterly earnings declined $0.13 over last year, due to factors we continue to monitor, including the economic conditions and lower demand for electricity in Brazil. As you will recall, International also had a favorable income tax adjustment of $0.07 in last year’s quarter, associated with the reorganization of our operations in Chile. Our Commercial Portfolio, formerly Commercial Power, is primarily made up of our commercial renewables business. In the second quarter, we incurred slightly lower earnings, due to lower wind production. This decrease in wind production was experienced broadly across the United States. Turning to slide seven, I’ll now provide some insight into the second half of 2015. And the key drivers that give us confidence in our 2015 guidance range of $4.55 to $4.75 per share. Through the first half of the year, our adjusted earnings per share of $2.20 is consistent with our plan. The regulated business has experienced favorable weather, and has seen strong growth in wholesale contracts and weather normal retail sales. The sale of the Midwest Generation fleet, as a whole, has been favorable to our plan in the first half of the year. These positive drivers have helped offset continued weakness at International. In order to achieve our full-year 2015 earnings guidance range, we expect higher EPS contributions in the back half of the year, over what we earned in the comparable period last year. There are a few primary drivers that support this. First, we expect continued growth in contracted wholesale volumes, as well as organic growth in retail demand over the last half of the year. Second, we experienced unfavorable weather last year in the third quarter. Assuming normal weather for the remainder of this year provides an uplift of $0.05. Third, the early completion of the NCEMPA asset purchase will provide an additional earnings per share impact of around $0.04. Earnings from our Commercial renewables business should also see an improvement in the second half of the year. We are on track to put over 200 megawatts of additional wind and solar capacity into service later this year, which would bring 2015’s total additions to more than 400 megawatts. Related to O&M cost, we expect third quarter O&M to be higher than the prior year, while fourth quarter should be lower. As a result, O&M shouldn’t be a significant driver in the second half of the year. Similarly, we expect International’s earnings contribution in the second half of 2015 to be comparable to last year. This is not a full list of drivers for the rest of the year, but these represent variances that are likely to occur based on current expectations. As you are all aware, the third quarter is historically our strongest quarter. We will be in a position to provide more insight into the year after we see those results. Moving on to slide eight, I’ll now discuss our retail customer volume trends. On a rolling 12-month basis, weather normalized retail load growth increased by positive 0.1% driven by strong second quarter growth of positive 1.7%. This was the first quarter we have experienced positive growth across all customer classes in over a year. Although, one quarter does not make a trend, this recent uptick is encouraging. Within the residential sector, we continued to experience strong growth in the number of new customers, approximately 1.3% over the same period last year. The growth in the Carolinas and Florida regions has been particularly strong, at around 1.5%. The Carolinas and Florida also saw usage per customer level off, after trending lower over the past several quarters. We continue to see favorable trends in the key indicators for the residential sector including, employment, median incomes and household formations. In fact, the 6 states we serve captured over 20% of the additional nonfarm job growth over the last year. The commercial sector grew by 0.3% on a rolling 12-month basis. This sector continues to benefit from declining office vacancy rates, and expansion in the medical and restaurant subsectors. We’ve also experienced some growth in the tourism related businesses, in certain markets. The industrial sector grew by 1.3% on a rolling 12-month basis. This growth was led by metals, transportation, construction and chemicals. Additionally, we are starting to see textiles in the Carolinas build momentum. We will continue to monitor the impact of the strengthening U.S. dollar on manufacturing activity. Our economic development teams remain active, successfully helping attract new business investments into our service territories. So far this year, these activities have led to the announcement of another $1.7 billion in capital investments, which is expected to result in over 5,000 new jobs, across our six states. We are encouraged by the continued strengthening of the economy, particularly in the Southeast. We remain on track to achieve our full-year 2015 weather normalized load growth of between 0.5% and 1%. Moving on to slide nine. Let me update you on our coal ash management activities. First I’ll cover adjustments to our asset retirement obligations related to coal ash basin closures. As you’ll recall, in the third quarter 2014, we recorded an approximate $3.5 billion ARO, reflecting our best estimate to comply with the newly enacted Coal Ash Management Act or CAMA. In April, the U.S. EPA published its final Coal Combustion Residuals Rule in the Federal Register. The EPA’s final rule is consistent with our compliance plan for basins in North Carolina under CAMA. However, the final rule did create a legal obligation related to ash basins outside of North Carolina and existing landfills across our system. Therefore during the second quarter, we recorded an additional $1 billion obligation representing our best estimate of cost to comply with the new Federal EPA rules. As of June 30, we now have total ARO obligations of $4.5 billion, which represents our best estimate to comply with state and Federal rules. These costs will be spent over the next several decades. We will continue to refine this estimated liability as plans are finalized. Next, let me summarize our cash spending assumptions for our coal ash activities. In February, we estimated $1.3 billion in spending from 2015 to 2019, to close the initial high-priority sites under CAMA. During the quarter we announced our recommendation to fully excavate 12 additional basins in the Carolinas. Our estimate of cost to close these additional basins ranges between $700 million to $1 billion. Ultimately, we expect these costs will increase our five year capital spending plan that was disclosed in February. However, we are unable to predict the precise timing under which we will incur these costs until the final risk classification is set by the North Carolina Department of Environment and Natural Resources and the Coal Ash Commission. We will continue to provide updates as our plans become finalized. There is still work to do with our remaining basins and we will keep you updated as we continue to refine our estimates. Taking a look at slide 10. Let me provide an update on our International business. As we entered the year, we anticipated challenges at International due to one, the prolonged drought conditions in Brazil, causing thermals to dispatch of hydros for the entire year. Two, unfavorable Brazilian foreign exchange rates. Three, declining earnings contributions from our interest in National Methanol, which sells products that are correlated to Brent crude oil prices. And four, a prior year Chilean tax benefit. We also assume no energy rationing and around 2% growth in demand for electricity. During 2015, reservoir levels continue to be low. Rainfall has recently been above average in the Southeast region of Brazil, where our assets are located. Reservoir levels stood at about 37% at the end of July, higher than the 20% level they started the year. However, they are still low for this time of the year. These conditions have caused the system operator to continue to dispatch thermals ahead of hydros. Additionally, the government is continuing to encourage customers to voluntarily reduce electricity consumption. The economy in Brazil continues to weaken as evidenced by S&Ps recent change in outlook for the country’s credit ratings. The softer Brazilian economy, higher tariff prices for end users and the voluntary conservation measures have placed additional pressure on electricity demand so far in 2015. As a result, we now expect 2015 electricity demand in Brazil to be lower than 2014. Taking this all into account through the second quarter of 2015, International’s earnings have declined by $0.26 per share, compared to last year. As you will recall, our original full year forecast of International contemplated about $0.12 per share of lower year-over-year earnings. We do not expect these levels of year-over-year weakness to continue into the second half of 2015. We expect the third and fourth quarters to be more comparable to the second half of 2014 for the following reasons: First, the system operator began to change the dispatch order to the detriment of hydro generators in the second quarter of 2014. So in the second half of 2015, generation dispatch order will be similar to what it was in the second half of 2014. Second, the shaping of our contract should create a less significant short position in the second half of the year than we saw last year. Finally, we have seen recent declines in the market settlement prices or PLD. In June and July, these prices fell below the established ceiling of R$388, averaging approximately R$300 per megawatt hour. These lower spot prices should provide some relief as we continue to cover our short position through market purchases, helping offset the impact of lower demand. Our International team continues to manage well in this difficult environment, concentrating on items within their control. We actively are managing our ongoing contracted levels and focusing on our cost management during this downturn. However, we do not expect International to meet its original financial plan for the full year. Before moving on, let me mention a recent development in Brazil that has received some media attention. There have been recent discussions aimed at providing some financial relief to the hydro generators. These discussions are in the early stages and it is difficult to speculate on how they may play out. We’ll keep you updated as events unfold. Slide 11 outlines our financial objectives. The balance sheet is strong and our credit ratings are in line with our target levels, allowing the company to access the financial markets on reasonable terms. We are executing our plan to access $2.7 billion of international cash over several years. In June, we returned approximately $1.2 billion to the U.S. The strength of our balance sheet and cash flows helps fuel our growth strategy, support the dividend and maintain low cost rates for our customers. Our dividend continues to be a very important piece of our shareholder value proposition. In July, we were pleased to announce an increase in our quarterly dividend growth rate from 2% to approximately 4%. In 2010, we have been working to reach our target payout ratio of 65% to 70% of adjusted EPS. Now that we are at the high end of that ratio, we will continue to target dividend growth more in line with our long-term earnings growth targets. Let me provide an update on our earnings growth objectives, both short term and long term. We are on track to achieve our 2015 guidance range of $4.55 to $4.75 per share. Near-term headwinds at the International business have been offset by strength in Regulated Utilities and early execution on some of our strategic initiatives. On a longer term basis, we continue to target earnings per share growth of 4% to 6%, underpinned by the strength of our domestic businesses. We are executing on our strategic growth initiatives, which provides a foundation for growth through 2017 and beyond. Our International business however, continues to face unfavorable macroeconomic trends such as poor hydrological conditions and a weakened economy in Brazil. As we look beyond 2015, the extent and duration of these challenges is uncertain. We will learn more as the year progresses, and we’ll evaluate the longer term impacts as we finalize our financial plans for 2016 and beyond. We remain committed to delivering long-term value for our investors. With that, let’s open the line for your questions. Question-and-Answer Session Operator Thank you. And we will first go to Daniel Eggers with Credit Suisse. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) Hey. Good morning, guys. Lynn J. Good – President and Chief Executive Officer Hi, Dan. Steven K. Young – Executive Vice President and Chief Financial Officer Hello, Dan. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) Hey. On the load growth numbers in the second quarter, I guess both customer gains, weather adjusted usage, both looked pretty good and kind of broke from trend that we’ve seen the last couple quarters. Should we read much into things getting better and this being perpetuated or this is just kind of the – some of the volatility that comes with quarterly adjustments in numbers? Steven K. Young – Executive Vice President and Chief Financial Officer Well, Dan, as we said, I’m always careful when I just look at one quarter’s results. I think we have to always have that in the back of our mind. We are seeing some pretty good trends here, though on a few factors that I will mention. The growth of customers into the Carolinas and Florida has been ramping up from 1% now to 1.5% and that’s got to be a good metric there for the future as we move forward. We’re also seeing some favorable statistics when we look at new housing starts in our service territories, meaning new homes are starting to get actually built. We’re also starting to see a lower number of rejections of mortgage applications which say that people are having the funds to buy a home or a place to live, some of those statistics are certainly compelling. We’re always cautiously optimistic on one quarter, but there are some good results here. Lynn J. Good – President and Chief Executive Officer And Dan, one thing I would add that Steve talked about in the script, we’ve been tracking lower usage per customer kind of quarter-after-quarter and actually, saw a leveling-off of that reduction this quarter as well, which is another thing that I would point to as a bit of a new trend for us. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) When we think about the load growth and you guys were at 0.5% to 1%, this year, I know you’ve kind of talked about 1% being more of a normalized long-term target. How important is getting to that 1% number to the utilities being able to support their end of the 4% to 6% growth target? Steven K. Young – Executive Vice President and Chief Financial Officer It’s important, Dan. As you know on our sensitivity, a 1% increase in our organic load growth would translate to about 2% earnings growth, and it is essential to us to see growth in our service areas. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) The trends you’re seeing right now, are they giving you encouragement that 1% is feeling a little bit better after maybe feeling a bit shaky the last couple quarters? Steven K. Young – Executive Vice President and Chief Financial Officer Well, as I mentioned, I think some of these trends behind the good quarter we had in the second quarter do make us feel well. As Lynn mentioned, the usage decline stopping per customer and some of the raw data on employment, median household income starting to pick-up and get a bit of traction in our service territories, do give us some comfort there. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) Okay. I’m sure, that folks are going to ask about it, but just on the international side. Looking past this year, are you guys thinking that things that are happening this year are structural or do you think they’re situational to these market conditions? Lynn J. Good – President and Chief Executive Officer Dan, I think there are a combination of things going on. The hydrological conditions, I believe were seasonal, right. So, if we have a strong rainy season that starts in the fall, continuing into 2016, we may see a situation where dispatch order changes. I think the regulatory body in Brazil has learned a lot about the changing generation mix and how that fleet has reacted in this environment. So, over maybe a short-term to medium-term, we could be some mitigation of some of the pressures there, or changes in regulation that could be helpful to the hydro operators. I think the long-term issues are more around the Brazilian economy. And does the Brazilian economy get traction again and start growing at a pace that would be more consistent with what we have seen over the last decade. So, I think you’ve got a combination of shorter-term and medium-term to longer term issues. And so, our focus is to be as transparent as we can on what we see, and we’ll continue to update you as the year progresses. Dan L. Eggers – Credit Suisse Securities ( USA ) LLC (Broker) Very good. Thank you, guys. Operator Next question comes from Shar Pourreza with Guggenheim Partners. Shahriar Pourreza – Guggenheim Securities LLC Good morning. Lynn J. Good – President and Chief Executive Officer Hello. Steven K. Young – Executive Vice President and Chief Financial Officer Hi, Shar. Shahriar Pourreza – Guggenheim Securities LLC Steve, I think you sort of touched on this in your prepared remarks, but on the injunctions in Brazil, is there preliminary, is there any procedural process that we could follow to see how things are transpiring? And then the second question is Brazil does have relatively high rates. So is there any talk on how – the potential of passing these costs onto customers? Steven K. Young – Executive Vice President and Chief Financial Officer Yeah, Shar, on the injunctions, in talking with our teams in Brazil, I don’t know that there is a set timeframe or schedule that you can look to to determine resolution of this. I think these initial injunctions and discussions around the market, by various stakeholder groups are a positive step. But we expect that it will take quite a bit of time to resolve this issue, and get new processes and settlements in place. So that’s just the nature of the way these negotiations often go in Brazil. So I wouldn’t look for a timeframe there. Regarding Brazilian retail rates, they did jump up quite a bit over the past year. And certainly that is something that is on the minds of Brazilian politicians, as to how do we deal with the cost of this out of dispatch situation due to hydrology issues. And right now, the hydro generators are bearing a lot of that burden, and the customers have borne some burden as well. That’s part of the debate that will be worked upon over the next year or so in Brazil. Shahriar Pourreza – Guggenheim Securities LLC Got it. Got it. And then on slide 11, you added a new footnote, footnote 3. Just curious, this footnote, is it basically inferring that the 4% to 6% is embedding some of the challenges you’re seeing in the International business, or it’s sort of pending some of the challenges that you’re seeing in International business? Lynn J. Good – President and Chief Executive Officer You know, Shar, what I would say is, given the depth of the challenge we’ve experienced during the first six months, and the fact that we’ve seen hydrological conditions really coupled with some of the complexities around other economic factors including Petrobras, and other things going on in Brazil. That the duration of this challenge is uncertain to us as we look past 2015. So when we look at the back half, we believe the back half of 2015 will be reasonably comparable to 2014. We’ll be anxious to see how the rainy season begins, but we need more information and time to look at our forecast for 2016 and 2017. And so, we wanted to just provide some transparency on that, and that’s the – really consistent with the remarks we shared with you today. Shahriar Pourreza – Guggenheim Securities LLC Got it. Got it. And then just lastly, on the weaker wind resources was a little bit of a theme this quarter. Is this something that we should think about from a structural standpoint just given that the El Nino cycle is just starting or is this something that’s sort of a bit of an normally? Steven K. Young – Executive Vice President and Chief Financial Officer I don’t know that I’ve heard anybody profess to understand the wind patterns that well, Shar, that they could predict them. So I don’t know that it’s anything more than an anomaly now. We’re heading into the second half of the year where the wind traditionally picks up. So we’ll get a better idea after that. Shahriar Pourreza – Guggenheim Securities LLC Excellent. Thanks very much. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Greg Gordon with Evercore ISI. Greg Gordon – Evercore ISI Good morning. Lynn J. Good – President and Chief Executive Officer Greg. Steven K. Young – Executive Vice President and Chief Financial Officer Hey, Greg. Greg Gordon – Evercore ISI So, I just wanted to go over some of the things you said just to make sure I understand them in terms of looking on actually slide 14, which is your original assumptions put up against your year-to-date results. It looks like you’re basically telling us that if International is flat in the second half versus the second half last year, that you’re $0.10 behind plan. On the other hand, you’re saying you’re $0.04 ahead of plan at the utility because of the early close of the NCEMPA acquisition and then you’re also – see better results in the second half versus the second half of last year in the Commercial business because of the 400 megawatts of new renewables and that’s how you sort of get back to plan. Is that a reasonable summary of what you said or am I missing something? Steven K. Young – Executive Vice President and Chief Financial Officer I think you’ve hit on some of the elements there. Assuming normal weather over the last half of the year, and we have had warm weather in July, you get a pick up there. Certainly, the wholesale contract associated with the NCEMPA acquisition provides about $0.04 there. We’ve also seen growth in our retail load year-over-year, even at modest percents that can add several cents to it. If it stayed like the second quarter’s results, it would be more than that. Our wholesale business has also picked up through new contracts with co-ops and munis in the Carolinas and in Florida in particular. So, those are some of the things that we look to to continue provide growth over the second half of the year. Lynn J. Good – President and Chief Executive Officer And, Greg… Greg Gordon – Evercore ISI Great. I understand that. I guess to clarify my question, many of those things were baked into the $2.95 billion budget. Lynn J. Good – President and Chief Executive Officer Yes. Greg Gordon – Evercore ISI I assume normal weather was baked in there. The wholesale pickup was – you were very, very clear on in your disclosures on the expectation there. So, I’m just focused on what’s changed from the plan. I guess you’re a little bit ahead of normal going into July which is good, NCEMPA closed early which is good. So, I’d really like to circle back to your answer and focus on what’s changed that’s not in the plan. $0.04 from NCEMPA… Lynn J. Good – President and Chief Executive Officer So, let me give it a try. Greg Gordon – Evercore ISI Okay. Lynn J. Good – President and Chief Executive Officer Yeah, Greg, let me – so, if we step back from this, as we started the year, we expected the back half to be stronger than the first half from the get-go. And then, if you look at the first half of the year, the weakness in Brazil has basically been offset by strength in the regulated business. We had weather that was strong and comparable to last year, even a bit ahead. We had an early closing in the Midwest Generation sale, which gives us incremental. When you go to the back half, we expect the back half to be stronger, wholesale growth, retail growth. Our O&M outage was more in the first half than the second half. And then, we have the sweetener of the NCEMPA transaction closing. And so, the weakness that we offset in the first half with weather and strong results, we don’t expect to see in the back half because we think Brazil will be comparable to 2014. Greg Gordon – Evercore ISI Great. And that 400 megawatts… Lynn J. Good – President and Chief Executive Officer Does that help? Greg Gordon – Evercore ISI …of new renewables coming in, in the back half of the year is baked into your $185 million plan or is that stuff…? Lynn J. Good – President and Chief Executive Officer It is. Steven K. Young – Executive Vice President and Chief Financial Officer Yes, it is. Greg Gordon – Evercore ISI Okay. Great. That’s much clearer. Thank you very much. Have a good morning. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Julien Dumoulin-Smith with UBS. Julien Dumoulin-Smith – UBS Securities LLC Hi. Good morning. Lynn J. Good – President and Chief Executive Officer Hi, Julien. Steven K. Young – Executive Vice President and Chief Financial Officer Hi, Julien. Julien Dumoulin-Smith – UBS Securities LLC So, perhaps to follow-up on Greg’s question just a little bit and be clear. First, where do you stand in the context of 2015, if you can specify? And then, perhaps more broadly as you think about the 4% to 6%, is there any thought or expectation to update that and specifically rebase at any point or how do you think about that given where you stand on hydro and obviously 2015 is – could be a weather event related, but I’d be curious if you want to just elaborate on the 4% to 6% at this point too? Lynn J. Good – President and Chief Executive Officer So, Julien, we are on plan through the first half. And for the reasons we just discussed, we’re confident we’ll remain within the range of $4.55 to $4.75. In terms of guidance, our current thinking is that we will approach that in the same way we always do. So, you’ll have February of 2016 for 2016 and for the longer-term outlook. We will continue to update you in third quarter on any further developments we see in any part of the business as we also normally do. So that’s the schedule we’re thinking about at this point. Julien Dumoulin-Smith – UBS Securities LLC Got it. But perhaps just more specifically, rebasing, is there any thought process of rebasing the base year of that 4% to 6% at all? And then, perhaps the second bigger picture question if you will, with regards to the Clean Power Plan and I know, obviously incredibly complex as you already alluded to. Could you elaborate how the company is positioning to capture opportunities there and obviously you’re involved in many of the key angles that would benefit in theory from the CPP, but could you elaborate how you are thinking about taking advantage of each of those respective niches? Lynn J. Good – President and Chief Executive Officer And on rebasing, Julien, we’re anchored in 2013 at this point. We will rebase at some point. We haven’t made a final decision on that and we’ll update guidance in February of 2016. The Clean Power Plan appreciates those questions and we are continuing to digest, we do not have a definitive plan in any of our jurisdictions. Of course it will impact our IRP planning, and impact our thinking on state-by-state. As I’m sure you’re aware, the plan did change emission reduction targets. So we have more stringent targets in the Midwest. We have moderately less stringent targets in the Southeast, North Carolina, South Carolina and Florida. There’s a notion being introduced of a market trading platform, which is new, which we’ll need to evaluate, and then the compliance period with these incentive credits and so on, in 2020, 2021, I think, will also be something that we digest. So, we’re beginning to understand the elements, I think there is flexibility here. It will be important to involve a stakeholder and state process. These are the states’ implementation plans ultimately. But we believe that much as we’ve delivered consistent carbon reductions over the last 10 years, we’ll be looking for a way to continue progress in that direction, at the lowest cost to our customers. Julien Dumoulin-Smith – UBS Securities LLC Great. Thank you. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Steve Fleishman with Wolfe Research. Steven I. Fleishman – Wolfe Research LLC Yeah. Good morning. Lynn J. Good – President and Chief Executive Officer Hi, Steve. Steven I. Fleishman – Wolfe Research LLC Hi, Lynn. A couple questions. First, just specific details. So, I think you guys said, you expect it to be $0.12 down in 2015 in International versus 2014 and in the first half, you’re down $0.26. So, assuming it’s flat the rest of the year, that means you’re kind of off by about $0.14 from plan. Could you maybe just break up, what makes up that $0.14, how much is it below average? How much is it the hydro versus some of the other, the economy or currency or other things, at least a rough cut of that? Steven K. Young – Executive Vice President and Chief Financial Officer Yeah, Steve. The bulk of that is – and you’re just talking about International, the delta in International? Steven I. Fleishman – Wolfe Research LLC Yes. Steven K. Young – Executive Vice President and Chief Financial Officer From the original expectations versus where we’re at now, is that correct? Steven I. Fleishman – Wolfe Research LLC Yes. Steven K. Young – Executive Vice President and Chief Financial Officer Yes. The biggest difference that we’re seeing is the impact of informal rationing, if you will, and the weak economy, those two impacts on the demand for power in Brazil. When we set up our assumptions in February, we stated we had no assumption of informal rationing and we had over 2% demand growth. And now what we’re seeing is that the demand is actually slightly negative. Because thermals are dispatched first, all of that delta, all of that swing comes out of hydros. And of course, we’re a hydro owner here. So that is the big difference that we did not have in the $0.12 downtick for International back in February. And we stated we didn’t have any view on rationing in the numbers if rationing came about or lower demand, the results would be lower. So that is by far the bulk of the difference in International. Steven I. Fleishman – Wolfe Research LLC Okay. Lynn J. Good – President and Chief Executive Officer Steve, one thing I might just point out, Chile, the Chilean tax adjustment that was reflected in second quarter of 2014 is $0.07 of that $0.26 that was planned. We were aware of it. And the additional weakness is in Brazil and NMC [National Methanol Company], the oil prices have deteriorated slightly, but we saw a lot of that at the beginning of the year. And then all the conditions, we’ve talked about here on further weakening in Brazil is where the larger challenge has originated. Steven I. Fleishman – Wolfe Research LLC Okay. So when we think about beyond 2015 and if we made the jump that hydro might actually normalize. The issues outside of that are primarily related to the economy, I assume somewhat currency and are those two main issues? Lynn J. Good – President and Chief Executive Officer I think those are two main issues, Steve. Steven I. Fleishman – Wolfe Research LLC Okay. Any thoughts to reconsider strategic alternatives for the business? Lynn J. Good – President and Chief Executive Officer Steve, that’s a question we’ve spent a fair amount of time on as you imagine. We thought our process and I still believe our process last year was a good one, very thorough. We were looking at growth, we were looking at cash and we solved the cash, which we believe is important to supporting the dividend. We’ve already brought home, $1.2 billion of that $2.7 billion. There is no question we’re operating in a challenging environment, and all of the factors we talked about today are something that the team in International is focused on. I am pleased with the way they’ve responded to these challenging conditions. And at this point, I don’t have anything further to share on how we think about this business strategically, but we’ve certainly learned a lot about volatility in this business as a result of these recent events, and that’ll factor into our planning in the future. Steven I. Fleishman – Wolfe Research LLC Okay. And then one last question maybe at a high level. Between the balance sheet and position you have now, and things like the securitization coming in Florida some point soon, how much available cash or balance sheet capacity do you have for investment in growth opportunities, right now? Steven K. Young – Executive Vice President and Chief Financial Officer Well, we have a solid balance sheet and we have a number of growth opportunities, where our capital spend is typically in the neighborhood of $7 billion a year. So, there is… Steven I. Fleishman – Wolfe Research LLC I’m sorry. I want to make sure – I mean above kind of what you’re planning to do right now? So, like if you had opportunities that go above the current investment plan? Lynn J. Good – President and Chief Executive Officer We do. Steven I. Fleishman – Wolfe Research LLC And how much upside? Yeah. Okay. Lynn J. Good – President and Chief Executive Officer We haven’t quantified that specifically. The one thing I would say, Steve, is if you look at the leverage in the business, the utilities are situated relative to their cap structure that they earn on, capacity sits at the holding company and we’re probably at 27%, 28% of HoldCo debt. There’s probably capacity at HoldCo, up to 30% or maybe a little bit above, depending on how the credit rating agencies look at that. So, can’t quantify it any more specifically than that, but we’re committed to our ratings. We think we have an incredibly strong balance sheet with flexibility, to address and we think the business requires. And we’ll continue to manage that accordingly. Steven I. Fleishman – Wolfe Research LLC And how much will you get from securitization? Steven K. Young – Executive Vice President and Chief Financial Officer We will get about $1.3 billion from the securitization process. We’re targeting the first quarter of 2016 to get those funds. About half of those funds will be used to displace Florida – Duke Energy Florida OpCo debt, the other half of the funds will come up to the parent. Steven I. Fleishman – Wolfe Research LLC Okay. Thank you. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Chris Turnure with JPMorgan. Lynn J. Good – President and Chief Executive Officer Good morning. Christopher J. Turnure – JPMorgan Securities LLC Good morning, guys. Steven K. Young – Executive Vice President and Chief Financial Officer Hello. Christopher J. Turnure – JPMorgan Securities LLC You kind of mentioned in your prepared remarks and then in response to an earlier question that, it’s too early to tell what’s going to happen potentially with GSF reform (49:07) in Brazil and I can definitely appreciate that. But, do you have at least a sense as to what the EPS impact would be there, if we went from say a 20% now to a 10% or a 5% protection type level, just versus normal in any given full year? Steven K. Young – Executive Vice President and Chief Financial Officer We don’t have any sensitivities on that, Chris. There is a lot of variables here? Where is our contracted load? What is the PLD price? So there is just variables there that are too multiple for us to try to put a metric on. Lynn J. Good – President and Chief Executive Officer And I think… Christopher J. Turnure – JPMorgan Securities LLC Okay. Lynn J. Good – President and Chief Executive Officer …as we get to a point of clarity on the way the courts and the way the regulation will change, we’ll be in a position to give you a better sense of timing, what our contracted position is, where we we’re forecasting PLD. But it’s premature to do this at this point, because there are too many moving parts. Christopher J. Turnure – JPMorgan Securities LLC Okay. Fair enough. And then, just kind of going back to the 2016 and beyond picture, it’s still pretty early here to talk about any potential growth guidance changes. But I just wanted to address maybe balance sheet capacity like we were talking about in the last question or just your ability to do other things outside of what you’ve already talked about, whether it’s accelerating more repatriation of cash or doing other securitizations outside of the Florida one that you already have in plans or maybe pulling forward Carolina’s rate cases earlier than the kind of 2017 to 2018 timeframe than you’re currently thinking about right now? Lynn J. Good – President and Chief Executive Officer In connection with our planning process, Chris, we’ll look at every element of the business to ensure we’re delivering as much value as we can. I think we’ve demonstrated an ability to identify investment projects that are beneficial to customers and also delivering returns to shareholders. We do have flexibility in the balance sheet for additional investment. So, we’ll be evaluating all of those alternatives in connection with our business planning process. Christopher J. Turnure – JPMorgan Securities LLC Okay. But at this time nothing is seeming more likely than not or nothing’s standing out in your mind? Lynn J. Good – President and Chief Executive Officer Yeah. Nothing that I would share at this point. Christopher J. Turnure – JPMorgan Securities LLC Okay. Great. Thanks. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Michael Lapides with Goldman Sachs. Michael J. Lapides – Goldman Sachs & Co. Hey, guys. Just wanted… Lynn J. Good – President and Chief Executive Officer Hi, Michael. Michael J. Lapides – Goldman Sachs & Co. …to revisit – hi, Lynn. Just wanted to revisit a few things on the Regulated side of the house. First of all, can you remind us for the spend you do on coal ash in North Carolina what the cost recovery process is, meaning, how do you actually – how and more importantly, when do you actually get this in rates? Steven K. Young – Executive Vice President and Chief Financial Officer Yes, Michael. There is no definitive plan for collection of the coal ash in rates. We spent about $100 million to-date on this and that will ramp up over the next several years. And the way this will work, we’ll start spending and acting on our plans in conjunction with CAMA over the next several years. And then at some point, an appropriate point, we can go in for a rate case, and we can incorporate coal ash spend into that rate case. So we have flexibility there, there is no set timeframe for this. And you might look in time and think about the next rate case, being associated with the completion of a large power plant, a combined cycle or a completion of a lot of nuclear work in Duke Energy Progress area. That might put you in the later part of the teens, for going in for a rate increase. At that point in time, we would probably request an increment in base rates for coal ash recovery. And the Commission would then begin to monitor coal ash cost recovered through rates versus coal ash spent and adjust it from there, this is not like a normal capital project, where you spend over in a short intense period and then are completed, the spend will go on for a long time. So I think it will have that type of nature of recovery to it. Michael J. Lapides – Goldman Sachs & Co. There is precedent in North Carolina for more real-time recovery of environmental cost, thinking back to like Clean Smokestacks from a number of years ago, just curious, is there an opportunity, whether via a regulation or via legislation – and I’m not sure which one it would require – to get more real-time recovery of coal ash spend and more kind of the certainty of recovery over time? Lynn J. Good – President and Chief Executive Officer Yeah, Michael. I’ll take that one. I think North Carolina has demonstrated over a long period of time recovery of mandated cost and certainly coal ash, whether it’s at a state level or Federal level, those are required costs of decommissioning the plants. I don’t see in the next year or two, any change in the recovery mechanism that Steve just described and given the magnitude of the spend that we’re talking about, I think that’s reasonable. So, we’ll be addressing it in connection with the general rate case and evaluating what else might make sense over time. I think about Clean Power Plan, I think about – we have trackers for renewables. There are a variety of events that could trigger consideration of other forms of recovery. But I don’t see coal ash as being one that would – we would approach as a single item at this point. Michael J. Lapides – Goldman Sachs & Co. Got it. One last question on utility O&M. Did I hear correctly that what you’re basically saying is, O&M levels in the second half of 2015 will be flat to second half 2014? Steven K. Young – Executive Vice President and Chief Financial Officer Yes. That’s correct, Michael. Michael J. Lapides – Goldman Sachs & Co. When you look at broader O&M, what are you – at the Regulated businesses and especially in the Carolinas – what do you see as potential – you’re a couple of years out post-merger, but continued cost saving opportunities to where instead of flat, it’s even potentially down? Steven K. Young – Executive Vice President and Chief Financial Officer Some of the cost savings opportunities that we are now pursuing are the rollout of work management systems. We’ve already done a lot the corporate work. We’ve rolled out work management systems in the fossil area. We’ve done a lot of nuclear work. But now we’re rolling out into T&D and that’s more dispersed in asset location and employee workforce. So, that’s an area that is ripe for some benefits. So, we’ll continue to roll these projects out and have some opportunities here to offset some of the cost increases that we face, such as cyber security, normal inflation, Fukushima and that kind of thing, but I do believe there are efficiency opportunities still out there. Michael J. Lapides – Goldman Sachs & Co. Got it. Thank you, Steve, and much appreciated. Lynn J. Good – President and Chief Executive Officer Thank you. Operator Next question comes from Jonathan Arnold with Deutsche Bank. Lynn J. Good – President and Chief Executive Officer Hi, Jonathan. Jonathan P. Arnold – Deutsche Bank Securities, Inc. Good morning, guys. Steven K. Young – Executive Vice President and Chief Financial Officer Good morning. Jonathan P. Arnold – Deutsche Bank Securities, Inc. Sorry to revisit this, but you’ve said a couple of times, you want to be clear about and transparent about what you’re saying on growth. And I just on this – we’ve already talked about the footnote on the slide around long-term earnings growth. You also changed the word you’re using from deliver to target. And I’d hate to read too much into that, but I just – Lynn, are we saying that if International kind of doesn’t rebound post-2015 in a decent way that you may not be able to stay at the low end of the 4% to 6% or are we not saying that? I’m not feeling I heard the clarity. Lynn J. Good – President and Chief Executive Officer Yeah. And you know, Jonathan, I’m not trying to reset guidance range at this point. But I am trying to flag for you that we see uncertainty in the International business that is difficult sitting here in early August of 2015 to predict duration and extent. And so, a rebound, if we see a rebound in 2017, that’s certainly positive. But it’s more challenging today than I would have said to you it was in January of this year and that’s what we’re trying to signal or trying to say. And we’ll continue to update you as we see rainy season starting to develop and we see any potential changes in the regulatory scheme, the injunctions and other things, but it’s more challenging based on what we see right now. Jonathan P. Arnold – Deutsche Bank Securities, Inc. Great. Thank you. And again, apologies for the revisit. Lynn J. Good – President and Chief Executive Officer No. That’s fine. Great. Steven K. Young – Executive Vice President and Chief Financial Officer All right. Operator Next question comes from Ali Agha with SunTrust. Ali Agha – SunTrust Robinson Humphrey Thank you. Good morning. Lynn J. Good – President and Chief Executive Officer Hello. Steven K. Young – Executive Vice President and Chief Financial Officer Good morning. Ali Agha – SunTrust Robinson Humphrey Hi. Listen, with regards to the securitization proceeds, Steve, you said half of them will be used for OpCo debt reduction, half going to the parent. Any thoughts on how that other half gets used? The reason I ask is on the original settlement agreement you were going to be earning an ROE on it, granted it was a 30% reduction, but there was earnings coming from that and so is there a dilutive potential given securitization that may not have been part of the original plan. Is that a fair way to think about this? Steven K. Young – Executive Vice President and Chief Financial Officer You’re correct there. We are giving up the equity return that was baked into the Crystal River 3 recovery mechanism from the settlement in 2013, albeit it was a haircut return. Whether it’s dilutive or not depends upon the redeployment of the proceeds here. And again we will be looking for growth opportunities to help replace that equity return loss. Ali Agha – SunTrust Robinson Humphrey So at this point you would not assume that that is used for any HoldCo debt reduction. It probably goes into some rate base kind of investment? Steven K. Young – Executive Vice President and Chief Financial Officer Well, it will move into our general funds and help fund growth. Ideally we’d like to find an investment to put it right into, but certainly it will be utilized to reduce HoldCo debt that then helps fund other acquisitions, other purchases, other investments more efficiently. Lynn J. Good – President and Chief Executive Officer And Ali, what I would say to that, we haven’t earmarked a specific investment for those funds, but there have been a lot of questions today about holding company capacity for additional investment, this would be part of that. And so our objective will be to deploy that in a way that maximizes the value. Ali Agha – SunTrust Robinson Humphrey Yeah. And Lynn, what’s the latest on the Edwardsport investigation in Indiana? Is that still out there? I thought it should have been done by now. What’s the latest? Lynn J. Good – President and Chief Executive Officer So there is a rate proceeding in front of the Indiana Commission, Ali, on the regulatory every six month rider mechanisms as well as the fuel clauses. And we would expect an order from the Commission before the end of the year, perhaps even as early as the third quarter. So, that does remain out there. In the slide deck we’ve given you kind of a chart of what the open proceedings are, I think it’s on slide 21 just to give you a sense of where these are. Ali Agha – SunTrust Robinson Humphrey Okay. Yeah, I thought it was a summer timeframe, I guess it’s a little later. Lynn J. Good – President and Chief Executive Officer I think it’s a little later. Yeah. Ali Agha – SunTrust Robinson Humphrey Okay. And last question, the timeline for some of you investments, you’ve made that investment in the pipeline and you’ve got the other bigger pipeline out there. Are you thinking, Lynn, when you update your long-term growth rates perhaps next year, that you may stretch it out over a five-year period as opposed to the three-year periods that we’ve been doing currently, given that some of the stuff won’t hit until later in the decade? Lynn J. Good – President and Chief Executive Officer Ali, it’s a good question, we debate the period internally. We had a longer term one, we moved it to three years, five years is a possibility. But I think the point you’re making is a good one, which is infrastructure investment occurs over a longer period of time. So, we haven’t made a final decision on that, but we are – we will evaluate it. Ali Agha – SunTrust Robinson Humphrey Okay. Thank you. Lynn J. Good – President and Chief Executive Officer Great. Thanks so much. Operator And ladies and gentlemen, that does conclude today’s question-and-answer session. I’d like to turn the conference back over to Ms. Lynn Good for closing remarks. Lynn J. Good – President and Chief Executive Officer Thanks, everyone for being on the call, for your interest and investment in Duke Energy. We are scheduled for a third quarter call on November 5, and look forward to seeing many of you in the coming months. Thanks again. Operator Ladies and gentlemen, that does conclude today’s conference. We do thank you for your participation. You may now disconnect. Have a great rest of your day.