Vanguard Group Records The Highest Net Inflows For 2015 So Far

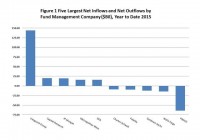

By Patrick Keon Vanguard Group has taken in over $143 billion of net new money for the year to date. In what can be seen as evidence of current investor sentiment for passive management over active management, Vanguard’s positive flows are so large they are greater than the next ten largest net inflows (+$124.3 billion) at the fund-management company level. Vanguard has spread the wealth – six of its funds have grown their coffers over $5 billion each so far this year. The largest increases have been seen by Vanguard Total International Stock Index Fund (MUTF: VTIAX ) and Vanguard Total International Bond Index Fund (MUTF: VTABX ) , which took in net new money of $39.3 billion and $17.3 billion, respectively. These net inflows have contributed to Vanguard’s growing its mutual fund assets under management to just shy of $2.4 trillion, leading all U.S. fund managers. Following directly behind Vanguard on the plus side for the year are Capital Research & Management Company (+$19.9 billion) and JP Morgan Investment Management (+$19.7 billion). The money flowing into Capital Research has been widespread – over 50 of its funds have taken in net new money this year. The three largest net inflows for Capital Research funds belong to American Funds Global Balanced Fund (MUTF: CBFAX ) , American Funds EuroPacific Growth Fund (MUTF: CEUAX ) , and American Funds American Balanced Fund (MUTF: CLBAX ) , which have all posted increases of over $2 billion. The inflows into JP Morgan are a bit more concentrated, with the five top funds accounting for the lion’s share of the overall total. JPMorgan Core Bond Fund (MUTF: PGBOX ) has posted the highest total among the group, with net inflows of $3.7 billion. PIMCO has posted the largest net outflows among fund companies for 2015. Still feeling the effects of Bill Gross’s departure, PIMCO Total Return Fund accounts for $44.4 billion of the firm’s $64.3 billion of net outflows. Other fund companies that have seen significant amounts leave their coffers include Wells Fargo (-$14.7 billion), Goldman Sachs (-$12.2 billion), Fidelity Management & Research (-$9.7 billion), and Charles Schwab (-$9.3 billion). Fidelity – second to Vanguard with $1.9 trillion of U.S. mutual fund assets under management – has seen a handful of its funds experience significant net outflows. The largest outflows for the company belong to Fidelity Contrafund (MUTF: FCNTX ) and Fidelity Growth Company Fund (MUTF: FDGRX ) , which have seen $5.8 billion and $4.4 billion leave. (click to enlarge) Share this article with a colleague